Chinese investors are finding innovative ways to tap into the digital assets markets and participate in some of the year’s most profitable trends despite Beijing’s ban on cryptocurrency trading.

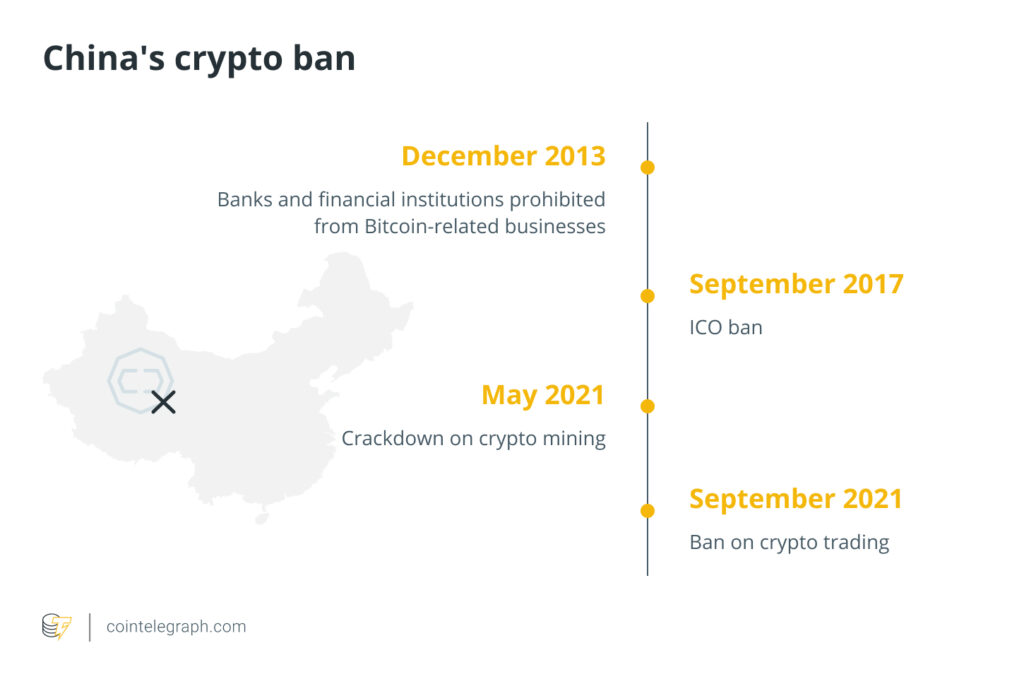

The government has banned crypto amid a blaze of publicity numerous times, including a 2013 ban on banks dealing in crypto, a 2017 ban on initial coin offerings and exchanges, followed by a trading and mining ban in 2021.

Despite this, accessing cryptocurrencies in the mainland isn’t that difficult, pseudonymous investor Lowell tells Magazine.

Lowell is a recent university graduate who describes herself as a full-time cryptocurrency trader. She had the option to pursue a career in her field of study but says that a “normal” job cannot match the profits she can make with crypto.

China’s cryptocurrency bans aren’t always crystal clear or effective. Though crypto trading and businesses are prohibited, there are channels for investors to partake in the global market.

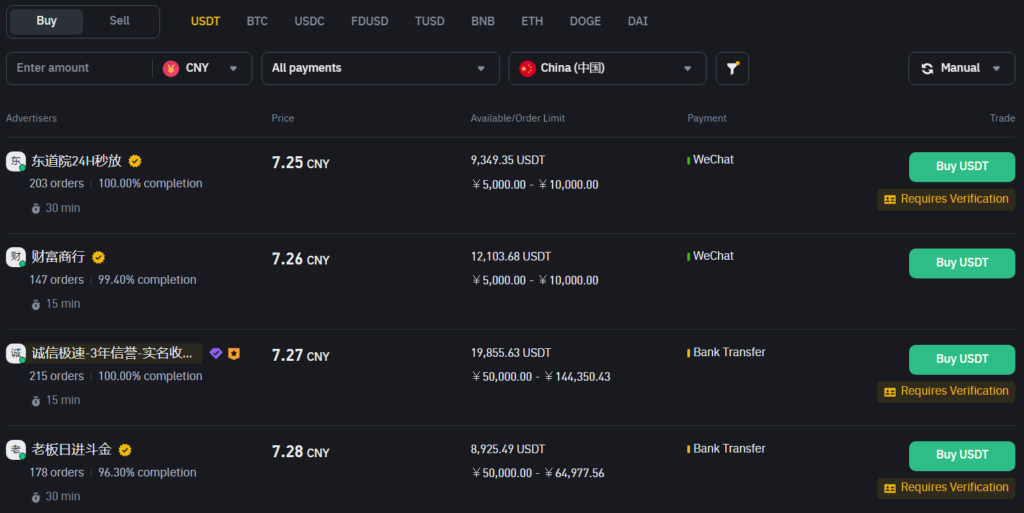

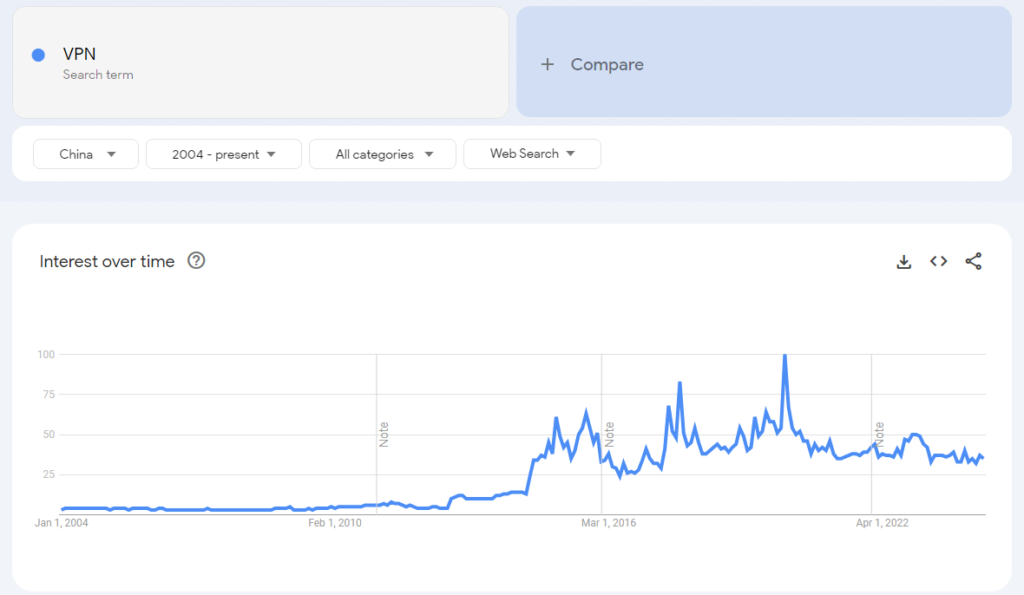

Local traders say they buy and sell their cryptocurrencies to other investors via peer-to-peer trading on centralized exchanges like OKX and Binance. While China’s Great Firewall prohibits access, savvy users with VPNs can access the websites and apps they need.

Investors also seek lucrative opportunities in borderless DeFi, like using bots or hiring students to farm airdrops which has become a quasi-industry for some.

Crypto isn’t totally illegal in China

As it happens, crypto tokens are not themselves illegal in China, Robin Hui Huang, a law professor at the Chinese University of Hong Kong tells Magazine. Exchanging them also falls into a gray area.

“People can hold cryptos in China. They can also exchange cryptos for other properties, but such exchanges are not protected by law, that is, if the other party breaches the contract, no legal protection is available.”

While the law does not protect these transactions, it also does not ban them. Therefore, private individuals can exchange cryptocurrencies for other properties if they mutually agree to do so and fulfill their commitments, Huang adds.

Outside the mainland, rumors are circulating, fueled by key opinion leaders in the cryptocurrency community including Galaxy Digital’s billionaire founder Mike Novogratz, suggest that Beijing may be contemplating a reversal of its crypto ban.

However, experts tell Magazine that the likelihood of this rumor being true is quite low.

They point to recent developments concerning China’s central bank digital currency, the digital yuan, which were highlighted during the Third Plenum of the Central Committee of the Communist Party of China, chaired by President Xi Jinping.

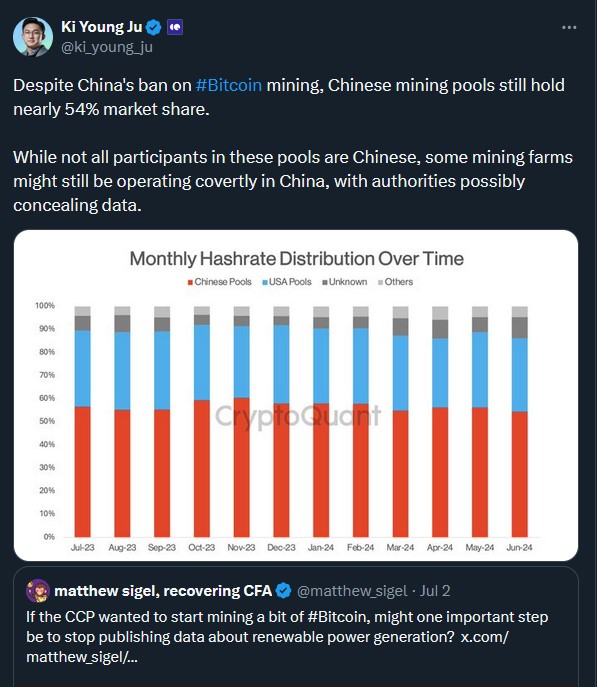

China mining ban fails to ban mining

Although China’s Bitcoin mining ban was widely reported by pretty much every major media outlet in 2021, it has conspicuously failed to prevent mining in the country.

According to Bitcoin ESG researcher Daniel Batten, that’s because the ban was misreported as being harsher than it actually was. He argues that closer analysis of the wording of the ban suggests the legislation actually prohibited the establishment of new mines and merely contained a “statement of intent” that mining should be gradually eliminated due to electricity use, climate targets and the association with money laundering.

Precise figures aren’t that easy to come by, and many appear to be out of date, but most estimates suggest China still accounts for at least a fifth of the global hashrate.

According to the University of Cambridge Center for Alternative Finance, and World Population Review figures, China accounts for around 21.1% of the total, while CryptoQuant founder Ki Young Ju released a chart in July showing Chinese mining pools account for 54% of the global hashrate. Not all miners in a pool are located in China, he noted, but added “Some mining farms might still be operating covertly in China, with authorities possibly concealing data.”

VPNs and trading apps make crypto available in China

Crypto users in China are aware of the trading bans of course, they just find creative ways to get around them without attracting the attention of authorities.

“Most crypto traders in China, we don’t talk about these things because we know that China is like that,” Lowell says.

Today, P2P trading channels are available on social media or crypto exchanges enabling users to buy crypto with the Chinese yuan via bank transfers, WeChat Pay or Alipay — two of the nation’s top payment rails.

OKX and Binance are two of the most popular in Lowell’s network, though she personally prefers the former. As you can see in the picture below, Binance offers yuan P2P sales in the China region. The two exchanges did not respond to Magazine’s request for comment.

“I can access these two apps. I use an iPhone and I can download these two apps on the Hong Kong store or other country stores,” says Lowell, adding that the apps are not available on Apple’s mainland App Store.

Access to apps in China is governed by a more restrictive internet environment compared to what users outside the country experience. This system, known as the “Great Firewall,” blocks access to popular domains like Google and Facebook, among many others.

Magazine requested a source in mainland China to test access to cryptocurrency exchanges. The test confirmed that users cannot access Binance and OKX websites without using VPNs. The mobile applications for these exchanges are accessible without VPNs.

Someprojects like MakerDAOprohibit users from accessing the protocol with VPNs, but that’s mainly out of fear of getting sued by US regulators rather than Chinese ones.

Wayne Zhao was formerly the CEO of Beijing-based analytics firm TokenInsight, who relocated to Singapore to start his DeFi project BitU. He says that using a VPN is almost second nature to mainland internet users.

“VPN is common sense for people if you want to visit Google or YouTube,” Zhao says. The same applies to DeFi platforms.

For platforms, providing users P2P access is a “gray area” that risks regulators coming down on the overseas exchanges and their executives, Joshua Chu, co-chair of the Hong Kong Web3 association tells Magazine.

“That could lead to a lot of legal costs even if they don’t always lead to prosecution, especially once they enter China,” says Chu, pointing to the recent detention of a Binance executive in Nigeria as an example.

Airdrop farming in China

Chinese crypto trades are restricted to P2P options, but that’s not the only way to get a hold of tokens.

Lowell has profited handsomely from airdrops, including $50,000 from Ethena’s ENA campaign and $40,000 from StarkNet.

According to at least three local sources, airdrop farming in China has scaled up to an industrial level.

Similar to how Bitcoin mining was once accessible to private individuals using laptops in their bedrooms, but eventually grew into a profitable enterprise with businesses investing in professional equipment and filling warehouses, airdrop farmers are now investing in advanced technology and equipment to maximize their profitability.

Zhao attributes the rise of airdrops to the move-to-earn era during the pandemic, popularized by StepN, a Solana-based project that rewards users with its GST tokens for moving.

“When people started to find out that you can actually earn money with your cell phone, it’s quite natural to think that you can do it with hundreds of cell phones at the same time, Zhao tells Magazine.

Airdrop farmers automate transactions with bots on up-and-coming protocols believed to be planning a future airdrop, or even manually log them with multiple devices.

Protocols are aware of users deploying bots to automate transactions to farm their airdrops, and take measures to limit them.

But airdrop farmers are taking creative routes to bypass the blockers. Some Chinese airdrop farmers even hire students to conduct transactions to replicate organic onchain behaviors.

“My friend earned a lot more than me in airdrops because they hired some college students to do transactions for them,” Lowell says.

“I had about 30 or 40 accounts but they have like 200 accounts,” she says.

Crypto traders and businesses still exist, but there’s always a risk

Any crypto business in China always carries the risk of sudden shutdown notices.

“It happened before with a very good friend of mine,” Zhao says.

“They just got a notice that said, ‘Sorry guys, you cannot do this anymore. You have to shut it down,’ and that was it. A few days later, they shut it down.”

P2P traders face risks as there is no trusted intermediary.

They are buying cryptocurrencies directly from strangers, often without knowledge of the assets’ origins. This poses the risk of unknowingly participating in money laundering or being deemed guilty by association with other illegal activities.

Due to such risks, Lowell says she prefers dealing with personal acquaintances, though this option is limited.

“When I’m selling to my friends, I know they won’t do some illegal things and I won’t be arrested,” she says.

“So I’m willing to sell my USDT to people I know but they may not always have that much money so I also need to use exchanges.”

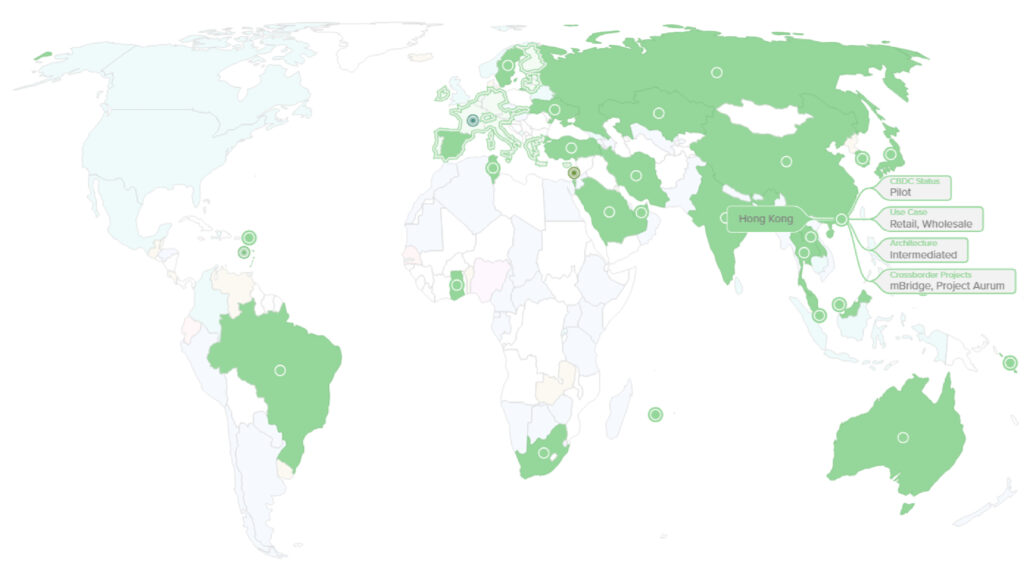

CBDC plans put paid to crypto ban reversal rumors

Winston Ma, an adjunct law professor at New York University, tells Magazine that it is unlikely that Beijing will reverse its crypto ban as it wants to go all in on a CBDC.

In July, Beijing held its third plenary session, a meeting of senior Communist Party officials. The meeting resolved to promote RMB internationally with a particular focus on the digital yuan, state-backed media Xinhua News Agency reported.

China considers its CBDC as the sole legal digital tender, rendering all other digital currencies, including Bitcoin, illegal for use as payment.

“You can expect the central bank to now move at full speed because it’s coming from the Central Committee. You cannot get more authoritative than that,” Ma says.

Ma says the renewed momentum for China’s CBDC points to the “complete opposite” direction of a crypto ban reversal.

“You can expect the central bank to now move at full speed because it’s coming from the Central Committee. You cannot get more authoritative than that,” Ma says.

Ma says the renewed momentum for China’s CBDC points to the “complete opposite” direction of a crypto ban reversal.

Local traders have all they need

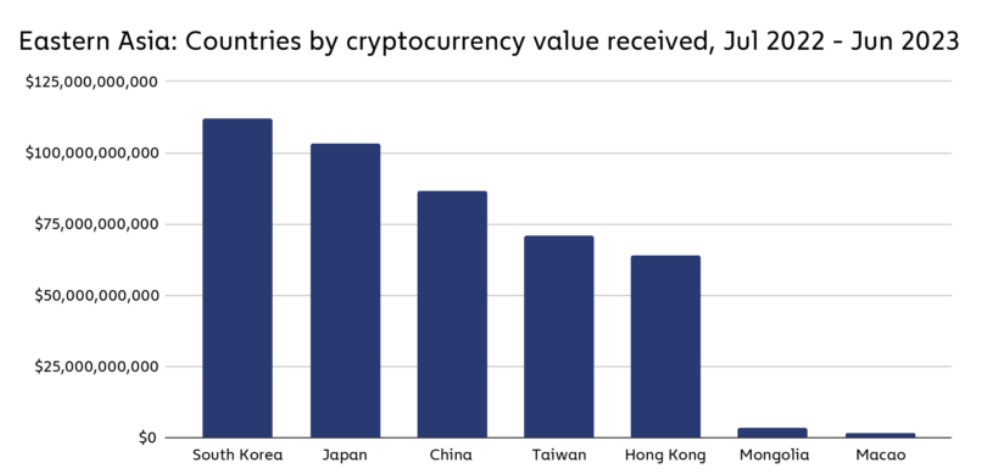

Zhao of BitU believes that while trading continues, the demand for crypto in China is low at present, and points to the trading performance of Hong Kong’s newly launched crypto exchange-traded funds (ETFs).

Chinese nationals are banned from accessing the ETFs unless they have a temporary or permanent residency permit.

“We all saw what happened to the Hong Kong ETF. The trading volume, it sucks,” Zhao says.

“The reason is that most of the people in mainland China or Hong Kong who are willing to buy Bitcoin or other cryptocurrencies have already done it.”

week.

The post How Chinese traders and miners get around China’s crypto ban appeared first on Cointelegraph Magazine.