Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & collectibles

Dear Bankless Nation,

The talk of the town this week is Blur’s latest release, Blend.

Blend’s a new type of NFT lending protocol that has big potential and big risks.

For today’s post, then, let’s dive into the basics of this platform and why it’s causing some controversy!

-WMP

🙏 Sponsor: Kraken — Kraken NFT is built for secure NFT trading ✨

Blend 101: Everything You Need to Know

The basics of Blend

Designed by Paradigm researchers and implemented by Blur, Blend is a new peer-to-peer lending protocol that enables users to borrow ETH against NFTs.

Blend’s unlike any lending protocol the “NFTfi” sector has seen before, as it has no oracle dependencies and no expiries. This design means borrow positions remain open indefinitely until paid back or liquidated, and with interest rates determined by the market.

Unlike onchain peer-to-pool lending formats, e.g. BendDAO, users looking to borrow against their NFTs on Blend are matched with lenders offering the most competitive rates through an offchain offer protocol. Borrowers have the flexibility to repay whenever they choose, and lenders can opt out of their positions by initiating a Dutch auction to discover a replacement lender with a different rate. If the auction is unsuccessful, the borrower undergoes liquidation, and the collateral is transferred to the lender’s ownership.

To dive deeper into the inner workings of Blend, check out the new protocol’s whitepaper and this great primer thread by Paradigm’s Dan Robinson.

Borrowing and BNPL

Blur implemented the Blend design to actualize two new products on its platform: Borrowing and Buy Now Pay Later (BNPL).

Out of the gate, these new products support three initial collections — CryptoPunks, Azuki, and Milady Maker — with more collections slated to be integrated going forward.

Through the Borrowing functionality, holders of these collections can quickly borrow ETH against their NFTs without having to sell the underlying digital collectibles. Conversely, the BNPL feature is a mortgage-like system where users can buy an NFT with an upfront down payment and with a Blend borrow position that then needs to be paid down over time covering the rest.

Lending ETH on Blend

The other side of the Blend Borrowing product is, of course, lending.

Zooming in here, lending ETH on Blend allows you to earn yield plus Lending Points on the Blur platform. While previously users deposited funds into the Blur Pool wallet to make bids on the platform, now you can make loan offers too with your Blur Pool funds.

To start, a lender would click the “Loans” tab on their target project’s collection page. They’d then select the maximum amount of ETH that can be borrowed using a single NFT, with higher “Max Borrow” values earning more points. Next, they’d select their desired APY for a loan to complete their offer.

Once a borrower accepts a loan offer, their NFT is locked, and the lender starts earning interest in ETH. It’s possible to close the loan at any time to claim your ETH and interest, and the borrower then has 30 hours to repay or refinance the loan with another offer, otherwise the lender will receive their NFT.

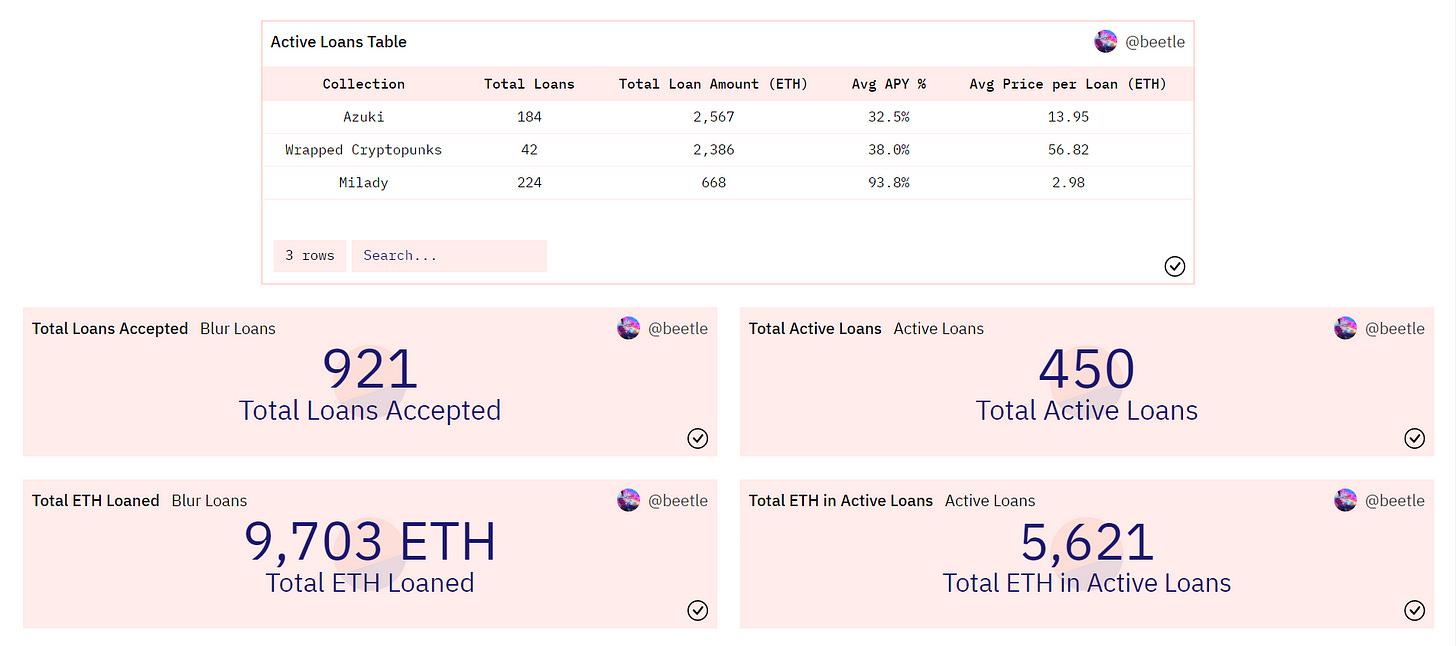

The pulse of Blend

According to the Blur Loans Dune dashboard by beetle, the newly-launched Blend is off to a fast start in having already facilitated +900 loans and +9,700 of total ETH loaned. At the time of writing, there were 450 active loans on the platform with +5,600 ETH in total active loans.

Why Blend matters

• Blend positions Blur to become a dominant and expanding force in the NFTfi category courtesy of its large user base and $BLUR incentives.

• Blend further bolsters Blur’s position as a force to be reckoned with in its ongoing rivalry with NFT marketplace juggernaut OpenSea.

• Blend brings further utility to the $BLUR token, as its parameters and fees are controlled by $BLUR governance.

• Blend has an innovative “no oracle” design that will likely influence a new wave of NFT protocols to explore and experiment with eschewing oracle dependencies.

On Blend’s controversy and risks

Of course, many NFT users aren’t DeFi power users, many don’t have a firm grasp on the basic mechanics of borrowing, many don’t understand the risks of leverage and liquidations, and so forth.

So on the one hand we’ve seen complaints that with Blend, Blur is continuing to over-financialize the NFT space and fuel a “gambling economy.” On the flip side, others have expressed concern that regular users who shouldn’t be messing around with more sophisticated NFTfi products like NFT mortgages will be enticed and likely get burned by these new offerings.

All that said, I do think it’s good to understand the basics of Blend and its context in the contemporary ETH ecosystem, if for nothing else to stay informed and prepared for future developments in the space. However, as for actually using Blend, it’s important to keep in mind that it does come with these big risks and complexities, and in that regard it’s really only suitable for advanced NFTfi users. In kind, watching from the sidelines is a perfectly fine strategy for the vast majority of us right now.

The big picture

In the context of mechanism design and expanding the frontier of the NFTfi sector, Blend is quite interesting. It may even inspire more DeFi projects to explore “no oracle” designs, etc. Yet it’s important to stress that unlike more basic NFT products, Blend is risky and absolutely not for everyone, and novices who dive into the system unawares are poised for rude awakenings.

If you are keen to try Blend firsthand, treat it as an experiment and approach it cautiously only after deeply educating yourself on the system’s intricacies!

Action steps

-

Check out Blend: explore the new Blur offerings 🪙

-

Read my previous weekly roundup if you missed it: The NFT Crossroads 🛣

Author Bio 👋

William M. Peaster is a professional writer and creator of Metaversal—a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, JPG, and beyond!

A Bankless Citizen ⚑ turned $264 into $6,077 last year. A 22x ROI 🚀 in a bear market!

🙏Thanks to our sponsor

KRAKEN NFT

Kraken NFT is one of the most secure, easy-to-use and dynamic marketplaces available. Active and new collectors alike benefit from zero gas fees, multi-chain access, payment flexibility with fiat or 200+ cryptocurrencies, and built-in rarity rankings. Learn more at Kraken.com/nft

👉 Visit Kraken.com to learn more and open an account today.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.