Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & beyond

Dear Bankless Nation,

The creation of Inscriptions, i.e. Bitcoin NFTs, has been surging lately.

Yet the boom isn’t limited to Bitcoin, as we’ve now seen an explosion of analog efforts sweep across all the top chains in the cryptoeconomy.

What are the big ideas of this current craze, and why now?

Let’s unpack these question for today’s post!

-WMP

🔮 Thanks to Kraken NFT 🔮

👉 Kraken NFT is built for secure NFT trading ✨

The Inscriptions Boom Explained

What are Inscriptions? A refresher

The current Inscriptions craze can be traced back to January 2023 when Casey Rodarmor introduced Ordinals, a system for creating Bitcoin NFTs by inscribing data across individual satoshis, the smallest BTC denomination.

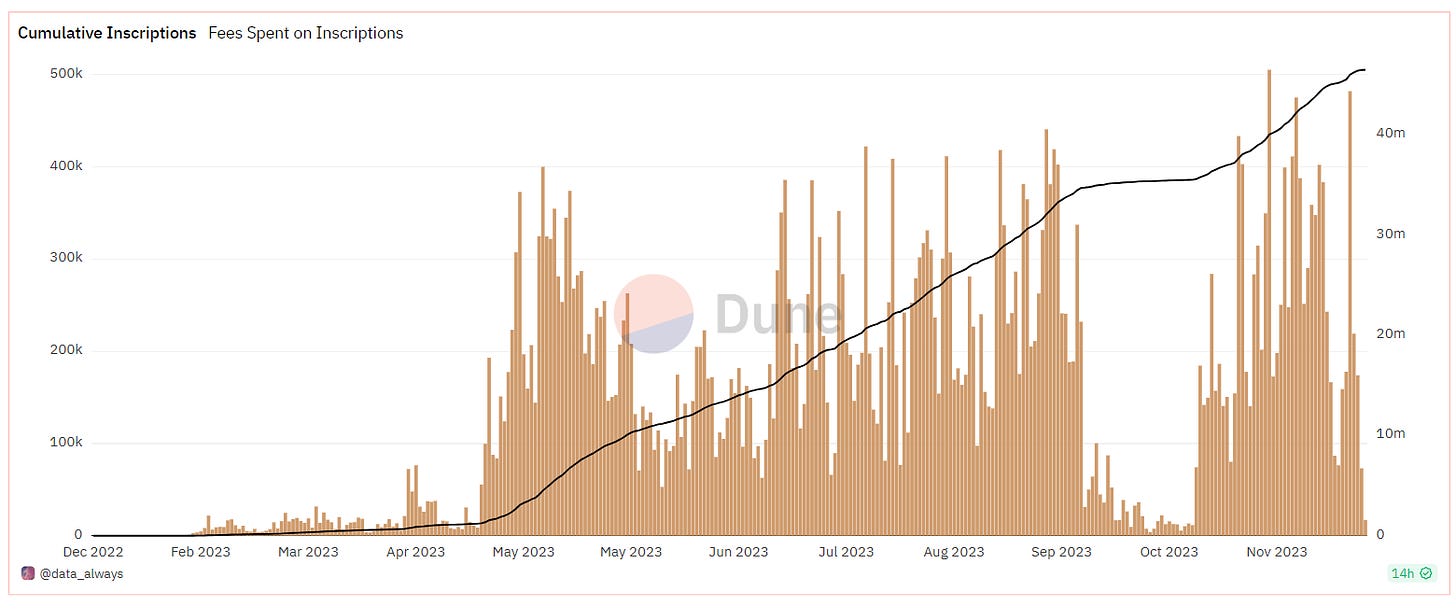

The arrival of this new onchain storage technique on mainnet led to an immediate explosion of minting activity as people flocked to the novelty of a new kind of native Bitcoin token standard. By the end of February 2023, more than 100,000 NFTs had been inscribed on the OG blockchain using this system, leading to a considerable surge in fee revenues for Bitcoin miners.

Fast forward to today, almost one year later, and Bitcoin has now facilitated over 46 million Inscriptions and counting, with over $105M USD worth of fees spent by users so far for inscribing their data.

The vast majority of Inscriptions to date have been BRC-20s, an experimental semi-fungible token standard that arrived in May 2023 in a bid to approximate Ethereum ERC-20s on Bitcoin. Think DeFi tokens or memecoins, but created in batches atop Inscriptions. Notably, earlier this week $ORDI just became the first BRC-20 to cross the $1 billion USD market cap mark.

Of course, Ordinals and BRC-20s arose to meet the demand for native Bitcoin tokens, in contrast to other tokenization systems like Counterparty that were built atop Bitcoin but not within it. Yet now we’re starting to see Inscriptions-style transactions surge atop just about every chain of note, including networks like Ethereum and Solana that do have official native token standards, e.g. ERC-721, pNFTs, etc.

🏹 Settle, Hunt, Claim, Repeat.

Be more bankless and become a Bankless Citizen today!

Why the surge now?

In recent months we’ve seen more projects generalizing the Ordinals method and emulating it on other chains, which has proved relatively straightforward. And since this work all occurs at the transaction level rather than in smart contracts, Inscriptions are very cheap to create and offer a new open issuance mechanism.

These dynamics have created a foundation for the popularization of Inscriptions, though some tailwinds have been helping to catalyze their climb, too.

For example, the recent BTC price rally and BTC ETF excitement has people zooming into the Bitcoin ecosystem anew, where Inscriptions are the hottest and most influential thing right now. And with BRC-20 tokens like ORDI booming lately atop Inscriptions, we’ve reached escape velocity with regard to people realizing there are new ways to capitalize on this rising category of crypto assets.

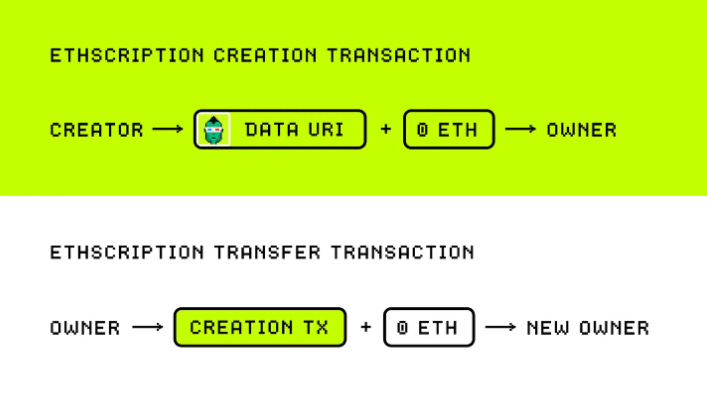

In the Ethereum ecosystem specifically, we’ve been seeing Inscriptions-style mints climb after the arrival of Ethscriptions in June 2023.

While projects have been storing media in Ethereum calldata for years, Ethscriptions offered a new Ordinals-inspired approach to doing so that has influenced similar efforts across other Ethereum Virtual Machine (EVM) networks ever since.

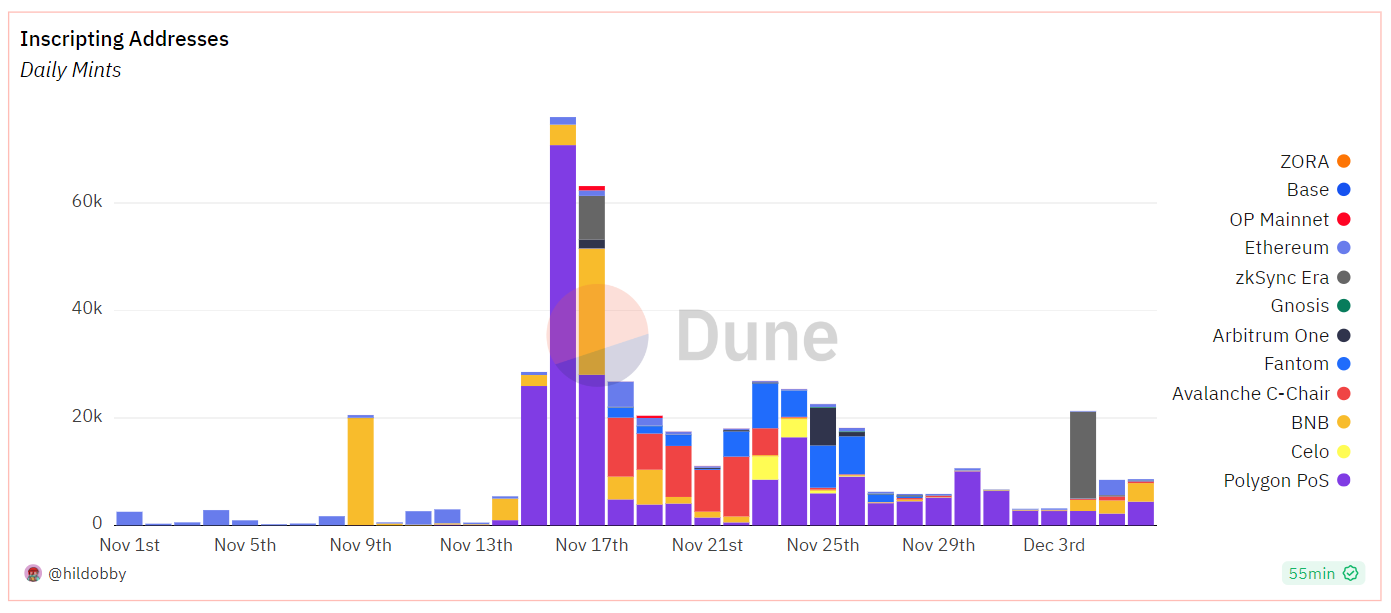

For instance, courtesy of this EVM Inscriptions dashboard by Hildobby, we can see that inscribing activity on the Polygon network (purple below) has been particularly prolific in recent weeks. We can trace this Polygon surge directly to the growth of POLS Market, an upstart Polygon Inscriptions marketplace that’s fielded many thousands of minters as of late.

Not all Inscriptions are created equal

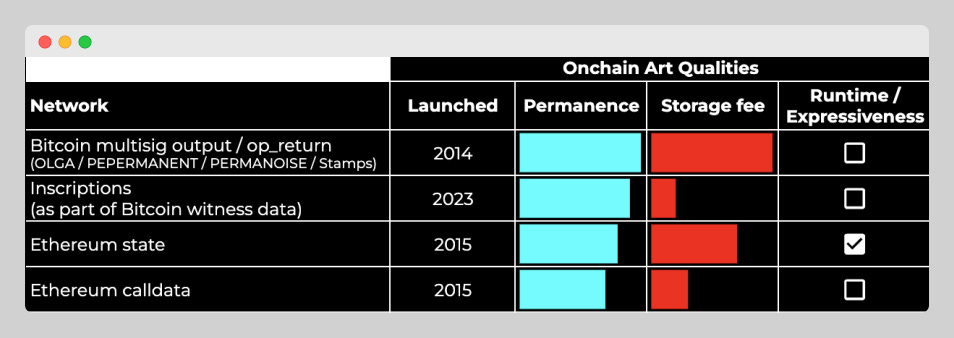

Note that since chains like Bitcoin and Ethereum have different designs, Inscriptions on them are created in different ways, which in turn leads to nuanced qualities between them.

On Bitcoin, Inscriptions are stored within what’s called the “witness” portion of a transaction via SegWit, an upgrade that was first introduced in 2017. This architecture allows Inscriptions on Bitcoin to offer very strong permanence assurances with very low storage costs.

In contrast, Inscriptions-style mints on Ethereum like Ethscriptions are stored within what’s known as transaction “calldata.” This approach offers relatively low storage costs too, though it doesn’t currently boast the same permanence guarantees as Bitcoin Ordinals since Ethereum’s future Purge update may lead to the pruning of historical state like calldata.

That said, while the Inscriptions craze may just become a temporary fad on smart contract chains, this possibility does nothing to negate the fact that Inscriptions on Bitcoin presently offer the best permanence-to-cost ratio for asset creation in all of crypto! And that reality’s here to stay for the foreseeable future.

A new battle for Bitcoin?

It’s important to keep in mind that Inscriptions are leading to a ton of new revenue for Bitcoin miners. But they’re also leading to a surge in transaction data demands, and some hardliner old-school Bitcoiners, like Luke Dashjr, accordingly see these mints as spam attacks.

Take note, then, because Dashjr’s new OCEAN mining operation has put in a filtering system to censor new Inscriptions from being added to blocks that it mines. It’s the biggest move against Ordinals yet, though on its own it’s unlikely to move the needle much as OG Bitcoiner Eric Wall recently explained:

“They don’t want to mine Ordinal inscriptions? Fine. They leave the revenue for the next block. The incentives of blockchains are such that this can’t really become a big problem on its own. If *all* miners are filtering inscriptions, then we must accept that inscriptions are not welcome in Bitcoin (probably for some reason?), or spin up our own miners and mine them.”

However, it’s extremely unlikely we’ll ever get close to all miners filtering inscriptions because it wouldn’t make economic sense for most operations to turn away from such an amazing source of revenue, especially as BTC block rewards continue to decline through halvings.

What is likely, though, is a deepening culture war between the hardliner originalist Bitcoiners and the more creative and experimental Ordinals supporters. Whether that’ll eventually result in a new chain split remains to be seen, but the battle lines here have already been drawn, that’s for sure.

What to watch

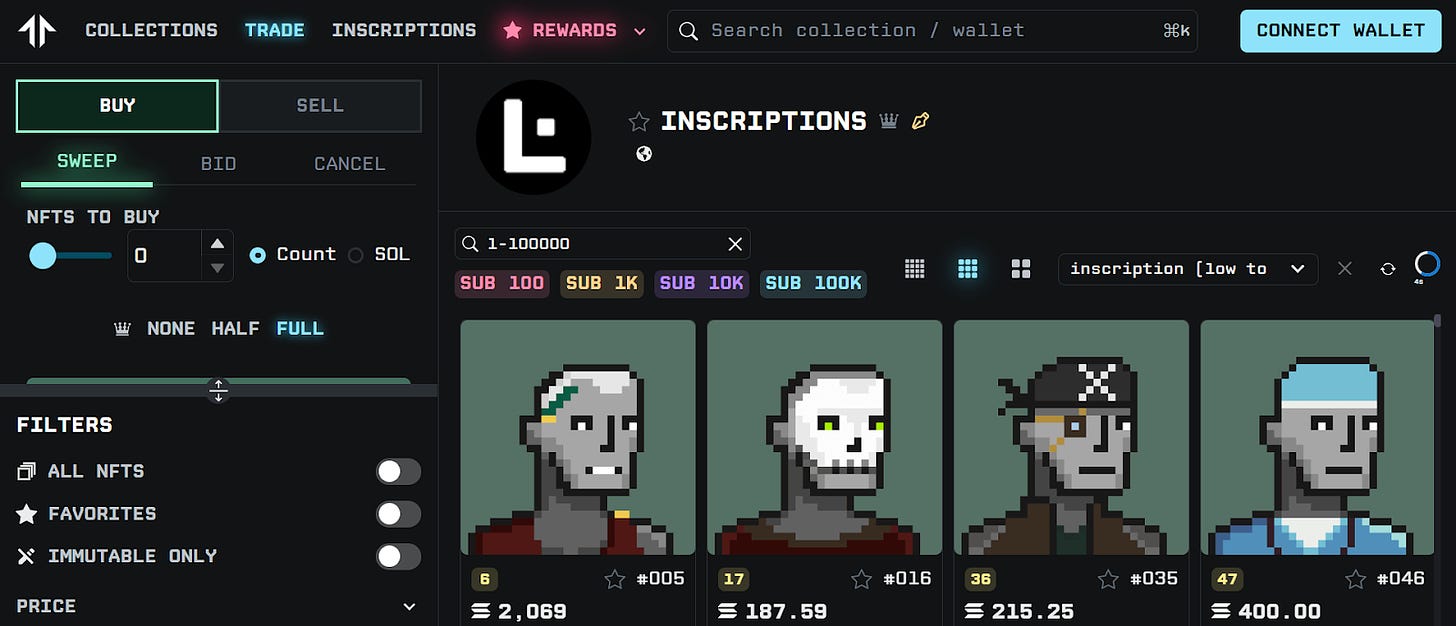

If you’re keen to keep following along with the Inscriptions craze in the weeks ahead, keep an eye on the top platforms that are facilitating them. I’ve already mentioned POLS Market on Polygon, and with regard to Ethereum there’s the main Ethscriptions marketplace for starters. On the Bitcoin side of things OKX has become popular for both BRC-20s and NFTs, and on Solana there’s Tensor, which is akin to Blur.

Ultimately, while the future remains uncertain for Inscriptions on smart contract chains that don’t ultimately need them, Inscriptions on Bitcoin are indeed a compelling new native token standard that’s opened up possibilities that weren’t available before on the inaugural blockchain. This reality, in combination with the impressive permanence / cost ratio, is why I’ll be watching the Bitcoin Inscriptions ecosystem closest here going forward, and I recommend you do the same!

Action steps:

-

🔥 Catch up on my previous write-up: Majors FTW

-

📚 Collect this post: Mint it on Mirror

Author bio

William M. Peaster is the creator of Metaversal — a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He also serves as a senior writer for the main Bankless newsletter.

🙏 Together with 🔮 Kraken NFT 🔮

KRAKEN NFT

Kraken NFT is one of the most secure, easy-to-use and dynamic marketplaces available. Active and new collectors alike benefit from zero gas fees, multi-chain access, payment flexibility with fiat or 200+ cryptocurrencies, and built-in rarity rankings. Learn more at Kraken.com/nft

👉 Visit Kraken.com to learn more and open an account today.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.