Governance in decentralized autonomous organizations is hard. Especially so with decentralized onchain token voting.

Ethereum creator Vitalik Buterin famously rejects it due to the difficulties of what is essentially an unbridled democracy.

Politics, money and misaligned incentives mean tokenholders are often out for their own benefit rather than the good of the DAO.

One danger of this sort of governance is that any party that amasses enough voting tokens can essentially do whatever they like — whether it’s to anoint themselves king, sell the assets or completely change the mission.

Core team members who’ve been there from the beginning see outsiders who gain control of projects as “DAO raiders” engaged in a hostile takeover to strip the DAO for parts. But the “raiders” might see themselves as hacktivist investors out to reshape the DAO’s mission.

Raiders vs. Nouns and Aragon

In 2023, DAO raiders — or hacktivist investors — took control of Nouns DAO and Aragon DAO by playing the arbitrage governance game for profit. They bought up loads of tokens — with the attached voting rights — and were able to do what they liked.

The arbitrage opportunity happened because Nouns NFTs and Aragon tokens could be bought for below their book value, or net asset value, relative to their proportional share of the DAO’s treasury.

Somewhat ironically, the Nouns raiders then proposed to eliminate the arbitrage opportunity by spending down the Nouns treasury, thus lowering the book value of each Noun.

These raids and governance threats led to the extraction of $27 million from Nouns and leadership spills at Aragon. Today, Nouns is bouncing back, albeit with a smaller treasury. A smaller product-focused Aragon lives on in the form of a new nonprofit with the leftover funds from the liquidation.

“We want to believe we are all friends, but there are always people that want to attack a group —any group — and assets managed together are potentially exploitable,” says Eyal Eithcowich from DAO analytics firm DeepDAO.

“Working to consciously prevent such exploits, as we’ve seen recently, is a very important development for DAOs. We are no longer naive about that.”

So, what can other DAOs learn from these “hacktivist” attacks?

Nouns DAO raid

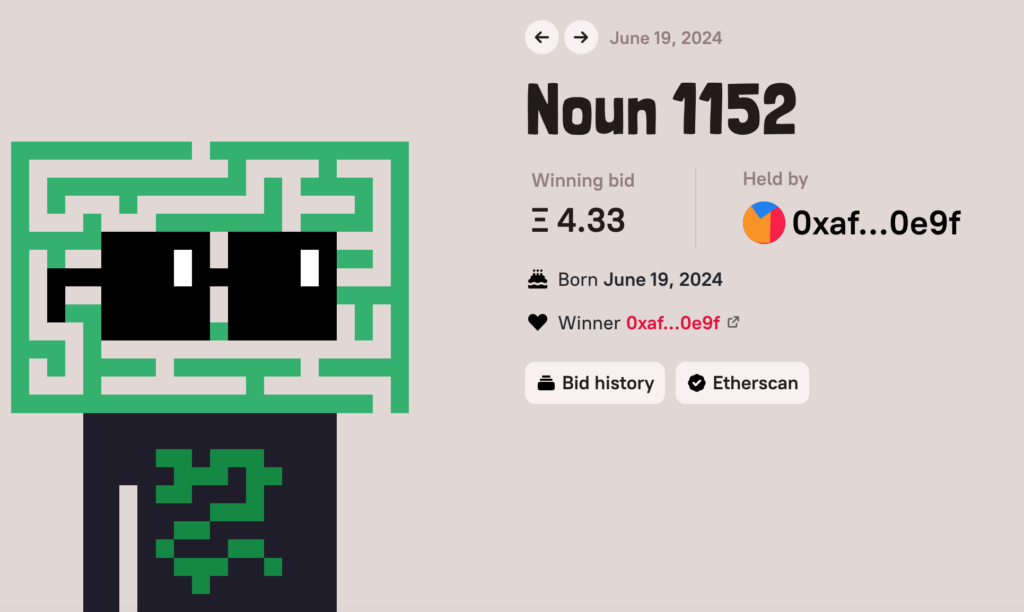

Founded in 2021, Nouns DAO is a community that releases one NFT daily for sale in perpetuity. Nouns DAO voters then decide to allocate funds to various projects. Fundings to date include paying $90,000 to name a rare Ecuadorian frog species, “Nouns DAO.” The DAO has also funded programs that provide free eye exams and glasses to children.

By 2023, Nouns DAO was crushing it with high-profile cool branding, boxy glasses and do-good spending.

Gami, a very active member of Nouns DAO, tells Magazine that in mid-2023, he introduced investor DCF GOD to join the DAO’s Prophouse, where voting proposals originate.

DCF GOD then “began accumulating Nouns NFTs while constantly criticizing Nouns,” recalls Gami. “I thought that was weird.”

Each Nouns NFT has one DAO governance vote attached. With the bear market and crashing NFT prices, DCF GOD and his raiders accumulated enough voting rights to propose liquidating the Nouns treasury.

In a properly functioning market, the treasury value should be at least equal to the market cap of the governance tokens.

So, in hindsight, Gami says, “the arbitrage opportunity was obvious to anyone who looked at our treasury and the number of Nouns.”

DCF GOD declined to comment on this story and appears to have deleted relevant tweets. However, he appeared on Holyheld’s Web3 Primitives podcast in 2023, where he explained that “DCF stands for discounted cash flow” and pointed out that in DAOs, whoever can get the most holders to actually cast their votes wins:

“As an investor, if you hold tokens, your duty is to vote. That’s why we have DAOs and we have tokens. Then, if you are not going to use them to vote and you’re just going to wait for the teams to put up proposals, then when those teams drain the treasury or use the funds to do things you don’t like, you don’t really have the right to complain.”

“Remember, the team is paid to be there, and investors are paying to be there,” he said.

Raid did not occur in a vacuum

The raid (or whatever you call it) emerged as the DAO was engulfed in politics, with Gami at the center.

“Nouns DAO started in a bull market, with over-the-top excitement at the time. And then, and as we entered a bear market, arbitrage opportunities emerged as tokens got sold regularly on secondary markets,” Gami says.

“I myself was nearly canceled in Nouns by the people not keen to spend.”

He proposed that the DAO pay 700 Ether (worth around $1 million at the time) to refurbish numerous skate parks around the world and add Nouns branding.

The money was to have been held by Gnars, an action sports accelerator incubated and funded by NOUNs, in a designated wallet for Gnars DAO’s treasury.

Skate parks are usually built by local municipalities and do not generate revenue, although Nouns DAO could have made money from branded skateboards and other merch.

The proposal was contentious and divisions quickly emerged between the free-spending supporters and newly joined activist investors, who were arguing for more prudent spending.

After one of the highest voter turnouts in Nouns DAO history, the skatepark vote was lost by a single wallet address and was “definitely suspicious,” says Gami.

The DAO raiders accused Gami of being a scammer for proposing the skatepark plan with no returns.

Gami was surprised by the book value arguments, saying, “Nouns was never an investment vehicle; it’s an experiment for rich crypto dudes.”

When Nouns was launched, it was “mostly crypto whales and degenerates buying.”

“Then, there was much confusion on how to proceed. Then the raiders made a proposal for an off-ramp to rage quit the DAO.”

Shortly after, in September 2023, $27 million exited the Nouns treasury after disgruntled investors, professing upset over the very proposal, designed a “fork” to give dissenters an exit ramp.

The raiders played the arbitrage governance game for a tidy profit.

Aragon DAO raid: Tokenomics not fit for purpose

In 2017, two young coders, Luis Cuende and Jorge Izquierdo, envisaged Aragon as a nation-state governed by its tokenholders onchain.

The Aragon Association — a Swiss non-profit foundation launched in 2017 — was a pioneer. In 2018, it launched the second grants program in Ethereum history and went on to fund Expresso, Prism and Snapshot. Aragon was a committed key player in building DAO governance and tooling models.

“Aragon circa 2017–2019 had a visionary engineering team. But in 2021, when the Aragon One [engineering] team left, this is where the foundation for these problems emerged,” Aragon’s current CEO Anthony Leutenegger tells Magazine.

He explains that the Aragon token was meant to be used for Aragon Govern and Aragon Court, which were basically on-governance projects that failed.

“The token was designed to add utility to those specific products,” he says. “Those products didn’t work out, so the tokens ended up in no-mans land. This gave the raiders an opportunity to exploit.”

He believes the “raiders” acted very deliberately and did not have the interests of Aragon DAO at heart.

“It’s disingenuous to call them activist investors,” he says.

The raiders arrived in May 2023 and managed to corner 51% of the token supply, giving them ultimate voting power.

As with Nouns, the “raiders” exploited early tokenomic designs resulting from unclear product lines and DAO goals. A later change, of course, rendered the tokenomics no longer fit for purpose because a planned governance transition from the Aragon Association to the Aragon DAO created arbitrage opportunities.

The original token launch, managed by the Swiss nonprofit Aragon Association, had grown to over $200 million as Ether prices rallied in 2021.

DCF GOD suggested that both sides went too far with their rhetoric: the Aragon team, when they claimed they underwent a 51% attack, and the activist investors, when they argued that the Aragon team was wasting money.

“The truth, in reality, is that both sides need to create as much drama and fanfare as possible in order to quote-unquote ‘win the debate.’”

In October 2023, a group of six addresses controlling a majority of the supply between them put up a governance proposal to sell Aragon’s treasury.

Even though the DAO leadership publicly opposed them, they had the tokens and successfully extracted over 86,000 ETH, worth around $163 million.

The DAO raiders were clearly opportunists, but internal tensions inside the Aragon nonprofit board only boosted their opportunity.

In the end, 86,343 ETH was sent to the redemption contract, and 87% of the treasury held in non-native assets exited the Aragon ecosystem, basically liquidating the nonprofit and the DAO. Enough money remained to continue building a more modest project.

Opportunists will take opportunities

“The DAO raiders are not activist investors,” says Leutenegger, “Liquidating an organization for maximum funds at the expense of many other stakeholders is not activist investing, as per the most famous activist investor of all time, Bill Ackman.”

In Lex Fridman’s recent podcast with renowned activist investor Bill Ackman, Ackman defines activist investing as being an arbiter of how public companies should behave and believing that there is long-term value in that company.

Ackman argues that true activists seek long-term success working with a board for the long-term good of the company.

Gami from Nouns urges other DAOs to professionalize their tokenomics and governance.

“Most people get burned in crypto because they are not skeptical enough,” he says. While “secondary market purchases with attached voting rights don’t go into treasuries,” he points out they can result in governance forking votes.

Like Leutenegger, he also doubts the raiders were activists.

“All is fair in love and war, but they virtue signaled all the time that we fix DAOs. But really, they just enrich themselves, take the cash and run. They cover all their tracks and run for the next opportunity.”

“To be clear, I don’t actually completely disagree with the DAO raiders. I despise it happening to us, but it’s a warning to builders: if arbitrage opportunities exist, they will do it.”

Solutions are emerging

DAOs are still a wonky concept. The concept of DAOs as an alternate corporate structure has lost its utopian appeal. Yet, DAOs have endured.

While the 2023 bear market may have shuttered many DAOs, onchain governance is still a thing. In reality, DAOs are financially flourishing, and it’s not just because the crypto markets are up and inflating treasuries. Solutions are also emerging to tricky governance issues.

Optimistic dual governance can increase resiliency

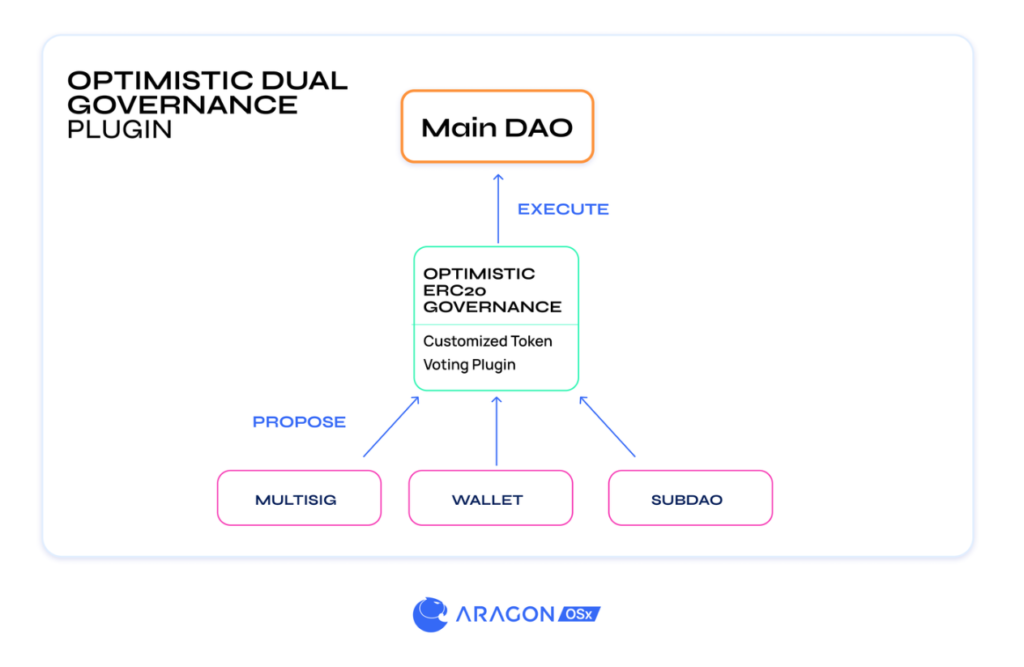

One such solution that has emerged is optimistic dual governance.

Optimistic governance means the tokenholders hold veto rights or can upgrade a protocol under certain conditions, leaving the right checks and balances in place. This governance design gives key stakeholders, such as a developer team, a veto safeguard while allowing teams to work efficiently.

“DAOs can be designed for the right methodology, such as optimistic governance with a veto mechanism. Clients are coming to us now for this the most,” says Leutenegger.

Aragon ecosystem lead Ivan Fartunov told Magazine that Lido Protocol and Zora’s optimistic dual governance structures are prime examples of improving the issues with liquid token governance.

“The challenges are widely observed, from projects struggling to institute change because tokenholders can’t be bothered to vote, to special interest groups pushing proposals prioritizing short-term price appreciation over growing protocol use.”

In short, building optimistically means core teams don’t need to put up proposals for everything they do. Optimistic dual governance is a way to introduce checks and balances between those working on the project and those with capital on the line, like tokenholders or protocol users.

Fartunov explains, “It is certainly not a silver bullet, but it is a very promising implementation for many rollups and DeFi infrastructure use cases. I don’t see it as an end-state solution, so we are building Aragon OSx to empower onchain organizations to evolve through a modular and flexible contract framework.”

Tokenomics is not an exact science — the key is creating a tokenomics strategy around a goal. An open-source immutable DAO that self-executes decreases the ability of the DAO to change course.

“Incentives for DAO participants must be designed to reach a goal while also including course corrections,” Leutenegger says.

Avoid risk-free value in the treasury

The DAO raiders are, according to Gami, “cult followers of risk-free value trading.”

RFV means that the rate of return is higher than the interest rate an investor could expect to earn on an investment that carries zero risk. In this case, selling the treasury was a better investment than building the DAO.

So, tokenomics allowed them to make money at a low risk due to simple DAO voting mathematics.

“If you don’t have a risk-free value, then there’s no reason for them to come into the DAO and try and buy tokens,” says Leutenegger.

But, tokens with high liquidity can be a poisoned chalice, Leutenegger explains:

“Another defensive mechanism for DAOs is to manage your liquidity. If you have a token and you also have a ton of liquidity. While that’s a good thing for traders to be able to trade, it also means your token can be bought up in large quantities without huge price volatility, which opens you up as well to a potential attack.”

Tokens operate differently from stocks, says Leutenegger. “You can’t do public buybacks. Treasury management is really crucial in ensuring you don’t have a risk-free value that opens a DAO up to more short-term attacks.”

In Aragon’s case, a buyback was created to incentivize holders to redeem their tokens, removing the distraction of ANT speculation from Aragon’s mission going forward.

Tokenholders have until late 2024 to participate in the redemption before the remaining ETH tokens are allocated to advance the new DAO’s development.

Many treasuries belong to a particular protocol, and it’s important to map out who gets access to the funds, DeepDAO’s Eithcowitch tells Magazine.

DeepDAO has observed three treasury types that can alleviate risk-free value concerns:

- Protocol funds: Locked in a contract for specific protocol actions such as DAO tokenomics for things like automated rewards, airdrop funding, etc.

- Private funds under DAO management: Locked in a DAO smart contract while owned by private users (e.g., staking). Private allocations like those for investors are not counted.

- Project funds: Officially related to the DAO project but not under protocol or DAO management (e.g., a legal foundation or a pre-DAO deployer).

Map voting groups

“Governance attacks are real, and you must stand guard and stop them if possible,” says Eithcowitch, who says onchain mechanisms can help, such as metrics for understanding which groups dominate governance and could attack the DAO.

“At a basic level, Snapshots and a multisig wallet is a practical solution even if purists don’t like it,” argues Eithcowitch. “Optimism has made a tool for measuring the concentration of power in the DAO. Other DAOs are doing the same.”

In addition, DeepDAO is now creating a Voter Discovery Report — a novel solution that measures several things, including the centrality and decentralization of governance.

It will also launch its Power Groups Tool, identifying which groups often vote together.

For example, if seven to eight wallets or NFTs vote together on 70–80% of proposals, that group has power beyond that of an individual. It could also identify conflicts of interest, such as one party having a large stake in both DAO A and DAO B and then voting to preference DAO A over DAO B.

Participatory incentive alignment is crucial

The press had a field day with the Aragon story, but building startups publicly with pre-product tokenholders is treacherous.DCF GOD’s view remains that these were the actions of activist investors:

“Your job as a tokenholder is to put up proposals for things that you want.”

After the DAO raid, Aragon’s new product team, AragonX, (separate from the new Aragon Foundation), is assisting in custom DAO builds for projects with $1.5 billion TVL locked or more.

Polygon is now building its governance. So, one of the largest projects in the history of Ethereum will be governed by Aragon.

Leutenegger argues that DAOS must get incentive alignment right off the bat, and launching a token before product-market fit might be a mistake.

“I think the DAO space is a bit confused right now. DAOs are failing to design incentives around reaching a goal, and you have to create the right incentive alignment and design the right course correction.”

“It’s a mistake to crowdsource wisdom that should be an outcome of incentive alignment. You have a common goal, but you can have differences on how to get there.”

Leutenegger argues: “Dissent within a DAO is a social question, for example, with Nouns the question is how can onchain governance have an impact on this? Rage quitting with a portion of the treasury is an onchain mechanism that we can install to allow dissenters to exit fairly. Aragon now knows how to build these kinds of mechanisms.”

Noun’s Gami concurs: “I want people to learn from these things. It would have been good if we had a way to have prevented these guys from stealing half our treasury.”

week.

The post ‘Raider’ investors are looting DAOs — Nouns and Aragon share lessons learned appeared first on Cointelegraph Magazine.

(@AragonProject)

(@AragonProject)