Coinbase; Alyssa Powell/Insider

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Terms apply to offers listed on this page. Read our editorial standards.

Overall rating

| Feature | Insider rating (out of 5) |

| Fees | 4.00 |

| Investment selection | 5.00 |

| Access | 4.10 |

| Ethics | 3.00 |

| Customer service | 5.00 |

| Overall score | 4.22 |

Is Coinbase right for you?

Launched three years after the creation of bitcoin in 2009, Coinbase is a cryptocurrency exchange that allows active traders to purchase, sell, or hold more than 100 virtual assets, including bitcoin, ethereum, the basic attention token (BAT), and others.

Coinbase also provides a range of investment options for businesses and institutions, including crypto storage, commerce services, and more. And in early June 2021, the exchange rolled out dogecoin access for Coinbase Pro users, as well as for its standard accounts and mobile apps. See more here.

Founded in 2012 by Brian Armstrong and Fred Ehrsam, Coinbase says it serves roughly 73 million verified users, 10,000 institutions, and 185,000 ecosystem partners across the world.

The company also recently went public through a direct listing on the Nasdaq exchange.

Coinbase vs. Kraken

|

Coinbase |

Kraken Exchange |

|

Min. Investment $2 |

Min. Investment $10; Cryptocurrency minimums can vary |

|

Fees 0.50% spread for buy/sell transactions; transaction fee from $0.99 to $2.99; up to 0.50% for Coinbase Pro |

Fees 0% – 0.26% |

|

Investment choices Cryptocurrencies |

Investment choices Cryptocurrencies |

| Coinbase | Kraken crypto account |

Coinbase and Kraken both offer large cryptocurrency selections, but the exchanges differ when it comes to fees and account perks. If you're looking for the lowest fees and access to options like futures trading, Kraken may be the best fit for you.

However, Coinbase offers a slightly larger cryptocurrency selection, and it's a better fit for beginners. For instance, in addition to its simple interface, features like Coinbase Earn pay you in crypto for taking courses and learning about different cryptocurrencies the platform provides.

Coinbase vs. Binance.US

|

Coinbase |

Binance.US |

|

Min. Investment $2 |

Min. Investment $10 |

|

Fees 0.50% spread for buy/sell transactions; transaction fee from $0.99 to $2.99; up to 0.50% for Coinbase Pro |

Fees 0.1% spot trading fee; 0.5% instant buy/sell fee (4.5% fee for deposits with US debit card) |

|

Investment choices Cryptocurrencies |

Investment choices Cryptocurrencies |

| Coinbase | Binance.us |

Coinbase and Binance diverge when it comes to fees and available investment products. If you're a beginner who values educational resources and other tools that can help you get acclimated to crypto more efficiently, Coinbase is the better option. Binance.US has a more limited selection of resources for beginners.

Binance.US also has a smaller crypto selection, but it offers lower fees.

But while Binance.US' 0.1% spot trading fee is lower than Coinbase's 0.50% fee, Coinbase offers a wider range of account options for individuals and institutions.

Ways to invest with Coinbase

Coinbase

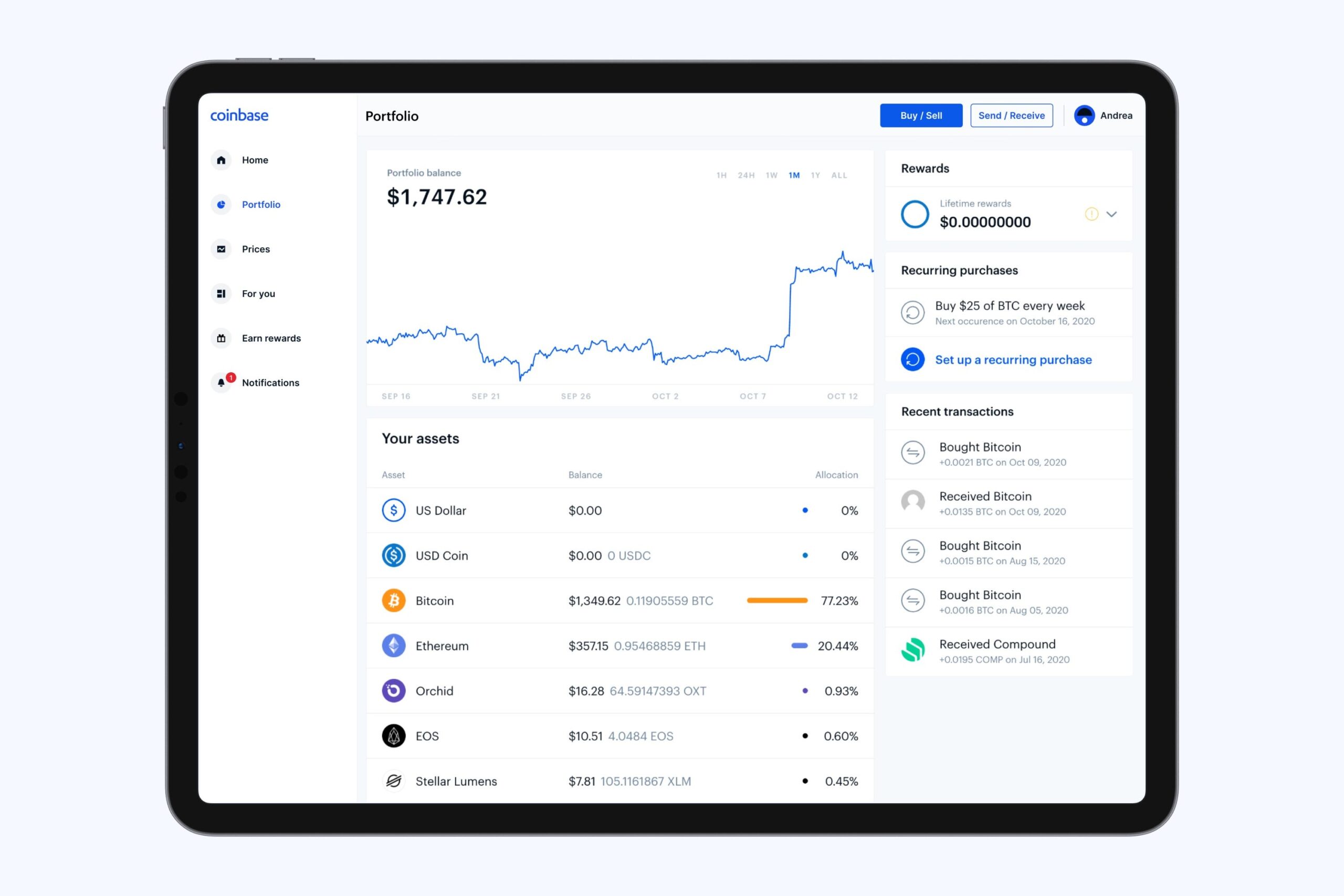

As long as you've got at least $2, you can trade more than 100 cryptocurrencies with Coinbase's standard trading account. But even if you aren't actively buying, selling, or using cryptocurrencies, you can take advantage of several other products, including its web and mobile interfaces.

Coinbase

The Coinbase Earn feature allows you to earn free crypto assets by learning about different cryptocurrency topics. Here's how it works: You watch short educational videos (typically no longer than four minutes each) on different cryptocurrencies, but you'll have to take a quiz after you complete each lesson. Coinbase will deposit crypto into your Coinbase storage wallet for each quiz you complete (see a full list of Coinbase Earn's offerings Coinbase Earn).

Coinbase also offers Coinbase USD Coin, a cryptocurrency that's backed by US dollars. The company also refers to these as stablecoins since — unlike regular volatile cryptocurrencies — you can always redeem one USD coin for one US dollar, according to Coinbase's website. In fact, the app allows eligible USD Coin customers to receive rewards at an APY of 0.15%.

If you're a US investor, you'll need to keep the following fees in mind:

| Payment method | Coinbase fee |

| US bank account | 1.49% |

| Coinbase USD wallet | 1.49% |

| Debit card purchase | 3.99% |

| ACH transfer | Free |

| Wire transfer | $10 ($25 outgoing) |

| Credit transaction | 2% |

| Crypto conversion | 2% |

In addition, if you're wondering about crypto custody and storage options, Coinbase provides its own online storage wallets. With the Coinbase Wallet app (this app is also separate from its iOS and Android mobile apps), you can manage your private keys and crypto assets online.

One thing to consider is that, while similar to many popular crypto and bitcoin wallets that give you non-custodial storage over your private keys, the Coinbase wallet also offers its own unique feature as well. The user-controlled wallet gives you a 12-word recovery phrase, or "seed,"that only users can access. This means that Coinbase won't have access to this secret code.

Coinbase also recently launched another product: NFTs. NFT-focused individuals can create and/or exchange NFTs without any transaction fees through Coinbase's beta version of its NFT platform (keep in mind that the 0% transaction fee offering is only available for a limited period of time).

Coinbase Pro

If you're more of an advanced cryptocurrency trader, Coinbase's Pro account could be a good fit for you. The account includes real-time order books, charting tools, and trading history. Coinbase also says its Websocket Feed gives you easy access to market data, while its trading API gives you the option to develop secure trading bots.

Coinbase Pro accounts also include FDIC insurance protection up to $250,000, and higher account balances result in lower trading fees. For instance, Coinbase Pro's fee structure is comprised of taker fees and maker fees. If you've got an account balance below $10,000, you may have to pay a taker fee of 0.50%. You'll only have to pay 0.04% if you hold more than $500 million.

Coinbase says taker fees are applied when you place an order at the market price that gets filled immediately. These fees range between 0.04% and 0.50%, depending on your account balance.

Maker fees, on the other hand, apply whenever you place orders that aren't immediately matched with existing orders, according to Coinbase's website. The platform says you'll pay a maker fee if another investor places an order that matches yours. Maker fees range from 0% to 0.50%. You can find the complete fee schedule here.

One more important detail: Coinbase says you'll pay a taker fee for the portion of any of your orders that are partially matched immediately. You'll have to pay a maker fee once the remaining portion of the order matches with another order.

Coinbase Prime

Coinbase also gives businesses and institutions a wide array of investment options. These include its Prime cryptocurrency trading platform, Asset Hub, commerce platform, storage options, and ventures services.

Coinbase Asset Hub lets businesses and issuers list crypto assets across the Coinbase platform to gain growth and exposure. Coinbase's commerce offerings help crypto-oriented businesses set up hosted checkout pages, invoices, payment buttons, and more.

The investment platform also offers secure Coinbase Asset Custody (also known as offline storage) for institutions and businesses. And the ventures feature gives new companies a space to raise money for expansion.

Coinbase Card

You can also do more beyond trading and staking, thanks to the Coinbase Card and other spending features. The Coinbase Card is a Visa debit card that's funded by your crypto account balance. You'll need to set up the iOS or Android mobile app to use it, and it allows you to spend crypto globally while earning up to 4% back in crypto rewards on each purchase.

It also allows contactless payments, PIN payments, or ATM withdrawals. You could formerly only use the card to either earn 1% back in ethereum, dogecoin, and bitcoin, or 4% back in the graph or stellar.

But on September 27, 2021, Coinbase announced that cardholders can also now spend USD (plus crypto) with the Coinbase card. And starting this week, you can earn 1% back in dai or 4% back in amp or rally. The crypto exchange says all US customers (excluding Hawaii residents) will be eligible to sign up for the Coinbase Card this fall.

Finally, Coinbase is also now allowing US customers to directly deposit any amount of their paychecks into their accounts in crypto or USD. This includes the option to get paid in crypto (this feature enables Coinbase to convert your paycheck from USD to crypto without any transaction fees).

Coinbase: Is it trustworthy?

Coinbase has received an F rating with the Better Business Bureau.

The BBB considers several factors when evaluating companies. These include time in business (as well as type of business), customer complaint history, licensing, government actions, and more. While Coinbase's rating is low, the bureau also says that its ratings don't guarantee that a company will perform well or exhibit trustworthiness.

For this reason, it's also important to do your own due diligence before making a final decision. The BBB says it assigned Coinbase an F rating because the company failed to respond to more than 2,525 complaints.

Earlier in July 2021, Coinbase Global, Inc. ran into a for allegedly violating securities laws. The bureau also lists a pattern of complaints among customers who describe being locked out of their accounts and being unable to reach customer service.

Coinbase has closed more than 1,900 complaints in the last 12 months.

Coinbase — Frequently Asked Questions (FAQ)

How do you make money on Coinbase?

Coinbase offers several ways to earn money while using its platform. Chief among these is cryptocurrency trading (the platform currently allows trading for more than 100 assets). Though crypto trading is the primary way to earn money through the company, you'll also have a few more options.

These include staking — a process that pays you interest rewards for holding set amounts of certain eligible cryptocurrencies for a set amount of time — and Coinbase Earn, a feature that pays you in crypto for watching educational videos about different assets. Plus, the Coinbase card offers up to 4% back in crypto rewards when you use it to pay for goods and services.

How do you withdraw money from Coinbase?

You can cash out your funds both on Coinbase's web platform and mobile app. If you're using a web browser, you'll first need to select your account balance under "Assets." You'll then find the "Cash Out" tab where you can set the amount you'd like to withdraw. Finally, once you choose the transfer destination, you can complete the transaction by clicking "Cash out now."

The process is even simpler through the mobile app. Note, however, that Coinbase places a short holding period on your cashed out funds when you move them from your Coinbase account to your bank account.

Can you trust Coinbase?

This is largely a question that you'll have to answer for yourself. However, Coinbase is one of the oldest and most recognized cryptocurrency exchanges. It was founded in 2012, three years after the first cryptocurrency, bitcoin, surfaced.

Prospective investors should note, however, that the Better Business Bureau has given the company an F rating. The BBB rates companies based off how well it believes they interact with customers, so keep this in mind as you weigh your options.