In addition to hyperinflation and the spate of bank failures, Saylor cited the rise of Bitcoin Ordinals as a further impetus for adoption.

According to Michael Saylor, the co-founder of Microstrategy and a Bitcoin enthusiast, the recent Ordinals trend has played a significant role in driving the adoption of Bitcoin.

“Every time someone builds an application that’s cool on Bitcoin, like all the Ordinals and inscriptions and whatever that are driving up transaction fees, its a catalyst,” said Saylor on the PBD Podcast.

He said that bank failures, hyperinflation, regulators calling the asset a commodity, and when “a company like Microstrategy buys another $100 million worth of Bitcoin” are all similar things that lead to adoption.

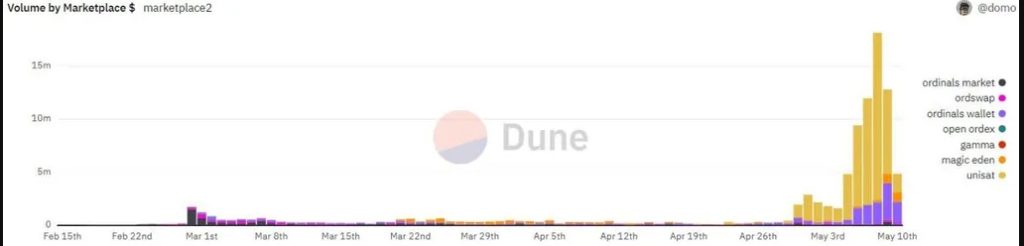

Ordinals, unlike the other mentioned catalysts, is a more recent addition to the leading blockchain.

They provide a method for storing media on the network by inscribing its information on satoshi, the smallest unit of Bitcoin. It was developed at the beginning of 2023, essentially ushering in non-fungible tokens (NFTs) on the industry’s largest network.

In March, another programmer created a standard for the creation of fungible tokens, BRC-20 , on top of Ordinals, causing a market flurry of meme currencies. The market capitalization of BRC-20 tokens surpassed $1 billion yesterday.

Ordinals are also gaining traction, with the world’s largest exchange Binance announcing plans to list Bitcoin NFTs on its platform.

While the increase in network demand has increased miner earnings, the high transaction fees have made BTC transfers extremely costly.

Because of Bitcoin Ordinals, network fees have gone up from less than $2 per transaction before May 2023 to around $20 per transaction.

Content Source: decrypt.com

The post Michael Saylor believes Bitcoin Ordinals will act as ‘Catalyst’ for adoption appeared first on NFT News Pro.

(@saylor)

(@saylor)