Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & beyond

Dear Bankless Nation,

During the previous bull run in 2021, all NFT action was basically on Ethereum.

As it seems we’re on the verge of a new all-out bull market again, I think Ethereum is well poised to boast incredible levels of NFT activity once more in 2024.

Yet I also predict big surges in NFT volumes on Bitcoin and Solana will make this next run-up more multipolar with regard to NFTs.

That said, let’s walk through the potential bull cases for Ethereum, Bitcoin, and Solana NFTs in 2024!

-WMP

🔮 Thanks to Kraken NFT 🔮

👉 Kraken NFT is built for secure NFT trading ✨

Three Chains to Rule Them All? Why I’m Watching Ethereum, Bitcoin, and Solana Next Year

At this point, it’s clear a new market cycle is beginning.

Most of the starting action so far has been centered around crypto majors like BTC, ETH, and SOL. But I think we’ll soon start seeing much more activity coalescing around the NFT ecosystems of these top coins’ underlying chains, too.

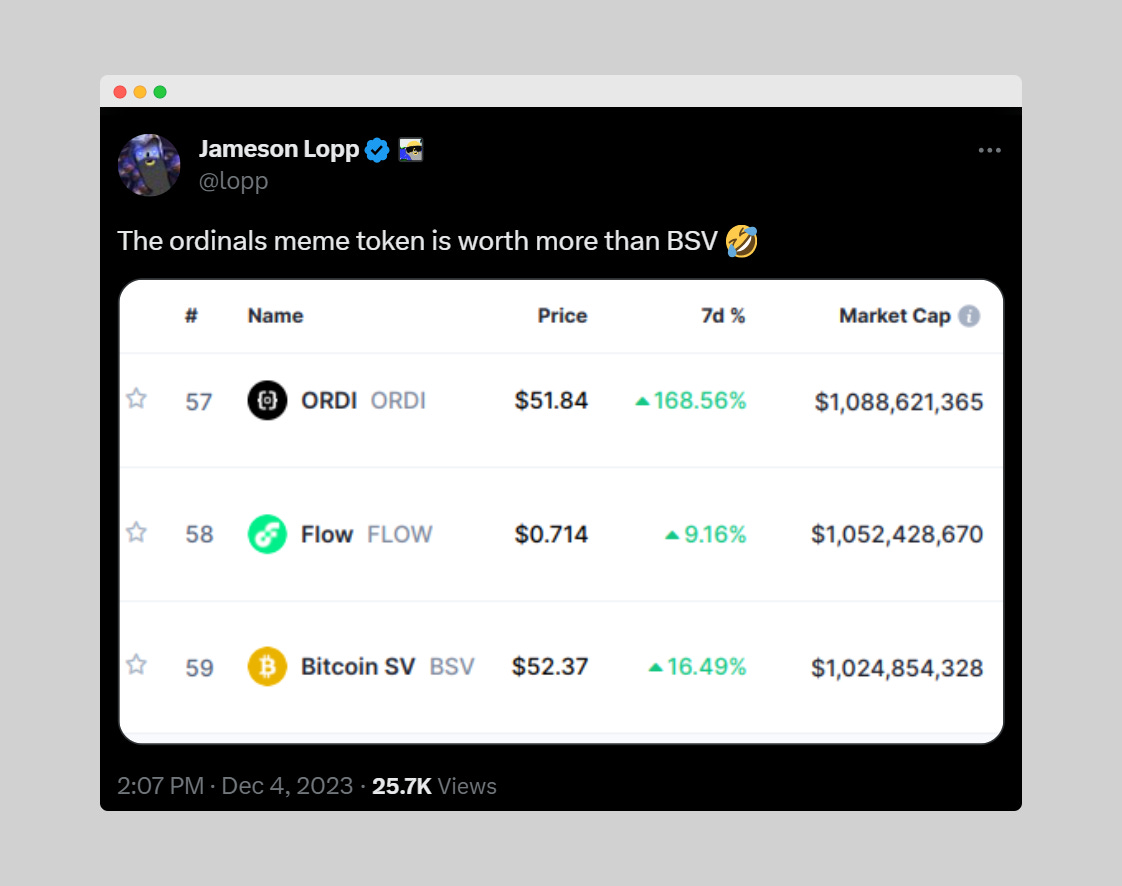

The early signs are already there. For instance, after arriving on the scene at the start of 2023, Ordinals-style Bitcoin NFT inscriptions have been booming lately, catalyzing a resurgence of creative endeavors atop Bitcoin and the popularization of semi-fungible “BRC-20” tokens like ORDI that rely on inscriptions.

🏹 Settle, Hunt, Claim, Repeat.

Be more bankless and become a Bankless Citizen today!

These new possibilities in combination with so many potential users thanks to Bitcoin being the most popular blockchain has translated into impressive rising demand for Ordinals.

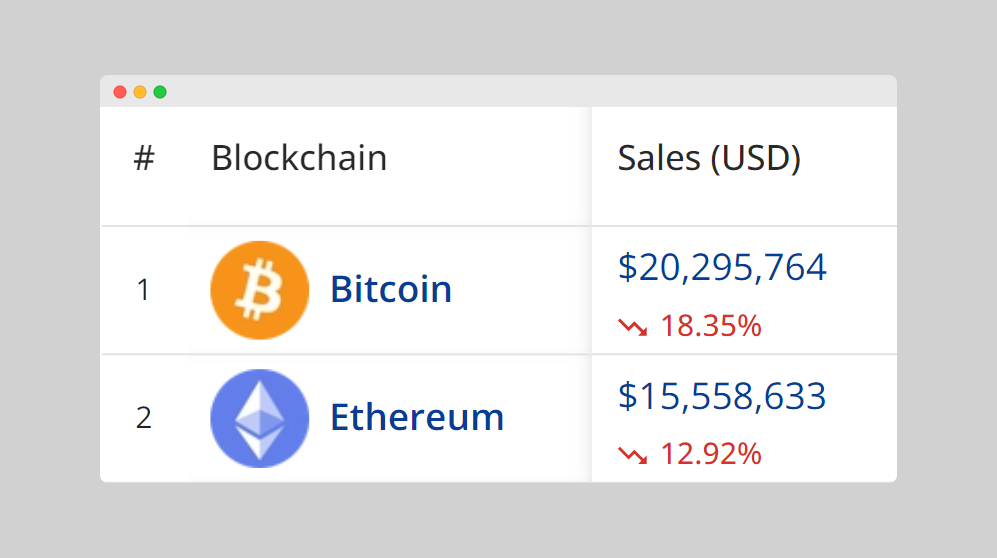

Indeed, recently it’s been typical for Bitcoin to be topping the daily NFT volume charts on CryptoSlam as people keep inscribing new collections and BRC-20 tokens left and right.

All the excitement and new projects to explore here has set the Bitcoin NFT scene up with a tremendous foundation for further growth in 2024. Yet it’s not just momentum factoring in here, as there are catalysts to watch in the months ahead.

For example, Casey Rodarmor, the creator of Ordinals, is preparing to release Runes, a new fungible token protocol that seems positioned to get more buy-in than BRC-20s as the new “unofficial official” fungible token standard on Bitcoin.

So think about it: we might soon be seeing another Ordinals-like boom, but this time with Runes, and then the main thing all these new Rune holders will have to spend their fungible tokens on are 1) other Runes, or 2) Bitcoin NFTs.

Bullish.

Then of course there’s Ethereum, who will undoubtedly benefit massively from its reigning “king of the hill” effect in the next bull run.

What I mean is that Ethereum easily has the most top-tier NFT projects, the most top-tier NFT infra, the most top-tier NFT builders and creatives, the most liquidity, so on and so forth.

These advantages will allow Ethereum to maintain and thrive in its position as the homebase for quality, certainty, and opportunity for the vast majority of NFTers once again this cycle, even as more NFT activity continues to migrate to its L2 scaling solutions, which in actuality are Ethereum extensions thanks to bridging possibilities.

And, like Bitcoin, besides great positioning the Ethereum NFT scene may have big catalysts next year, too. Maybe it’s just me, but I think we could see OpenSea launch an L2 next year. If that happened, the surrounding activity as people moved ETH and NFTs around, into, and out of the rollup could be immense.

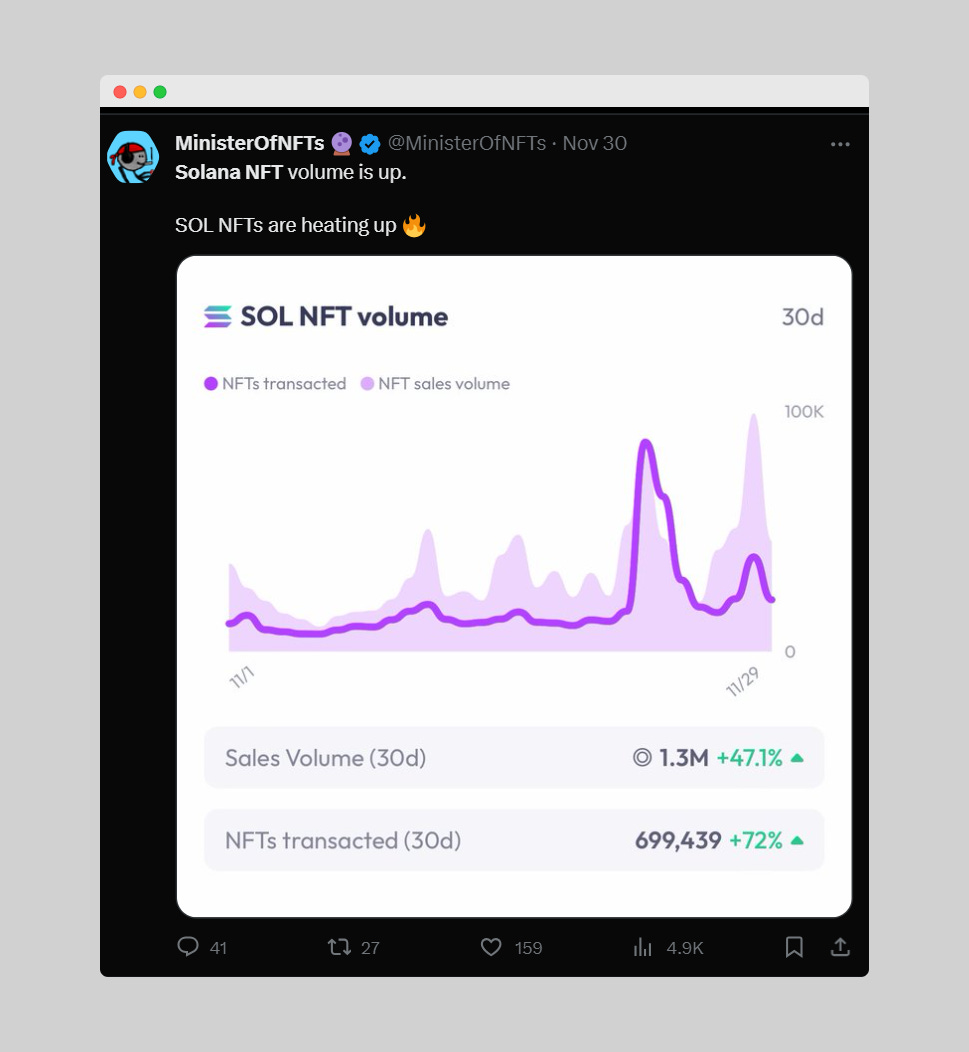

Lastly, I think Solana’s the other major chain that’s set to have a ripper of an NFT boom in 2024.

The network has shaken off the pains of the last bear market, become a new frontier for airdrops, and seen its SOL token rally harder than most in recent weeks, all of which has contributed to a large influx of new users. All of these folks have been looking for things to try on Solana, so many of them have been turning to NFT platforms like Magic Eden and Tensor accordingly.

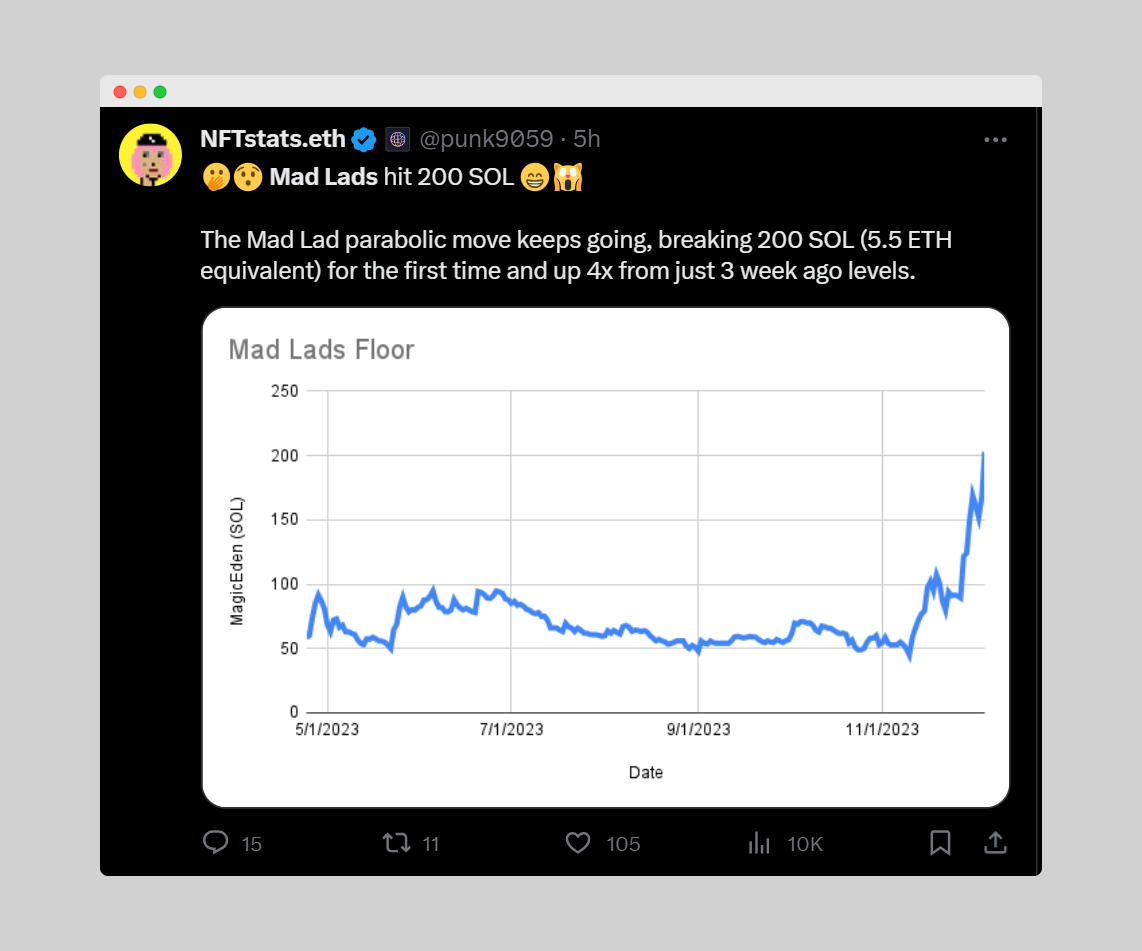

This big migration in is why we’ve been seeing a lot of buy pressure among the top Solana NFT collections lately. In other words, newcomers have been looking to get footholds here, so they’ve been piling into established projects that are known quantities like Mad Lads.

I see this Solana NFT ecosystem uptrend continuing for the foreseeable future thanks to the network’s slick UX and as the chain potentially rises to new heights in this fresh cycle.

Of course, over the next couple of years and among other metrics we may see BTC, ETH, and SOL all reach new all-time price highs, and you can imagine how the associated excitement around those milestones would feed back into NFTs across these chains.

Yet we don’t even need historic coin moonshots for NFTs to have a big year in 2024, as the fundamentals that are present today at the top of the crypto space are plenty to build out much further upon. Keep this reality in mind as we enter the new year!

Action steps:

-

🐧 Catch up on my previous write-up: Pudgy Penguins ATH

-

📚 Collect this post: Mint it on Mirror

Author bio

William M. Peaster is the creator of Metaversal — a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He also serves as a senior writer for the main Bankless newsletter.

🙏 Together with 🔮 Kraken NFT 🔮

KRAKEN NFT

Kraken NFT is one of the most secure, easy-to-use and dynamic marketplaces available. Active and new collectors alike benefit from zero gas fees, multi-chain access, payment flexibility with fiat or 200+ cryptocurrencies, and built-in rarity rankings. Learn more at Kraken.com/nft

👉 Visit Kraken.com to learn more and open an account today.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.