Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, and more!

Dear Bankless Nation,

Today, we’re delving into the world of Papr.

Papr’s an innovative NFT lending protocol that’s got a cool DeFi twist in being built on Uniswap.

Developed by the Backed team, this project isn’t peer-to-peer or peer-to-pool like other NFT loan systems. It’s more like a peer-to-token approach.

The Backed team also just released a fun adventure experience that makes taking out a loan with Papr super straightforward, so let’s dive in and see what this NFTfi project and its new UI’s all about!

-WMP

🦊 Thanks to MetaMask Portfolio 🦊

👉 Now you can stake your ETH via MetaMask ✨

A Quick Tour of Papr 🔄

What is Papr?

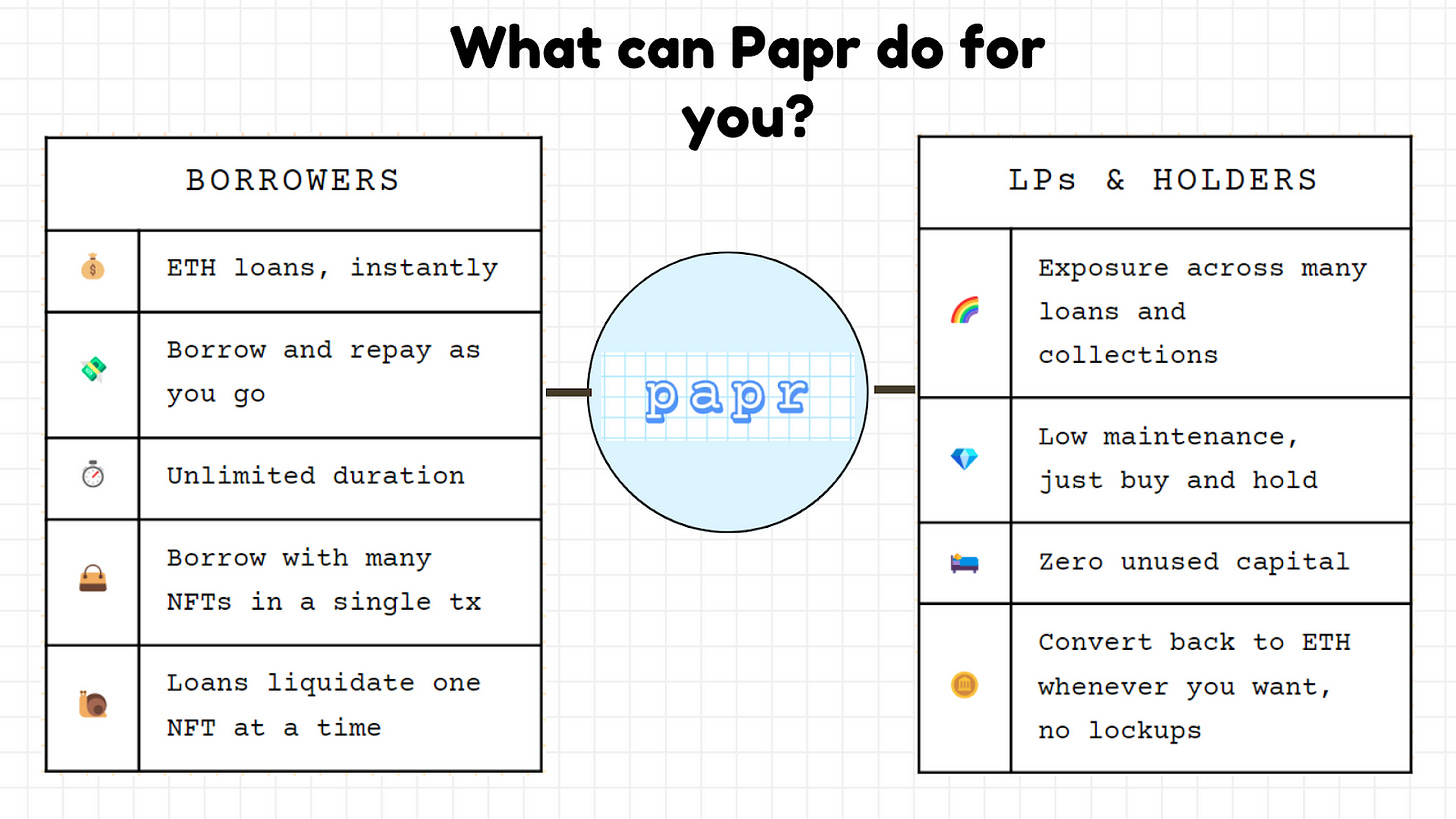

Papr, an up-and-coming NFT lending protocol developed by Backed, allows borrowers to mint loans denominated in Papr (“Perpetual APR”) tokens by using NFTs as collateral.

Borrowers can then trade these tokens on decentralized exchanges like Uniswap, e.g. for ETH liquidity, which thus creates a continuous feedback loop between the Papr trading price and the protocol’s interest rates.

As for lenders and/or liquidity providers, the Papr token offers holders a singular, low-maintenance way to gain exposure to loans across multiple NFT collections, with the first Papr token, $paprMEME, providing exposure to loans across over 20 popular collections and counting.

Accordingly, the protocol offers instant loans for NFT owners and instant exposure for lenders, with the change in $paprMEME’s price over time representing the cost of the loan to borrowers and the reward to $paprMEME holders.

How does Papr work?

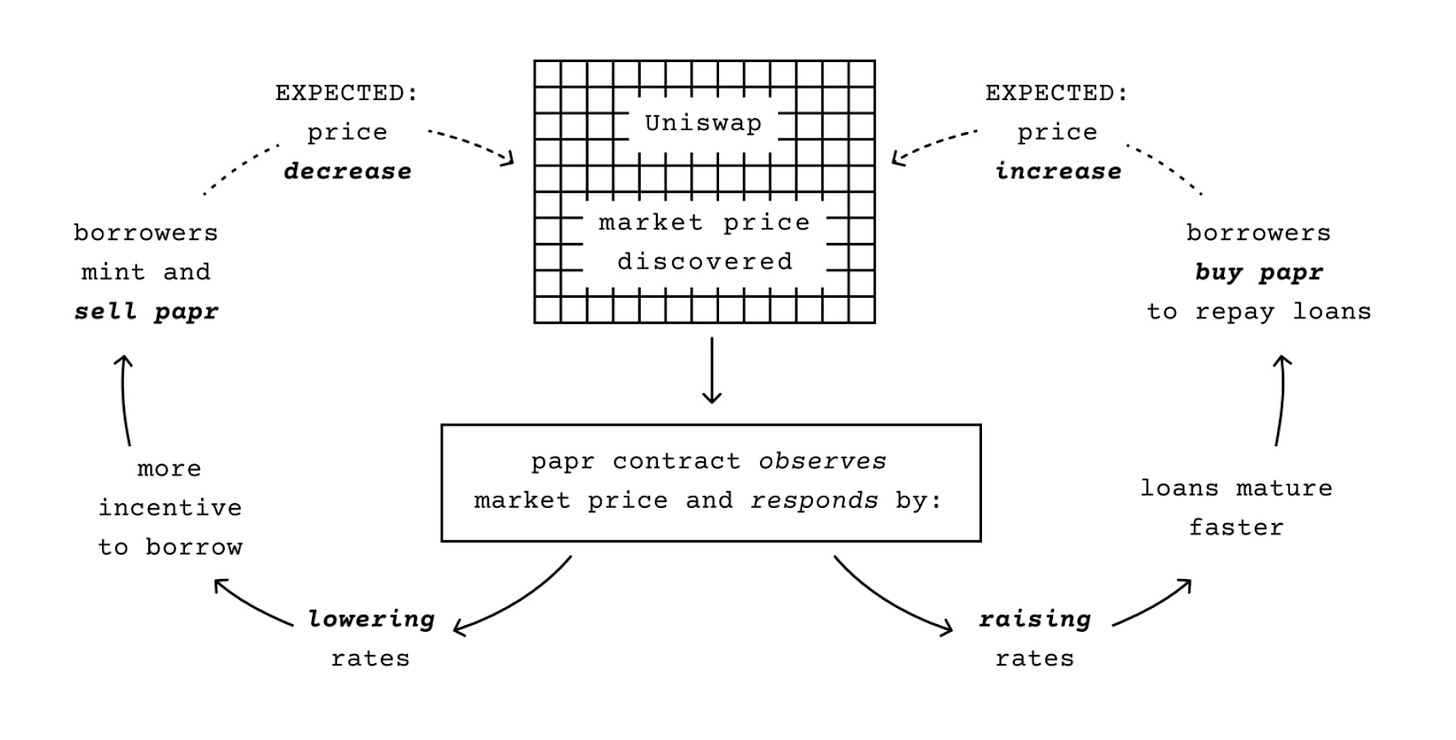

Unlike peer-to-peer or peer-to-pool lending systems, Papr is a unique NFT lending protocol where the project’s contract determines the interest owed by borrowers based on the market price. In this way, Papr is more like a “peer-to-$papr token” approach.

Accrued interest is thus compensated through the appreciation of the $paprMEME price, establishing a continuous interplay between the Papr trading price and the protocol’s interest rates. As $paprMEME’s value on Uniswap fluctuates, the interest rates adjust accordingly, allowing borrowers to respond by creating and shuttering loans as needed.

Since interest is paid via the value increase of $paprMEME itself, new borrowers receive less tokens for the same collateral over time. When a loan is closed borrowers repay the exact amount of $paprMEME they originally drew out, but due to interest charges, the market value of $paprMEME is likely to have increased since the loan’s inception.

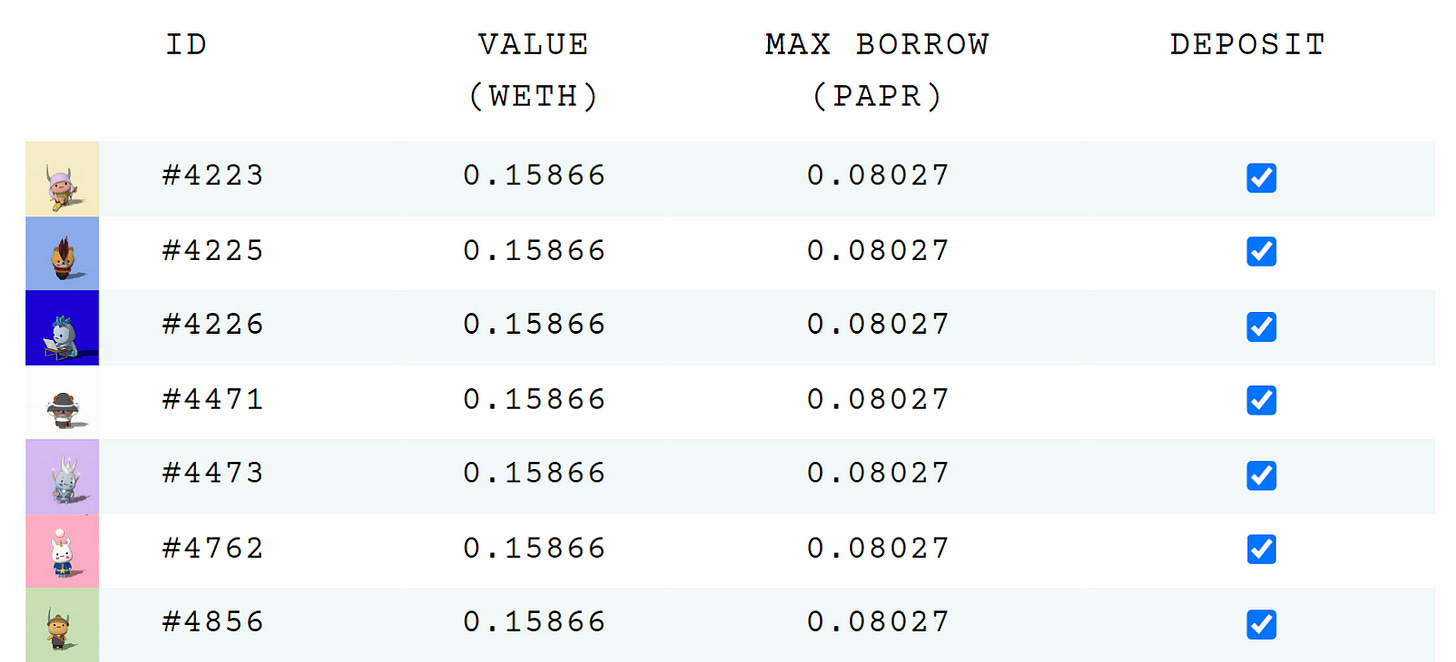

Note that Papr loans have a maximum Loan-to-Value (LTV) ratio of 50%, meaning the total debt cannot exceed half of the collateral NFT’s floor value. For example, if the current floor price of a Fini NFT is 0.15866 ETH as seen below, then the maximum amount I could borrow at the time would be 0.08027 $paprMEME each, since 1 $paperMEME token currently trades at 1.012 ETH.

The value of collateral is computed via oracles based on a 30-day time-weighted average of the collection’s floor listing prices. If a loan exceeds the liquidation threshold, the NFT collateral may enter a Dutch Auction, starting at triple the NFT’s floor value and decreasing by 70% daily. The proceeds are credited thereafter to the borrower.

What collections are supported?

$paprMEME currently supports borrowing against, or lending exposure to, +20 NFT collections, which are as follows:

-

🎨 Art Gobblers

-

🌱 Azuki Beanz

-

🐵 Chimpers

-

🆒 Cool Cats

-

🍑 CryptoDickButts

-

⚡ DeGods

-

💓 Finiliar

-

🧙♂️ Forgotten Runes Wizard’s Cult

-

🐸 Froggy Friends

-

🐧 Lil Pudgys

-

🎲 Loot

-

🚬 Mfers

-

👸 Milady Maker

-

🐦 Moonbirds

-

🌙 Moonbirds Oddities

-

🐈⬛ MoonCats

-

🎮 Pixelmon

-

👥 Regulars

-

🦭 Sappy Seals

-

🐱 Tubby Cats

-

😈 Wassies

-

👩 World of Women

-

🪰 CrypToadz

What’s new?

On May 15, Backed launched a new, user-friendly borrowing experience for Papr, adventure.papr.wtf. The new interface option simplifies the Papr loan process with an engaging, adventure-themed guide by a friendly hypothetical Toad NFT.

If you connect your wallet to the platform, the Toad will walk you through the process over the course of 5 steps. You could then select a supported NFT that you want to borrow against and then decide how much to borrow. The Toad will caution you on how risky your position is set to be, like so:

Once your collateral and loan amount are selected, you can press the “Borrow” button and confirm the transaction with your wallet to lock up your NFT and receive $paprMEME, which you can trade for ETH or etc. as you please. However, if your loan is never repaid, it will eventually be liquidated and the NFT will be auctioned!

Alchemygreg got a 20% gain using Bankless trading strategies last week 🚀

How? Being a Bankless Citizen ⚑

The big picture

Papr is a newer but intriguing entrant in the bustling NFT lending sector. As a small upstart project, it’s already carved out a unique space here thanks to its innovative “peer-to-$papr token” approach, which offers a dynamic, market-responsive protocol for NFT loans.

Additionally, the platform’s system and interface, guided now by Papr’s new Toad helper, notably simplifies the borrowing process and makes it accessible to wider audiences.

All that said, this one’s a protocol to watch I think. If you’re also interested in tracking the progress of Papr going forward, I recommend keeping an eye on resources like the Backed dashboard on DeFiLlama or the $paprMEME Dune dashboard by Backed co-founder Wilson Cusack!

Action steps

-

Explore Papr: check out papr.wtf 👀

-

Catch up on my previous write-up: ERC-6551 – The NFT Game-Changer 💥

Author Bio

William M. Peaster is the creator of Metaversal—a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also a senior writer for the main Bankless newsletter and a contributor to NFT curation platform JPG!

A Bankless Citizen ⚑ turned $264 into $6,077 last year. A 22x ROI 🚀 in a bear market!

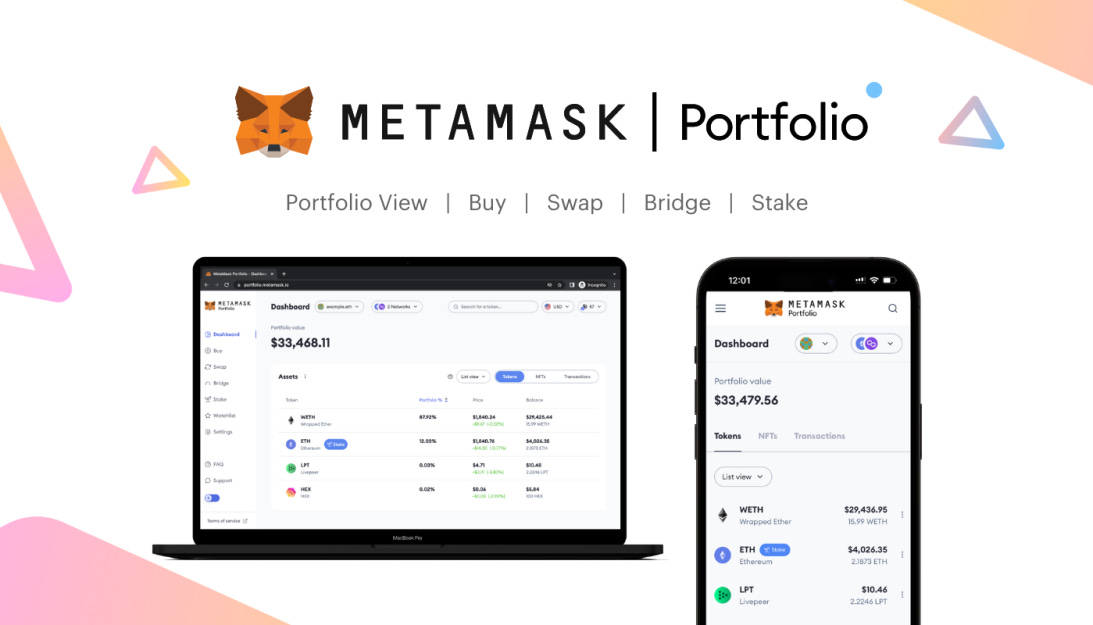

🙏 Together with 🦊 MetaMask Portfolio 🦊

You can now stake your ETH through MetaMask with liquid staking providers, Lido and Rocket Pool. Head over to MetaMask Portfolio to get started! You can also view your assets in one place and discover other features such as Buy, Swap, and Bridge.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.