Metaversal is a Bankless newsletter for weekly level-ups on NFTs and the onchain frontier

Dear Bankless Nation,

There are things I know now about NFTs that I wish I knew when I first began here.

That said, with a new bull crypto market taking shape, NFTs are gaining momentum again and may soon face their next big influx of users.

If family and friends start asking you for advice anew then, what should you tell them today?

I’ve been thinking about this question a lot, so for this latest post let’s go over 15 tips you can share with any NFT newcomers in your life!

-WMP

🔷 Thanks to Toku 🔷

👉 Make token grant administration simple ✨

15 Tips for NFT Beginners

1) Not everything’s a flip

Newcomers tend to initially approach all NFTs as investments, which is a recipe for frustration.

Sure, there are digital collectibles like profile picture (PFP) projects that you can speculate on as you would with physical collectibles, like action figures or trading cards.

But there are many different types of NFTs, from access passes to gaming assets and everything in between. And many of these are not “buy low, sell higher” plays, as they offer different types of value—e.g. cultural value, educational value, utility value, etc.

For example, I don’t want to sell my 20 Axies and don’t view them as investments because I use them as gaming pieces to access Axie Infinity, to fight for AXS token rewards, to breed more Axies, and so forth. Approaching all the different types of value around NFTs beyond just financial value is how to really make the most of being here.

2) Ceilings are for fans

If you’re like me, you may periodically find yourself fawning over the NFTs with the rarest traits in a collection, e.g a new 10k PFP project.

However, down the road these rarer NFTs tend to be very illiquid compared to their “floor” NFT counterparts, i.e. a project’s common lowest-price pieces.

All that said, only go after rare NFTs if you love them and wouldn’t mind holding them for a long time and potentially selling for a loss later.

Otherwise, if it’s flipping you’re after, stick to the floors, as they offer much better liquidity and volume prospects in general.

3) NFTs can be like levered longs

Speaking of flipping, owning an Ethereum NFT can be similar to having a leveraged investment in ETH. The same is true of a Bitcoin NFT for BTC, or a Solana NFT for SOL, etc.

The idea here? Sometimes NFTs have amplified price correlation with their native currency.

For instance, if ETH increases in value, an Ethereum NFT’s price may increase even more so percentage-wise. Be careful, though, because the opposite is also true: a drop in ETH’s value could lead to a larger percentage drop in the NFT’s value at that time!

4) Try to always at least mint 2

There’s always new drops happening around the NFT ecosystem these days.

Some of these projects may go on to become very popular, so a good rule of thumb is to mint at least two NFTs from any given drop.

This way you can have one to keep and enjoy forever if you’d like, while also having at least one available to sell in case good offers start flowing in later!

5) Beware of scams

There’s money to be made around NFTs, so the unfortunate reality is that scammers—ranging from lone-wolf blackhat hackers to nation-state cyber warriors like Lazarus Group—are on the prowl here.

As such, you have to take wallet security seriously at all times. Consider things like:

-

🔏 Siloing your most valuable NFTs in a Safe multisig.

-

👛 Minting from a dedicated mint wallet that doesn’t store your main crypto holdings.

-

🔍 Using transaction preview tools like Fire to vet your transactions.

-

❎ Routinely revoking your old token approvals on Revoke.cash to defend against smart contract hacks.

-

🧠 Researching and cross-checking drop links to avoid fake mint traps.

If you layer these sorts of approaches together, you can secure your NFTs and make sure hackers don’t have their work cut out for them.

Bankless Citizens who completed the Jito quest in our Airdrop Hunter tool just earned $15k or more 🏹

Don’t miss the next one 👇

6) Don’t rush on new chains

Over the last year, we’ve seen a resurgence of NFTs on non-Ethereum networks like Bitcoin, Solana, Cosmos, and Layer 2 (L2) scaling solutions.

There’s a lot to explore across the board, then. But if you’re just learning the ropes of NFTs in general, don’t let FOMO make you cut any corners.

Do your research, safely store your new wallet recovery phrases, triple check that the addresses you’re interacting with are the right ones. Stuff like this will help you surf the NFT frontier without major snafus.

7) Just mint it

For creatives, NFTs offer a great avenue for distributing your work, whether that be illustrations, music, photography, 3D sculptures, etc.

But in being creative, you may also have certain doubts. What if my work isn’t good enough? What if no one mints? What if I don’t have everything organized yet?

My advice is to ignore these doubts: just mint it. Experiment, explore, try different platforms. Archive your work, old or new, onchain for posterity. See what happens. And whatever happens, you can always look back on these NFTs as digital signposts of your creative journey.

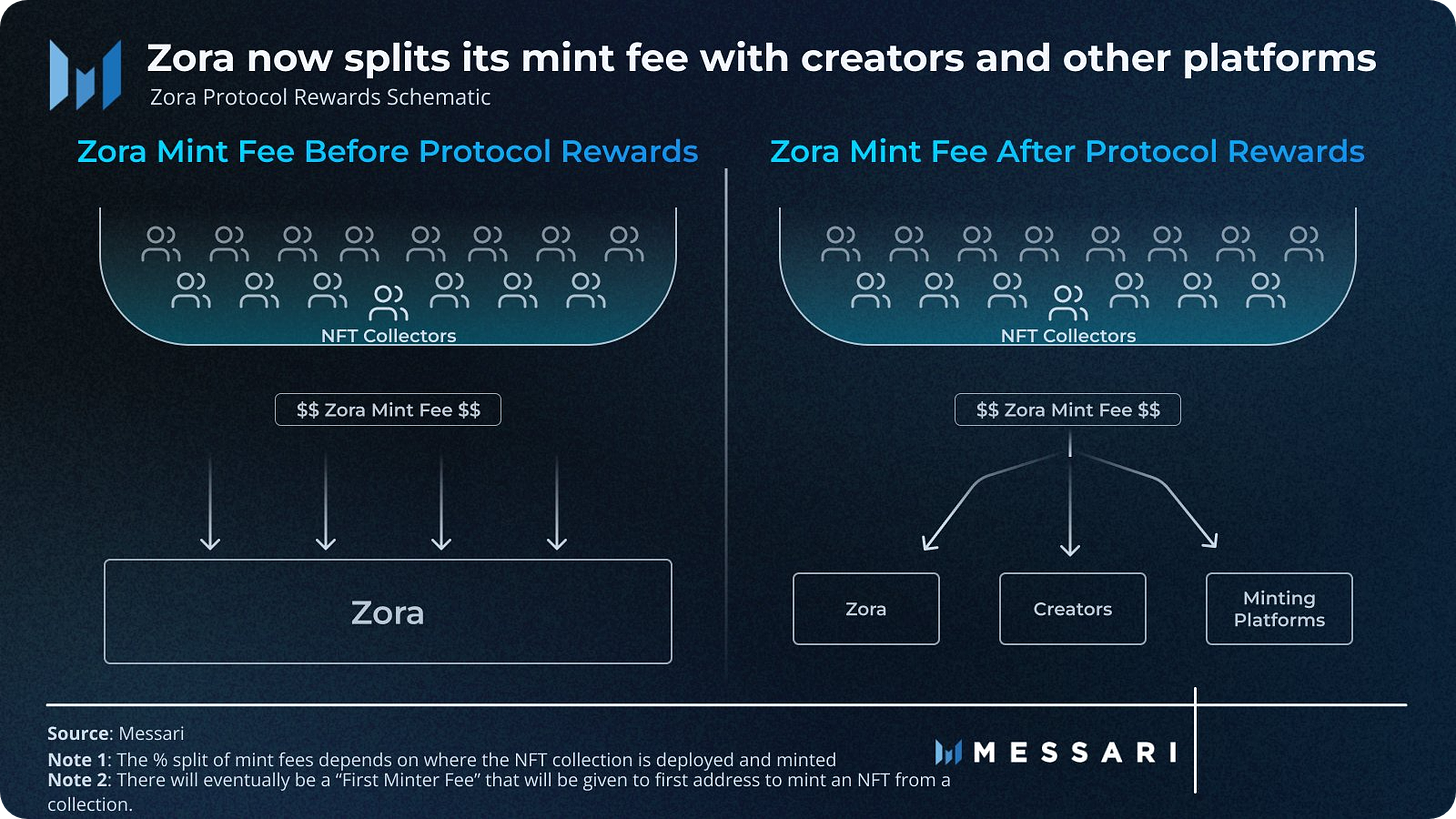

Also, consider testing the waters at the start by dropping free mints on projects with “Protocol Rewards,” e.g. Zora, Mirror, and Sound, so you can earn a little bit of ETH every time someone collects your work!

8) Explore NFTs as a medium

Some projects use NFTs just as plain ol’ digital containers for static art.

That model’s perfectly fine, especially from a distribution standpoint, but it’s also not as artistically interesting compared to blockchain-native art that approaches NFTs as a new medium.

That said, study the projects that couldn’t exist as they do without NFTs because they’re some of the finest demonstrations of boundary-pushing creativity in crypto today.

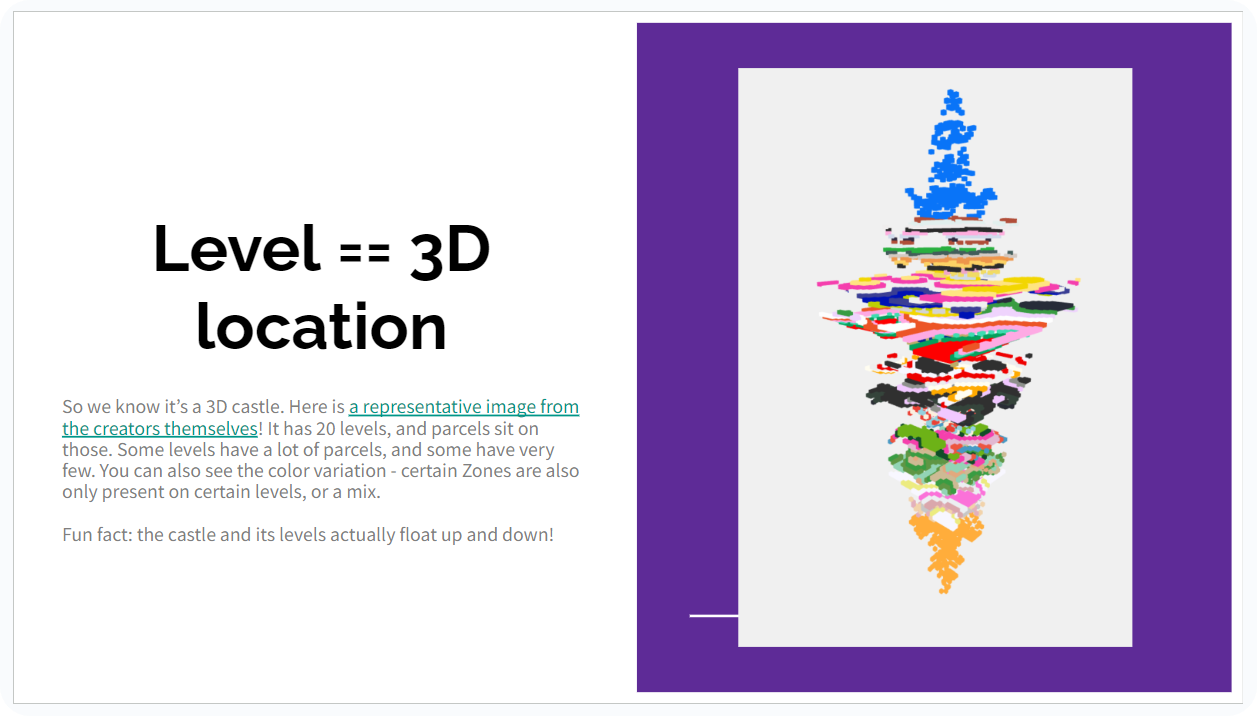

One excellent example here is the fully onchain art collection Terraforms by Mathcastles, which uses Ethereum as an always-on computer for the many 1,000s of interactive parcels that make up its Hypercastle artwork. Hunt for and study efforts like this, and you’ll learn the deeper magic of NFTs.

9) Experiment with NFT games

The NFT gaming sector may still be young and experimental, but its potential to disrupt mainstream gaming in big ways grows by the day.

Accordingly, NFT games are one of the most promising areas in crypto right now, and we’re starting to see more variety and deeper gameplay possibilities here, meaning more fun all around.

While you’re still getting the hang of things, it’s probably better to start with something simple and passive like the Tamagotchi-style Fren Pet game on Base, then work your way into deeper titles like Axie Infinity and Parallel.

10) Engage in interesting communities

Found a project you like? Hop into its Discord server and have a look around!

Some of the best discussions, connections, and mints I’ve ever come across have been derived from engaging around the communities of NFT projects I enjoyed.

To be sure, you’ll make the most of your time around NFTs if you shift from lurker to active participant, that I promise.

11) Try new projects

It seems like new platforms and protocols arrive every day in the NFT space. Don’t be complacent! This blooming gives you opportunities to be among the first users of these projects in the world.

Of course, knowledge is its own reward in crypto, so trying new things grants you valuable frontier XP. You want to be knowledge-maxxing all the time here.

But these opps can also lead to other rewards, like discovering more new projects or earning airdrops from protocols that are decentralizing to their communities. Sometimes it pays to be curious in NFTs!

12) Keep an eye on gas fees

In times of high network activity, the gas costs of transactions on chains like Bitcoin and Ethereum can run pretty steep.

If you’re facing high gas prices when trying to move some NFTs around, consider waiting for a period of lower activity when prices get cheaper to save money! For instance, Etherscan has a great Gas Tracker service you can monitor.

Also, make use of low-cost networks like L2s and Solana where you can sidestep fee pains altogether.

13) Don’t over invest

You may get FOMO and want to ape into an NFT project that’s caught your eye.

That’s normal, but it’s also important to never let that FOMO go so far that you overextend yourself and invest more than you can afford to lose.

Don’t try to keep up with others, everyone’s in a different place in their journey. Set aside what’s right for you when it comes to NFTs, stick to that and have some fun, and see what happens from there. That’s the way.

14) Don’t over fret your sells

You may end up selling an NFT one day whose value skyrockets after you sell it.

Whatever you do, don’t dwell on this fact. It leads nowhere good, like emotional “catch up” trading that tends to lead to busts.

Take your sells in stride, and avoid obsessing over your misses. You’ll be more relaxed and grounded for whatever the future brings accordingly. This is the NFT frontier, you’re going to experiment and have some hiccups. It happens to everyone!

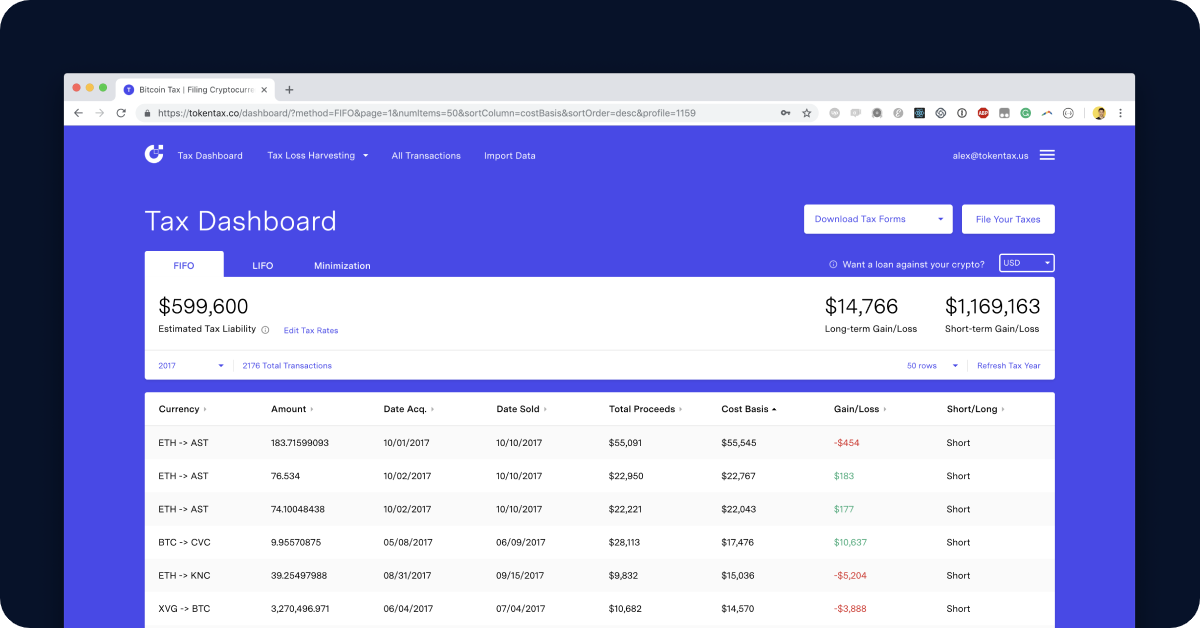

15) Mind your taxes

Remember, NFT transactions are taxable events in many jurisdictions.

That said, research your local tax laws regarding crypto and NFTs, and keep notes of your transactions for accurate tax reporting. Tax tools like Token Tax are also a great help here.

It’s certainly not sexy or fun, but keeping on top of your NFT tax obligations will save you massive headaches come tax season!

Action steps:

-

🔥 Catch up on my previous write-up: Recursive Bitcoin NFTs

-

📚 Collect this post: Mint it on Mirror

Author bio

William M. Peaster is the creator of Metaversal—a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He also serves as a senior writer for the main Bankless newsletter.

🙏 Together with 🔷 Toku 🔷

TOKU

Toku is the all-in-one global token grant solution trusted by leaders like Protocol Labs and Mina Foundation.

Toku makes token compensation simple:

-

Toku’s dashboard guides you through the entire token grant process with legal templates, vesting tracking, reporting, and exercising.

-

It handles all grant types—Token Purchase Agreements, Token Options, Restricted Token Grants, phantom tokens, you name it.

-

It provides tax withholding compliance with real-time tax calculations and reporting, and it integrates with any provider in any jurisdiction.

-

It gives your employees and investors clear visibility into what they own.

👉 Save time, money, and be compliant by working with Toku.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.