It’s fast become one of the big buzzwords in business and technology. It’s one of the hottest properties to invest in, and you can be sure it will only get bigger and bigger. But stick with us until the end, and you’ll see how many people have no idea what the word FinTech even means. Welcome to a Make An App. The place where future billionaires come to get inspired.

Over the previous two decades, technological innovations have altered how we interact, converse, shop, and conduct business. Consumers’ interactions with one’s funds, whatever they desire from financial institutions, and how certain institutions work have all been challenged by emerging technologies in the financial services industry. New technologies make operations easier and more efficient, reduce mistakes, improve communication, and change how people think about and interact with money.

100+ List of Top Fintech App Development Companies

Most significantly, these technologies may tremendously help recent trends in financial services. Chatbots and automation, for example, are emerging technologies in the financial services industry that cut person hours, enhance client connections, and increase profitability. While the influence of new technology on financial services may vary depending on the function, many of them are expected to be adaptable and beneficial.

We have listed the top 20 Fintech Trends that will change the industry in 2023.

You don’t need a computer science or finance degree to figure out it’s an abbreviation for financial technology. But when it comes to FinTech, whether you’re in the dark or well-clued up, we thought we’d shed a bit more light on this hot topic.

If they haven’t already, expect these emerging technologies for financial services to become a part of your institution’s IT stack.

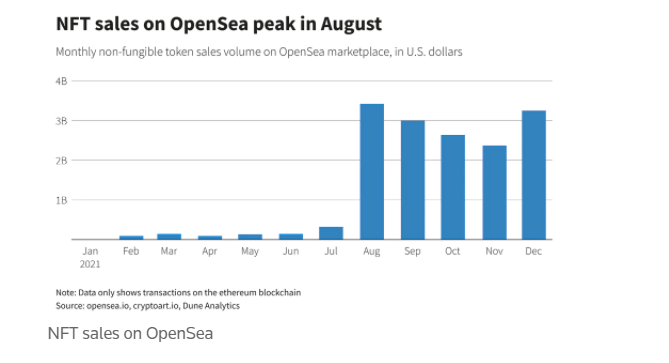

Rise of NFT and Crypto Transaction

According to Forbes, “NFT Market Generated Over $23 Billion In Trading Volume In 2021”.

The popularity of Non-fungible tokens (NFTs) are difficult to overlook. According to CBInsights, NFT funding surpassed $1 billion for the first time in the third quarter of 2021, increasing 6,427 percent year over year. According to research firm DappRadar, NFT sales volumes reached $10.7 billion in the third quarter, an eightfold rise over the previous quarter.

NFTs, on the other hand, have significantly more potential than bizarre digital artworks. NFTs are also used to buy digital land in virtual worlds, own, license, and produce next-generation music. Some analysts believe that NFTs will provide access to special sales or limited-edition products in the future.

Top 11 NFT Trends That Are Set to Change the Future

Top 10 Emerging Technologies in the Financial Services Industry of 2023

- Blockchain

- Machine Learning

- RPA

- Artificial Intelligent

- Chatbot for Banking and Finance

- Smart Contracts

- Digital banking

- Big data management

- Sensors and the Internet of Things

- Python

- Predictive Behaviour Analytics

- Java

1. Blockchain in Finance – Trending Fintech of 2023

Blockchain is among the innovative Emerging Technologies in the Financial Services Industry, revolutionizing the global era, yet adoption is limited. Blockchain is the platform that enables Bitcoin. It is widely recognized as one of the most promising areas for banking institutions today.

While blockchain technology is one of the most high-tech companies in the financial industry, it is still not widely available. While other organizations are working on broader solutions, most banks adopt blockchain solutions independently.

Modest banking firms without the resources to design a solution may face major challenges. Blockchain’s rapid acceptance will swiftly become a popular platform for transactions, fraud reduction, loan applications, crypto algorithms, and other applications over the last few years.

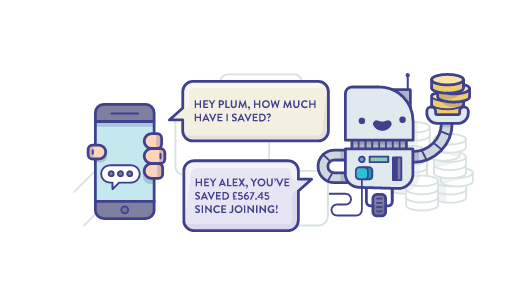

2. Chatbots and Artificial Intelligence

Chatbots and other artificial intelligence technologies are becoming an increasingly important aspect of the banking industry’s digital transformation. They are widely used by financial organizations and companies, with everyone from giant banks to small credit unions using them.

Rise of AI-Powered Chatbots in the Banking Industry

While chatbots are the most obvious artificial intelligence, AI also influences back-office operations, delivery processes, financial planning, marketing, and security. Machines use simple algorithms to handle data input to risk appraisal to loan form processing, saving major banks hundreds of thousands of staff hours.

Smaller banks may take advantage of these Emerging Technologies in the Financial Services Industry, including solutions to automate certain operations, including paperwork, data exchange, data analysis, client communication, and more.

The biggest problem is ensuring high performance in external procedures like chatbots, where some organizations frequently fall short. Many firms also face challenges such as walled data sets, compliance-related concerns, and the worry that AI won’t complete the task.

That’s why many combine technologies with physical establishment and supervision to avoid machine mistakes. This indicates that the adoption of new technologies in financial services may be delayed due to financial organizations’ concerns.

Customers are now more than ever seeking individualized services. Generation Z, who’ve been expected to become major financial services clients in the future, wants to be handled with a level of customization not seen in previous generations.

3. Role of Machine Learning in the Finance Industry

It’s a huge user of machine learning. As FinTech offers cutting-edge products, it stands to reason they use the most cutting-edge new technologies and is some of the biggest users of them, and none more so than machine learning and AI. One of fintech’s most famous uses of AI is in so-called Robo advisors. Now, sure, they might sound like armour-clad law enforcement agents from a dystopian future, but the word refers to algorithms that automate investment advice. And basically, they do the same job as financial advisors, but at a lower cost. And another way FinTech companies use AI is in their cybersecurity to fight online fraud. They do this with computer programs that use information about your payment history to flag up transactions outside of the norm.

4. Fintech in Predictive Behaviour Analytics

FinTech uses all kinds of new technologies, like chatbots, which assist customers with basic tasks and cut staffing costs, or an area called Predictive behaviour analytics used in car insurance apps like route insurance. The app tracks the driver’s movements, assesses their driving skills, and adjusts premium rates based on their behind-the-wheel performance. And of course, Blockchain was developed specifically to record transactions of Bitcoin and is closely connected with one of the most talked-about areas of FinTech, crypto.

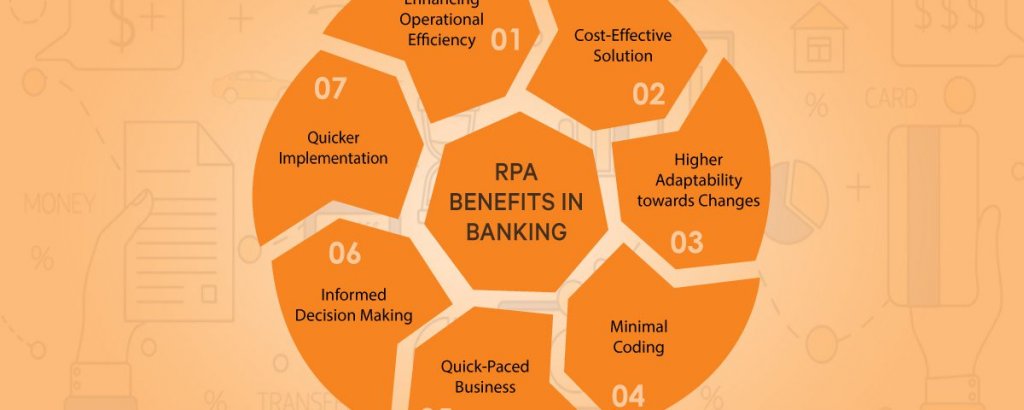

5. RPA in Finance Sector

Back-end office procedures such as customer onboarding, security checks, credit card and mortgage processing, and others are automated using robotic process automation. The financial services industry will progressively adopt RPA to complete work more quickly, save money, and increase organizational efficiencies while freeing employees to focus on more important activities like customer service.

Finance Technologies Digital Transformation Case Studies

10+ Case studies on digital transformation in the finance sector. Explore the case studies that demonstrate how finance technology makes our daily easy.

- Investment in FinTech is going up exponentially

- Banks’ Digital Experience Platforms

- Traditional banks are worried about it

- Digital Transactions or Digital Wallets

- Automation in Financial Services Technology Trends in Recent Time

1. Investment in FinTech is going up exponentially.

With so many movers and shakers of the last decade being FinTech, This one shouldn’t come as that much of a surprise; over $300 billion has been invested in FinTech in the past decade. And according to Goldman Sachs, the market worth of all FinTech firms is $4.7 trillion. That includes investments made by big tech firms into their platforms, like Apple Pay and Google Wallet, and the financing secured by a large number of startups, which is about 12,000 FinTech startups across the world. Number eight, the word FinTech originally described the back-end technologies of traditional banks. The first time most of us heard the word FinTech was probably sometime in the last decade. But the first recorded use goes back a lot further to 1971. It was originally used to describe the back-end technology banks and big financial institutions used. It’s ironic because we use it to talk about their competition. And the first FinTech that went global as a company we all know well, Paypal, was launched in 1998 by one of our favourite people here at a lux Elon Musk. Although it wasn’t until quite a bit later the term FinTech was used more widely.

2. Banks’ Digital Experience Platforms

Although revolutionary digital interfaces are not new, contemporary advancements allow banks to change an industry that is still pretty recent. Many technology trends in the financial service industry provide users with security and connectivity.

The emergence of API platforms, which allow users to link their banking information into other apps and vice versa, is one of the most significant advances. More financial institutions have battled API, but now that the EU has mandated open API, many organizations in the United States are following suit.

Consumers may benefit from open banking by sharing data with 3rd planning applications and utilizing managing money programs, allowing tiny banking firms who cannot afford these services to do so through outsiders.

3. Traditional banks are worried about it

With good reason to that’s because until a few years ago, banks had a tight hold on pretty much anything we did involving money, and being the huge bloated dinosaurs that banks are, there wasn’t exactly much incentive for them to innovate or be competitive. Fast forward a few years and a few leaps ahead in digital technology. And it was time for smaller, more agile players to make an entrance here, got it, FinTech, and in the last decade, they’ve been giving banks a real run for their money as innovation experts and fintech.

4. Digital Transactions or Digital Wallets

The term includes sectors you probably didn’t think were fintech. FinTech companies unbundle all the different types of financial transactions that banks traditionally do. And as each FinTech tends to specialize in just one area, they focus on doing it in a way that’s efficient and streamlined and as user friendly as possible on a digital interface and at a low cost to the consumer. That includes platforms that are already fairly obviously FinTech, like platforms that let you make payments online or in stores, square or PayPal, platforms that let you trade stocks, like eToro, or RobinHood and anything digital you use to apply for a loan. The FinTech label also includes cryptocurrencies, the crypto trading platform, coin base, and the so-called Neo banks, like chime TransferWise or revolute. But there are other players you may already be familiar with but hadn’t thought of as FinTech crowdfunding is also considered fintech. So it includes the likes of Kickstarter and GoFundMe. And if you make or receive payments via Patreon, you’re also using FinTech, or if you’ve raised money or donated money via online charity fundraising platforms, that’s FinTech too. And there’s FinTech, specifically for Medicare.

5. Automation in Financial Services Technology Trends in Recent Time

The most prevalent method for automated processes is robotic process automation, which automates fixed and monotonous activities. Automation, unlike AI, relies on a basic set of rules to provide predictable outcomes. These pre-programmed rules might include structured or unstructured data to manage digitalization, acceptance, risk alerting, and other tasks. Many also incorporate learning patterns, improving over time as more data is collected.

Robotic Process Automation is used to produce information, log data, automate repeated procedures, and keep track of logs. For example, may handle quick payments by employing a designed rule to authorize a payment automatically if all circumstances are satisfied. Another RPA would therefore record the transaction, transfer the paperwork into a larger folder, and modify information throughout all applications and systems that use the data.

RPA and other financial technology advance banking institutions to save money, reduce human error, and increase processing speed. Customers benefit as well, as they focus on looking for personal certification.

6. Fintech lifted millions of people out of the poverty

Fintech lifted millions of people out of extreme poverty. FinTech does a great job of bringing financial services to people who couldn’t access them before. Often that means people who didn’t have a regular income or a permanent address, and fintech, allowing them to build wealth and escape the poverty trap. A case in point is m paisa. It was released in Kenya in 2007 and transformed your smartphone into a bank account. It allows users to make and receive payments securely make online deposits. And it gets credit for having reduced crime in a society that used to be mostly cash-based and prone to theft. In fact, since m PESA was launched in 2007. It’s raised 2% of Kenyans, around 200,000 households out of poverty, and many other people in different countries throughout Africa where it’s also used. And we think that all of this means FinTech deserves some serious kudos.

7. Fintech Helping to Tackle Cyber Crimes

Cybersecurity is still a big concern. Of course, it comes with the nature of FinTech companies that they would hold huge amounts of sensitive data. And there are high risks if all of that gets stolen. And along with all of the good news around FinTech, it’s worth noting it’s not all rosy; we do need to be careful. Figures from last year show that 27% of FinTech companies have experienced a security incident, and 29% aren’t sure because they haven’t checked with more investment and more transactions being made through fintech. This is likely to improve in the future. But it still goes to show just how seriously we should be taking cybersecurity.

100+ List of Top Fintech App Development Companies

8. Financial Technology is Changing Loan Industry

it’s revolutionizing the loans market. Applying for a loan is a great example of how traditional banks were drowning in bureaucracy and how FinTech has shown us all it can be improved and streamlined for a lower cost. Now it’s possible to find a whole range of apps and websites that help you compare prices of credit card loans in a way that banks didn’t use to do. That includes peer to peer lending platforms like prosper marketplace and Lending Club sites for business loans like cabbage and the lender and fintech that lets you apply for mortgages, which take traditional brokers out of the equation and approve loans faster. And in 2016, American FinTech Sofi, which helps with Student Loan Refinancing, became the first online lender to get a triple-A credit rating.

Conclusion

After 2010, developing technology in Emerging Technologies in the Financial Services Industry influenced practically every company. Consumers are provided with a high level of personalization across products and services, and procedures have become more transparent. Payments are handled with security and accuracy, and customers are offered a high level of customization across goods and services. Companies should be allowed to improve their client intelligence assets, which can then be utilized to strategy customer-centric growth, with the above financial services technology trends at the heart of systems.

The post Trending Technologies in Financial Services Industry | Emerging Fintech 2023 appeared first on 2023.