Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & more!

Dear Bankless Nation,

It’s RWA this, RWA that lately in various circles of crypto.

Just catching up here? Well, RWA stands for “real-world assets.”

They’re created when “offchain” things — anything from U.S. T-bonds to Pokémon cards — are tokenized on a blockchain like Ethereum to unlock borderless liquidity, 24/7 markets, non-custodial ownership, etc.

Of course, NFTs are suited to represent non-fungible assets onchain, pointing to a future where widespread RWA adoption means widespread NFT adoption.

Let’s walk through the basics here for today’s post!

-WMP

🙏 Sponsor: Kraken — Kraken NFT is built for secure NFT trading ✨

RWA Adoption Is NFT Adoption

Broadly speaking, there are two types of RWAs: ones that represent financial instruments (bonds, real estate, stocks, etc.) and ones that represent cultural objects (baseball cards, Pokémon cards, etc.).

In either case, more people and groups have been going through the process of “onchaining” the “offchain” to take advantage of the unique things that a network like Ethereum can offer. Think non-custodial borrowing power in DeFi, or open and global auction infra through NFTs, right. Fundamentally making the illiquid more liquid.

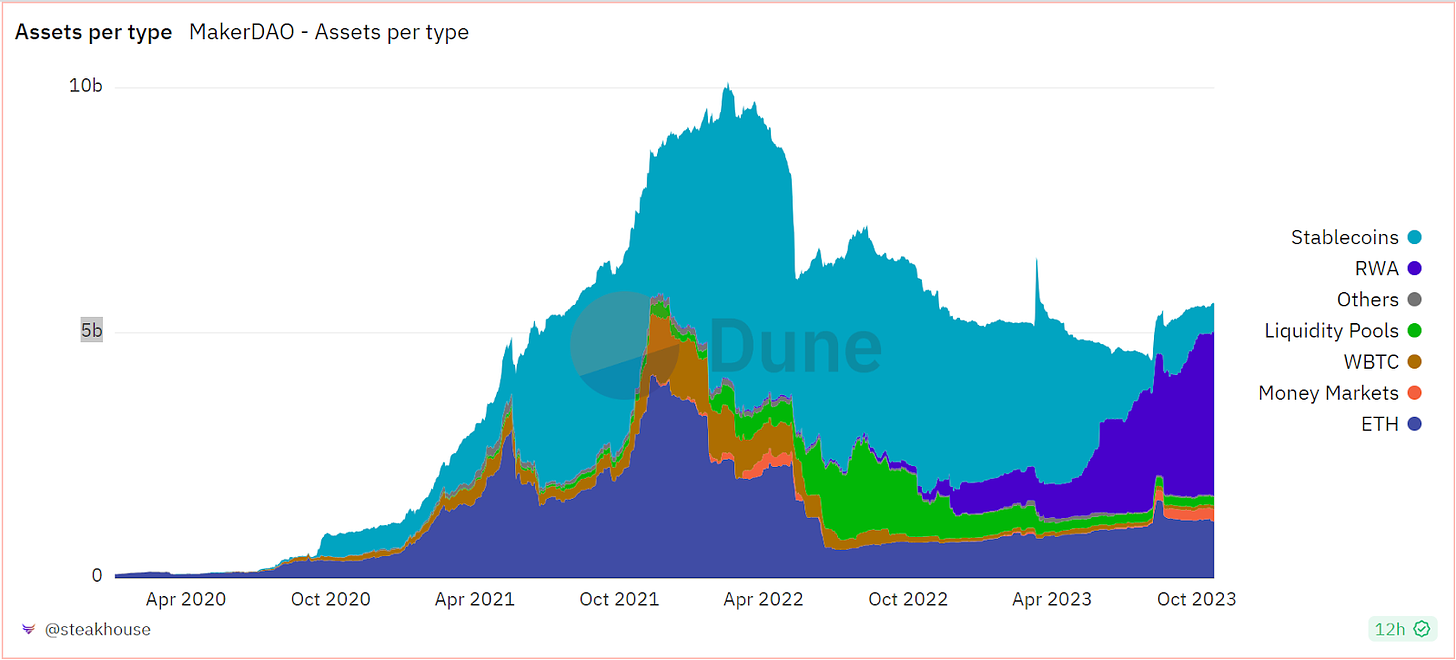

RWAs aren’t new in crypto, though. For instance, Maker, the first DeFi protocol to gain considerable adoption, has been increasingly underpinning its Dai stablecoin with RWAs like T-bonds since April 2021. Other DeFi projects like Canto, Frax, Maple, and Polygon have also recently made deeper advances into the RWA space.

🏹 Settle, Hunt, Claim, Repeat.

Be more bankless and become a Bankless Citizen today!

Yet if you zoom in here, the dominant approach on the DeFi side of things to date has been like Maker’s, i.e. tokenizing RWAs via pools of fungible ERC-20 tokens. It’s worked well, at least so far, as evidenced by how RWAs are now the majority of the backing behind the Dai.

Conversely, on the cultural side of things NFTs have become the tokenization tool of choice since they’re suited to being mapped 1:1 to distinct collectibles, for example a 1st-edition “mint condition” Charizard card that isn’t interchangeable with a 2nd-edition “great condition” Charizard, etc.

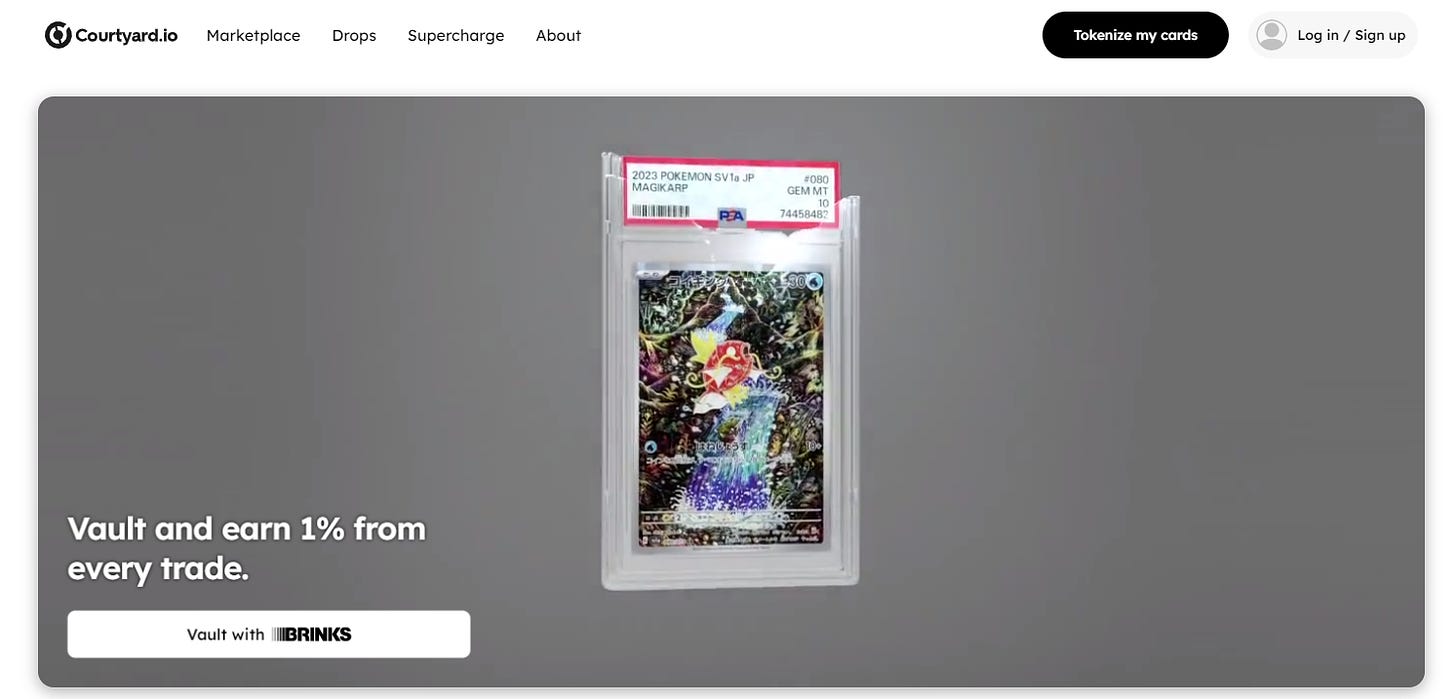

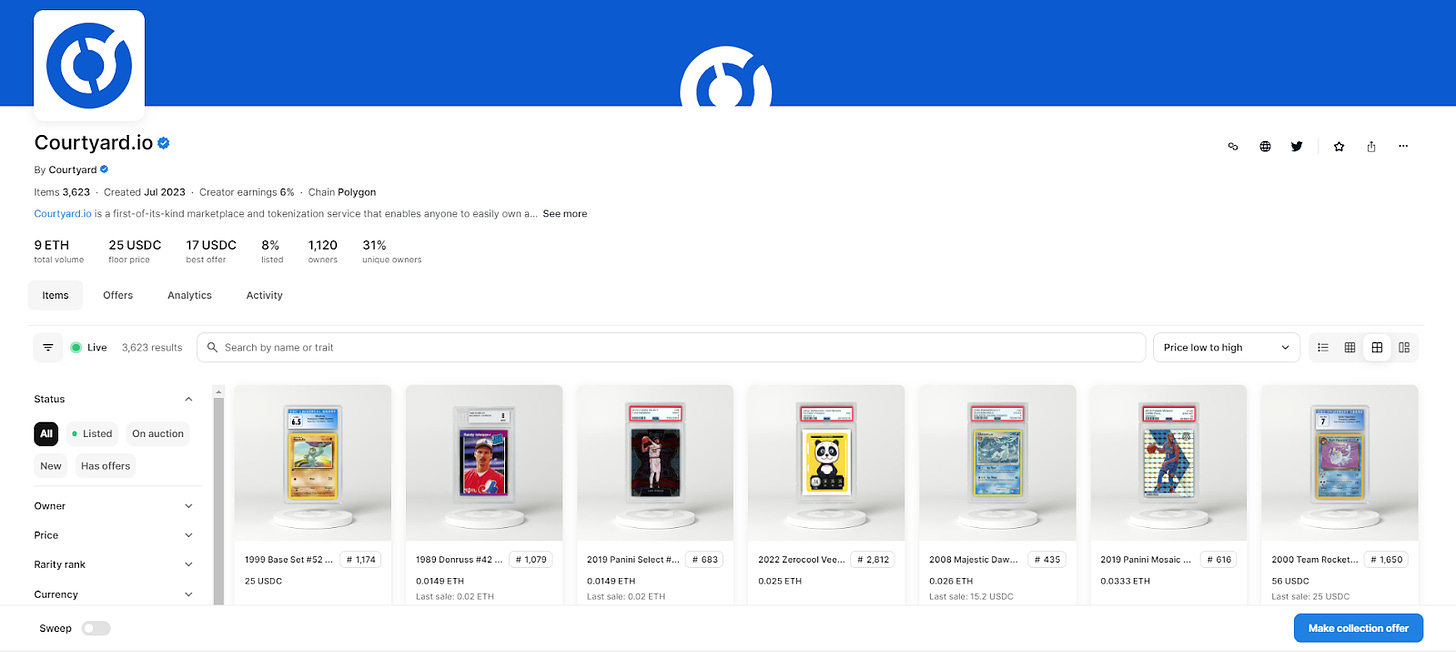

One of the biggest projects to pay attention to here right now is Courtyard.io, which has been making waves lately thanks to its recent Pokémon card drops on Polygon.

Both a tokenization service and a marketplace, Courtyard lets collectors vault and tokenize their own graded trading cards or buy and sell cards already put onchain by others. Its pack drops, some as low as $5 each, have been minting out in seconds, and one pack opener recently won a mint condition “Mario Pikachu” card worth ~$6k USD!

All cards on the platform are authenticated and then custodied in an insured vault at Brink’s, the valuables management giant, to ensure the integrity and redeemability of the associated NFTs at all times.

Yet it’s not just all fun and games at the NFT x RWA crossroads, as we’ve seen some finance-centric use cases start to gain some initial traction as well.

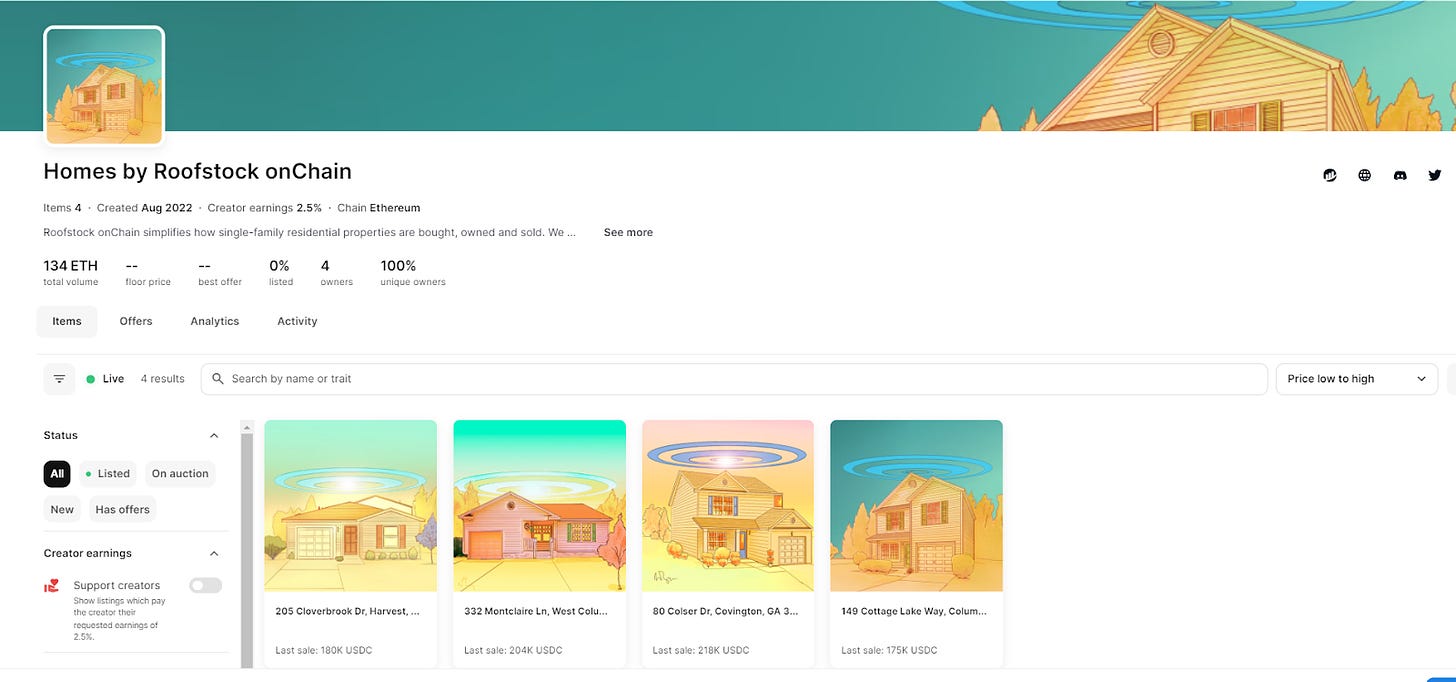

For example, Roofstock onChain has already resold a handful of houses in the real world via NFTs on OpenSea, with the highest sale so far being for 218k USDC.

Over time, I predict we’re going to see an increasing number of DeFi projects embrace the NFT approach to tokenization as more discrete financial assets are brought onchain and as more innovations keep becoming available around NFTs.

Indeed, for both the cultural and financial sides of things here, we’ve reached new possibilities around things like containability and composability — e.g. now you can put other tokens inside your RWA NFTs via ERC-6551, like a “gas pass” setup, or put your RWA NFTs inside other onchain things like onchain game engines.

That kind of stuff may sound far-fetched currently, but it’s exactly the power of RWAs and why they’re compelling going forward, i.e. they pave the way to doing things onchain that you can’t do elsewhere, and that’s the magic.

For now, though, the RWA scene remains a fairly experimental and pioneering space as the frontier is being built out here. Many challenges remain to be sure, like the current lack of regulatory clarity around crypto in general that’s keeping companies and major financial institutions on standby.

As we get more clarity over time, there may eventually come a day where all financial instruments and many cultural objects will be issued onchain, so my grand point then? If that future transpires, NFTs are poised to play a big role in making it all possible!

Action steps:

-

✅ Catch up on my previous weekly roundup: Mint-O-Matic

-

📚 Collect this post: Mint it on Mirror

A Bankless Citizen ⚑ turned $264 into $6,077 last year. A 22x ROI 🚀 in a bear market!

🙏Thanks to our sponsor

KRAKEN NFT

Kraken NFT is one of the most secure, easy-to-use and dynamic marketplaces available. Active and new collectors alike benefit from zero gas fees, multi-chain access, payment flexibility with fiat or 200+ cryptocurrencies, and built-in rarity rankings. Learn more at Kraken.com/nft

👉 Visit Kraken.com to learn more and open an account today.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.