It’s all fun and gains until your developer tweets: “oh fuck.”

Solana’s latest boom and its DEX developments have brought on a new wave of excitement to its decentralized applications.

At the forefront of the network’s DeFi resurgence are memecoins.

More than 19,000 new Solana tokens with some form of liquidity launched in the past week alone, according to trading data platform Birdeye.

The reason these tokens are so popular is they offer the slim chance to deliver life-changing gains for a relatively small outlay, leading some to dub the memecoin movement a “lottery” on Solana.

But unlike the traditional lottery concept, where hopefuls purchase cheap tickets in hopes of winning millions of dollars, memecoin investors can lose everything they own — and more.

Here are five risks you should consider before joining the Solana sweepstakes.

1. Memecoin creators are often totally inept

Memecoins are often set up by the very same people who invest in them — immature degens who don’t have a clue what they’re doing. A recent fat finger incident that burned investors is a perfect example of just that.

On March 18, the developer of memecoin Slerf burned $10 million worth of investors’ presale tokens instead of distributing them.

While it was a nightmare for presale investors, it quickly flipped into a win for Slerf, as media coverage helped spread awareness and centralized exchange listings stormed in.

Several exchanges, including HTX and Bitget, announced that trading fees earned from Slerf transactions on their platform would be used to help refund presale investors. It’s cold comfort to presale investors that Magazine has spoken with, though.

“I don’t feel satisfied even if my money comes back,” says one investor who spoke to Magazine on the condition of anonymity.

“You see, Slerf did a 10x on the presale, and I missed the opportunity,” he adds.

Slerf’s dramatic turnaround prompted industry participants to question the motive behind the “accidental” fat finger incident, with some raising the possibility of it being a marketing stunt.

Slerf maintains that it was a mistake, and many noted the crying dev in a Spaces event after the incident certainly sounded genuine.

Winston Ma, an adjunct professor of law at New York University, tells Magazine that if such a mistake occurred in a regulated environment, the case might fall under tort law. In such cases, a mistake that constitutes “gross negligence” may require the entity to compensate investors for their losses.

“In certain situations, people would say that monetary compensation is not the perfect contractual remedy,” says Ma.

“Instead, they would plead for specific performance.”

In a plea for specific performance, a party asks a court to order the other party to fulfill their contractual obligations as agreed, rather than pursuing monetary compensation.

2. Pseudonyms mean you never know which scammer created the coin

Memecoin creators and investors often operate under pseudonyms. There are legitimate reasons for this, such as protecting themselves from $5 wrench attacks or from disgruntled investors who lost money when the price plunged.

“People can win a lot, and people can also lose a lot, and this might create bad emotions,” Roman Big_Cat, pseudonymous product chief at Solana-based memecoin project Laika, tells Magazine.

“Someone can come to your house [and] that’s why I’m also keeping my pseudonymity,” he adds.

But while it’s a way to safeguard one’s identity, pseudonymity also presents new opportunities for scammers.

Anyone can create an online persona and disappear after conducting a successful memecoin scam. The same person can return the next day under a different pseudonym and a fresh memecoin. There were 19,000 new memecoins created this week. It seems unlikely they were all created by first-timers.

DeFi is largely pseudonymous and has limited regulation. This allows scammers to execute schemes without easily being identified or held accountable.

Big_Cat estimates that about 95% of the contracts on Solana are built by malicious actors.

“This is the harsh reality,” he says.

3. Rug Pulls are more likely than your memecoin going to the moon

A rug pull is a type of scam that can take many forms. Generally, it occurs when developers disappear with the project’s funds, leaving their community with nothing or worthless assets.

According to security firm Hacken, BNB Chain’s 149 reported rug pull incidents led the industry last year when Solana didn’t even crack the top 10.

However, in its yearly security report published in February, Hacken said that the expected surge of rug pulls on Solana is “particularly concerning” due to the explosion of new tokens on the network — 100,000 in December alone.

For memecoins, investors should keep an eye out for rug pulls on liquidity pools.

In this instance, a developer creates a new token and lists it on a decentralized exchange.

This token can start trading if it has a liquidity pool, which the developer can create by pairing their new token with a more established cryptocurrency, such as Solana’s native token SOL or stablecoins.

Investors can buy the new memecoin by trading in the paired tokens, raising the value of the liquidity pool in the process.

At any point, the developer can execute the rug pull by withdrawing all the assets in the liquidity pool, disappearing into their pseudonymous void.

Investors have ways to defend themselves from liquidity pool rugs by confirming that the project has locked liquidity, which ensures that developers cannot withdraw from the pool.

On Solana, investors can check a project’s liquidity status through bots that are accessible on various online channels like Discord and Telegram.

4. Presales are even riskier than investing in normal memecoins

Many of the most successful memecoin fundraisers on Solana recently have occurred through presales. In DeFi, this can refer to when investors send their funds to an account and hope to receive new tokens in return. This can be even riskier and more prone to the devs running off with the funds.

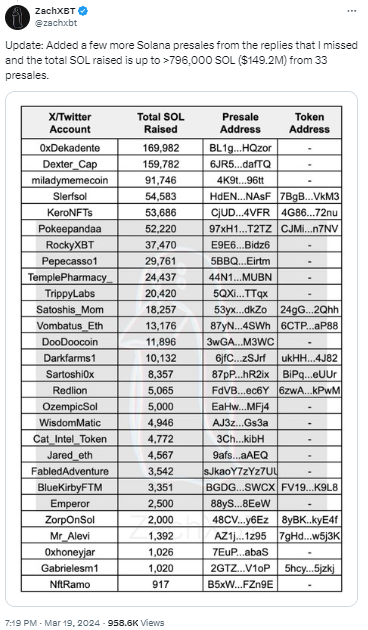

According to on-chain detective ZachXBT’s calculations, as of March 19, 33 Solana projects raised around 796,000 SOL ($149.2 million at the time) through presales.

At least four of those projects resulted in rug pulls and scams.

New York University’s Ma says a potential case under the contract law would look at whether these investment contracts should be viewed as securities based on the Howey test.

According to Ma, the presale campaigns advertised on social platforms such as X can be viewed as public solicitation.

“The public solicitation is very obvious, and that will help the Howey test very easily,” Ma says.

The United States Securities and Exchange Commission may require public presales to be registered if the asset is a security.

This is great to know, but as most memecoin investors don’t have the funds to take legal action, it’s a bit of a moot point.

Presales present opportunities for investors to dab into the asset before it hits the market, often at a cheaper price.

The allure of quick profits often overshadows due diligence for investors in the Solana memecoin frenzy, and it has drawn comparisons to the ICO boom of 2017.

The ICO, or initial coin offering, is a method for blockchain startups to raise capital. During the ICO boom seven years ago, many startups raised substantial amounts of money, often within minutes of launching their ICOs. The boom also attracted scrutiny and criticism due to its unregulated nature.

A 2018 study by the advisory firm Satis Group found that 80% of ICOs during the boom were scams.

5. Memecoins only have sentiment; there’s no utility in most cases

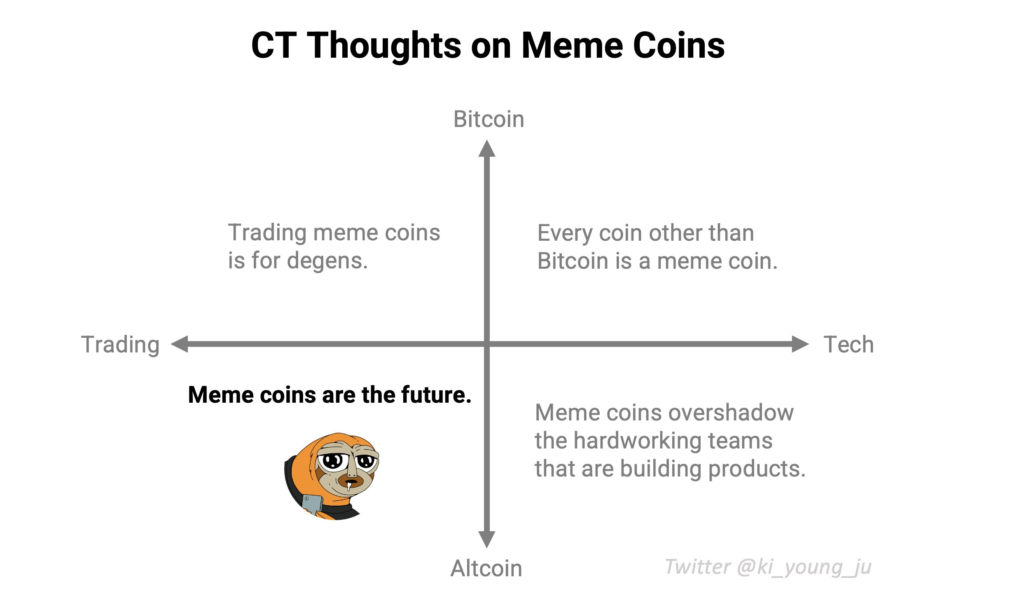

Although memecoins present overnight millionaire opportunities to the retail sector, industry veterans are highly critical of them.

Ki Young Ju, CEO of blockchain analytics firm CryptoQuant, has been an outspoken critic of the memecoin movement, stating that the allure of “easy money” could draw developing talent away from building valuable products and overshadow legitimate projects.

“Memecoins are fun for sure, but it won’t progress this industry, as they don’t have a product,” Ju tells Magazine.

On the other hand, the sheer dumb fun and money-making opportunities they present attract more people to crypto.

Laika’s Big_Cat says that the intangible utility of memecoins is the mass onboarding of retail traders into the crypto market.

Laika aims to woo investors with its primary mission, which is to send a helium balloon to low Earth orbit and stream footage there.

It then plans to launch its own layer-1 blockchain to build an ecosystem of memecoins.

Ju concedes that new investors that get introduced to the industry through memecoins may often have a “very bad experience.”

“However, if there’s a legit founder who can lead a memecoin project for a long time, it won’t be a problem,” Ju adds.

week.

The post 5 dangers to beware when apeing into Solana memecoins appeared first on Cointelegraph Magazine.