Ethereum, the world’s second-largest cryptocurrency, has been a talking point in the investment arena due to its impressive price performance and future potential. As the cryptocurrency market continues to gain traction, many investors are keen to understand where Ethereum’s price might be heading. This article aims to offer an Ethereum price prediction for 2025 based on various expert analyses and projections from sources such as Coinpedia, Changelly, and Forbes.

Ethereum’s Historical Performance

Before delving into future predictions, it’s essential to understand Ethereum’s past price trends. Ethereum, the brainchild of Vitalik Buterin, was first proposed in late 2013 and subsequently went live on July 30, 2015. Since its inception, Ethereum has solidified its position as one of the most significant players in the cryptocurrency market. Let’s take a closer look at its historical price performance.

At the launch of its initial coin offering (ICO) in 2014, Ethereum was priced at around $0.31 per Ether (ETH). When the Ethereum blockchain was launched in 2015, the price of ETH was just over $2.

For most of its initial year, Ethereum remained under the $3 mark. It was only in early 2016 that it saw its first significant surge, reaching over $14 in March. This increase was spurred by the formation of the Ethereum Enterprise Alliance, a consortium of major corporations interested in Ethereum’s blockchain technology, including Microsoft and JP Morgan.

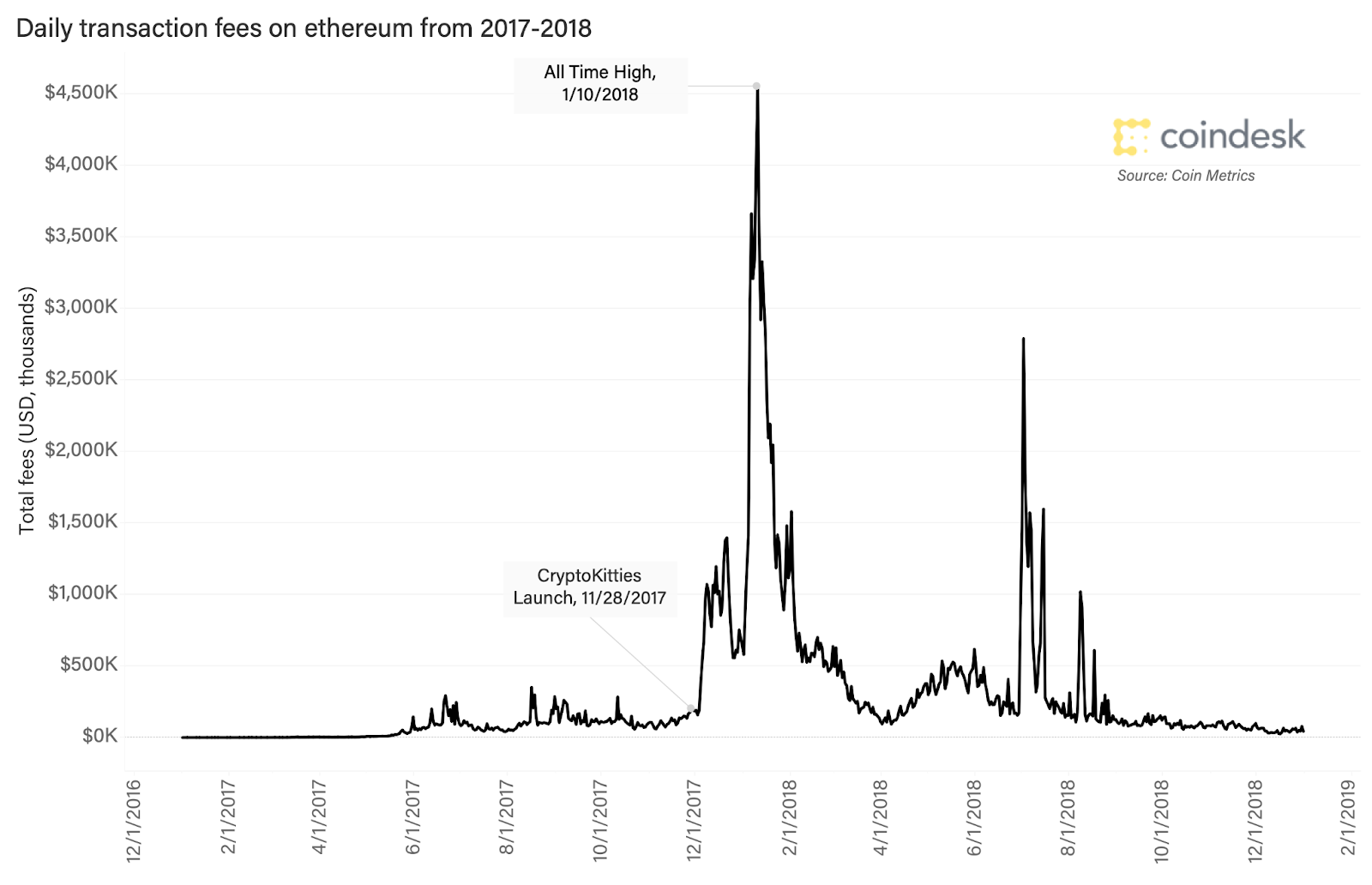

2017 was a landmark year for Ethereum, mirroring the overall cryptocurrency market’s dramatic bull run. In May, Ethereum surpassed the $100 mark for the first time. By June 2017, the price reached over $400. While there were fluctuations, the general upward trend continued throughout the year, with Ethereum ending 2017 at around $740.

The peak of Ethereum’s price coincided with the cryptocurrency market’s general peak in early 2018. In January, Ethereum hit its all-time high of around $1,400. However, the rest of 2018 saw a major market correction. Ethereum, like most cryptocurrencies, was not spared, and its value dropped throughout the year, ending around $138.

In 2020, Ethereum started to gain traction again with the advent of Decentralized Finance (DeFi) applications, most of which are built on the Ethereum network. This increased utility and demand for Ether, causing its price to rise once more. By the end of 2020, the price of Ethereum was over $700 on several exchanges like Redot.com.

The upward trend continued into 2021, with Ethereum reaching new all-time highs, partially due to the increased interest in Popular Non-Fungible Tokens (NFTs), many of which are also built on the Ethereum platform. By May 2021, Ethereum had crossed the $4,000 mark, further solidifying its position as a major cryptocurrency.

Overall, Ethereum’s historical price performance has been characterized by periods of rapid growth, interspersed with significant corrections. Its price has been influenced by factors such as technological developments, market sentiment, regulatory news, and its growing use in sectors like DeFi and NFTs.

Market Trends and Influencing Factors

Several factors contribute to the price trajectory of Ethereum. These include the growth of decentralized finance (DeFi), improvements in Ethereum’s network efficiency (such as Ethereum 2.0), and overall adoption trends in the blockchain industry. The rise of non-fungible tokens (NFTs) has also contributed significantly to the increased use of Ethereum, thereby impacting its price .

Price Predictions for Ethereum

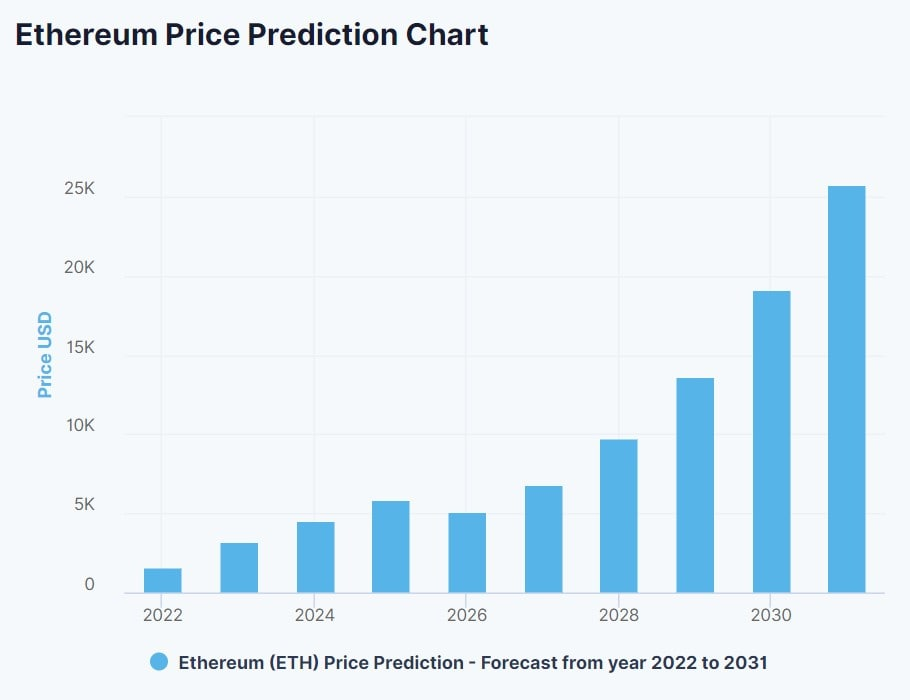

Given Ethereum’s potential and the broader market trends, experts have made varying predictions about its future price.

Coinpedia Prediction

According to Coinpedia’s analysis, Ethereum’s price may likely reach $10,000 by 2025. The rationale behind this prediction is the ongoing Ethereum 2.0 upgrade, which is expected to boost its scalability significantly. The migration from proof of work to proof of stake is predicted to reduce transaction costs, which could lead to an increase in Ethereum’s user base and price.

Changelly Prediction

Changelly also takes an optimistic stance on Ethereum’s future. According to their experts, Ethereum might reach $12,000 by 2025. This bullish projection takes into account Ethereum’s dominant role in the DeFi and NFT markets, which are forecasted to grow significantly in the coming years. Ethereum’s network improvements and increasing adoption are also significant factors in this prediction.

Forbes Prediction

Forbes provides a more conservative estimate. According to Forbes Advisor, the price of Ethereum could potentially reach $5,000 by 2025. This projection is based on the historical volatility of the crypto market, Ethereum’s competition, and potential regulatory challenges.

Conclusion

While these predictions vary, they share a common theme of optimism for Ethereum’s future. Factors such as Ethereum 2.0, DeFi, NFTs, and blockchain adoption all point to a promising outlook. However, as with any investment, potential investors should keep in mind that the crypto market is highly volatile and unpredictable. Due diligence and careful consideration of potential risks are crucial before investing.

Regardless of the exact price Ethereum reaches in 2025, it’s clear that this cryptocurrency has much to offer in the evolving world of digital finance. As technology continues to progress, Ethereum stands at the forefront of financial innovation, promising to shape the future of the global economy.

The post Ethereum Price Prediction 2025: A Detailed Analysis appeared first on Make An App Like.