Synthetix founder Kain Warwick awoke one morning in May last year with a realization: “Something’s wrong here. We’re approaching this in the wrong way.”

After launching Synthetix Perps v2 in late 2022, Synthetix founder Kain Warwick expected the new decentralized perpetual futures exchange would take a massive bite out of the Binance-dominated derivatives market.

Six months later, Warwick woke up one morning to the realization that wasn’t going to happen for two reasons: 1) Most traders still don’t want to use DeFi, and 2) The “build it, they will come” mantra is stupid.

“If you’re doing something the same way and expecting different results — that’s insane. That’s the definition of insanity. And so, my view was we need to change this up,” recalls Warwick.

Synthetix Perps v2 — launched just days before Christmas in 2022 — was created to take on centralized perp platforms. It introduced a “first-of-its-kind” off-chain oracle system that minimized the risk of frontrunning attacks and significantly reduced trading fees. The exchange also touted deep liquidity, one of the bigger friction points for DeFi.

“The volume was really good, the execution was great, and people were getting good fills,” says Warwick, but “the volume of Binance versus DeFi perps was still 95 to 5.”

“I actually woke up one morning in May, and I was like, ‘What’s going on here?’”

This line of thinking eventually led to his latest crypto project, Infinex, a front-end wrapper he hopes will gloss over the awkwardness that comes with DeFi with all the benefits of self-custody and control.

Warwick hopes the new user-friendly layer will encourage more traders away from centralized exchanges and platforms, which had a particularly bad year in 2022.

“Crypto history is littered with people losing other people’s crypto,” Warwick tells Magazine.

The premise behind Infinex is simple: Replicate the easy-to-use experience of centralized exchanges but with DeFi in the form of Synthetix Perps v3 as its backbone. Traders can do away with clunky transaction signing and wallet setups, needing only a username and password.

The idea is to give traders the benefits of DeFi and CEXs without any of the drawbacks, like having your funds “misappropriated” by a “super awkward CEO.” But as Warwick points out, even users burned by FTX didn’t jump aboard the DeFi train.

“The reality is that the vast majority of users went straight from FTX back to Binance, and that, to me, was really kind of a bit shocking.”

Infinex is yet to become available for public trading.

When it was first announced, Infinex was expected to launch in the fourth quarter of 2023 but only managed to release a closed alpha by the holiday season.

In March, Infinex suddenly announced it had “suffered a security incident,” though no user, treasury or working group funds were at risk. Moments later, Warwick announced he had taken over as the Working Group Lead for Infinex.

Infinex is now expected to launch sometime around ETHGlobal, which is slated for May 2.

Warwick admits he was wrong to think that simply building a solid decentralized trading platform with low fees would be enough to attract a herd of new traders.

“We had taken this very purist technocratic view of: ‘We’re going to build this the right way, and the world will eventually learn that this is right. We’re not wrong, the market’s wrong,’ sort of approach,” says Warwick.

“The reality is that the market is not wrong; the market can’t be wrong in some very real sense,” says Warwick.

The Synthetix founder has built a career on knowing when things aren’t working out as they should and pivoting to plan B — and then C.

Geneticist to B-list punk rocker

Warwick may be known as “the father of modern agriculture” today — a reference to his foundational role in popularizing yield farming, which resulted in 2020’s DeFi Summer — but it took quite a few massive life pivots for that to eventually happen.

Now 42, he’s the son of Australian tennis champion Kim Warwick and the oldest sibling to three younger brothers, all of whom followed him into crypto and Web3.

At 14, he already had his first taste of entrepreneurship, setting up a tennis racket-restringing business at his parents’ tennis center.

“For a 14-year-old, [it was] very successful; I would say I was making quite a bit of money.”

By age 16, he’d started helping people with tech problems for extra cash.

“I had this tension of like, ‘love technology, love computers.’ I was building computers,” he says. “I’d go around and set up networks for people and WiFi back in the day.”

A high-school science lover, he graduated with visions of becoming a geneticist, studying it at the University of New South Wales.

“You know, genetics really interested me… science was probably my best subject in school. I had always loved science,” says Warwick.

But he realized pretty soon that genetics wasn’t for him and dropped out 18 months into the degree to join a friend’s tech startup in Seattle. When that didn’t pan out a year later, he founded a punk rock band with a friend.

He’d dress up in Victorian-era clothing as the guitarist and vocalist for The Lie Society, a punk-rock band that ended up with a pretty decent local following.

“The biggest venue we played was like 1,000 people or something like that. So, you know, we’re not playing stadiums by any stretch, but we opened for some national touring acts.”

“We were just getting to a point where, I think, like, if we had really focused on it and got it out there, we could have done a little bit better,” he adds.

But Warwick eventually moved back to Australia and started a career in retail.

Trying to mine Bitcoin at Harvey Norman

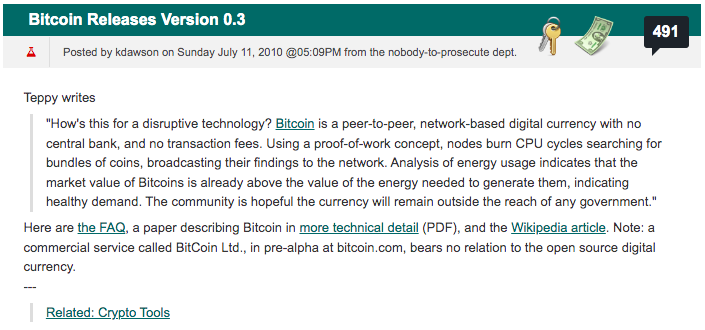

“The first time that I ever came across crypto was a Slashdot post, a very famous Slashdot post,” says Warwick.

At the time, around 2010 or 2011, he was working at an Australian electronics retailer, Harvey Norman, which sells computers, furniture, washing machines, refrigerators and other household goods — definitely not the crypto entrepreneur origin story you were thinking of.

The post, found here, detailed an early upgrade to Bitcoin, which eventually made it to the front page of Slashdot. It’s seen as one of the first articles to alert the wider tech community to Bitcoin.

“I had been on Slashdot for at that point many years, and it was the post that launched Mt. Gox,” says Warwick.

Warwick even tried to set up Bitcoin mining software on a row of display PCs at his store to make use of the free power.

“We had an IT guy at Harvey Norman who was a really super switched-on guy […] and I went into Harvey Norman one day in 2011 and said to him: ‘We should run Bitcoin mining on this thing [the display PCs].’”

He didn’t end up getting the IT guy to come around, and they’re both probably kicking themselves over it today after Bitcoin hit nearly $74,000 in March.

By 2015, Warwick had gone deep into Bitcoin. He launched his own online retail payment firm, Blueshyft, which allows customers to pay cash over-the-counter for digital goods and services, including Bitcoin. That service still runs today.

“I was still the BTC-maxi mindset of like ‘Bitcoin is the valuable thing here,’ and I didn’t really care about other stuff. Like, I thought Ripple was a scam.”

But Warwick changed his tune just over a year later. While on paternity leave after the birth of his daughter, he got bored and started to go down the “rabbit hole” of “old Vitalik posts” about the possibilities of Ethereum — prediction markets, stablecoins and Maker.

“That was when I was like, ‘Wow, this is the thing that everyone in Ethereum thinks is going to work, which is Maker.’”

Warwick ended up borrowing the central stablecoin idea of Maker and launched the Havven initial coin offering in 2018, which became Australia’s largest ICO, raising $30 million. It completed the offer in just 90 minutes, thanks to early pre-sale investors.

But the market spoke again when the project failed to gain traction amid the depths of the bear market that year. He pivoted Havven into Synthetix, which retained the idea of posting collateral to mint a stablecoin in the form of SUSD but added the idea of synthetic tokens.

Deserving his nickname

Synthetix is a decentralized network built on Ethereum (and now Optimism and Base) for issuing and trading synthetic assets, or “synths,” that track the value of real-world assets.

The platform’s Synthetix Network Token, or SNX, is used to collateralize and issue synthetic assets, and SNX holders were incentivized to stake as much as possible by being given a portion of synth trading fees and extremely high inflation rewards. Rewards were also given for providing liquidity on Uniswap and Curve, which served as the catalyst for the degen food farm-fuelled “DeFi summer” of 2020.

Warwick isn’t so sure if he deserves all the recognition, though.

“There are a million ways all of this stuff came together,” he said.

“Like, even at that point, you had what they called transaction mining. This was another earlier form of yield farming — centralized exchanges were giving out their own token for wash trading, basically, which isn’t all that different to yield farming.”

Compound’s COMP token is another one credited with helping to kick off the yield farming craze.

“So, you know, my view is that there’s always a prior start with these things. It was just, it was the first one that really worked and kind of locked things in and got momentum, so people will remember it.”

Get used to scams

Asked whether he feels in any way responsible for rug pulls, Ponzis and straight-up scams that followed, Warwick says it’s an ugly but necessary part of innovation.

“Over-investment is a cost that we, as a society, must bear. When you’re over-investing in things, you will get scammed. The alternative, though, is under-investing, and if you under-invest, you get no innovation.”

Warwick argues that similarly, even with the multitude of ICO “pump and dump” scams, the ICO boom was a “net benefit” for crypto.

“If you look at all the great projects that came out of there, I think the hit rate for ICOs was better than traditional venture [funding]. Yeah, of course, there were scams and things that go to zero and dumb stuff or whatever. That’s a function of over-investment,” says Warwick.

“But again, the alternative is under-investment, and under-investment will kill you as a society. You need to be over-investing in innovation, not under-investing.”

week.

The post Synthetix founder: It’s DeFi that’s wrong, not the market appeared first on Cointelegraph Magazine.

Infinex Account

Infinex Account