When Satoshi Nakamoto invented Bitcoin (BTC), the anonymous cryptographer envisioned a world where people would free themselves from the iron shackles of banks and tyrannical governments.

What he probably didn’t expect, though, was a crypto industry teeming with badly drawn frog, cat and dog tokens, along with a sprinkling of racist memes.

With coverage of the fourth Bitcoin halving overshadowed by a speculative mania in meme coins — including on the Bitcoin network itself — it’s not surprising to see a very vocal debate over the value of meme coins to the crypto industry.

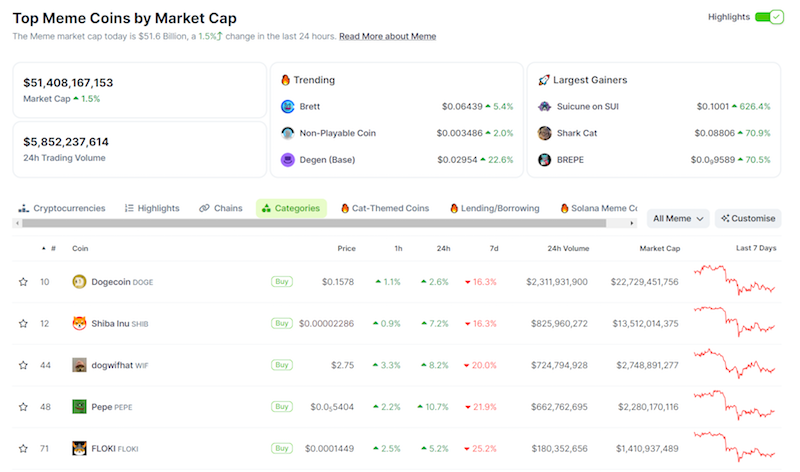

Which we can answer — they now have a combined value of $51 billion in market capitalization.

What is a meme coin? The “dumpster of crypto”

Many vocal critics, including popular anonymous crypto commentator Polynya, are disillusioned and angry about the recent meme coin surge, arguing they have no place in the crypto ecosystem.

In his final blog post on Medium, where he essentially rage quit crypto, Polynya decried meme coins as “merely a vehicle to transfer wealth from the many to the most obnoxious people on the planet.”

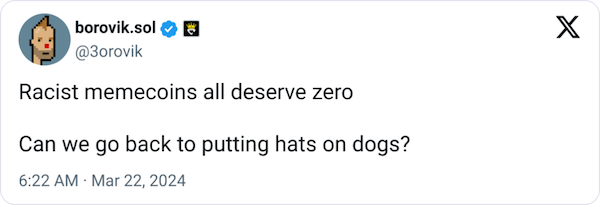

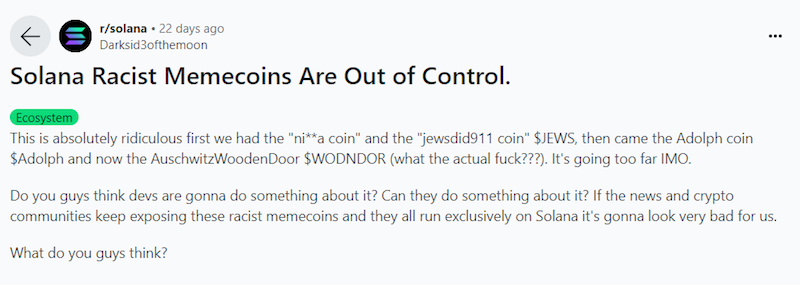

The analyst highlighted reports of a wave of racist meme coins (dubbed “SlurFi” by some) as representing the token form’s nadir.

“Things have hit an all-new bottom with 2024: racist, sexist, and other shitheaded memecoins.”

“At this point, this evil in crypto is banal and normalized. This has become the identity of crypto — sure, some useful stuff, but mostly just infested with scams and absolute degeneracy,” Polynya added.

Meme coins are also infested with rug pulls, scams and malicious taxes and are often run by inept founders who don’t know what they’re doing.

A recent investigation from Magazine found that 1 in 6 new Base meme coins are outright scams, while almost 91% of them had at least one security vulnerability.

According to BlockAid, more than 50% of presale tokens launched on Solana between November and February were malicious.

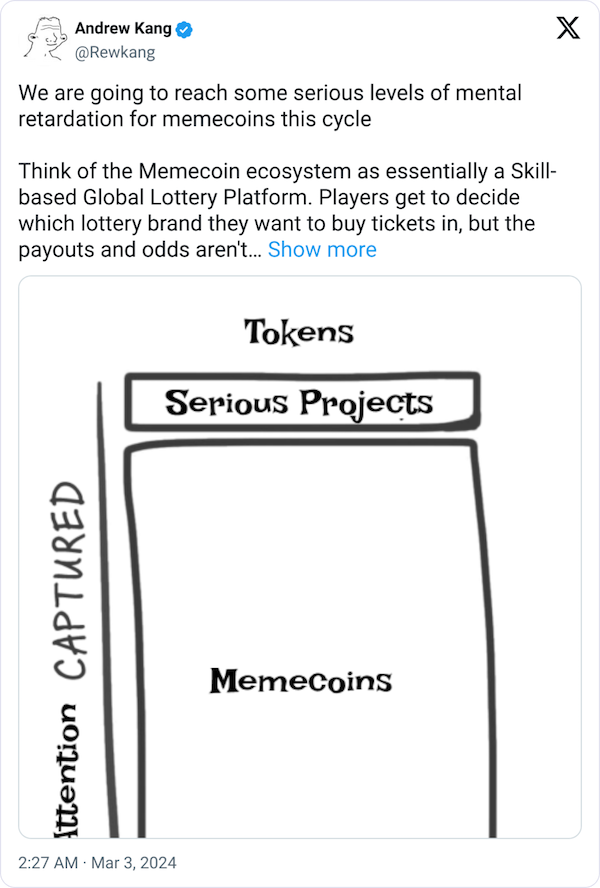

Is the recent meme coin degeneracy contributing to genuine builders giving up on the industry? There’s a fair degree of “financial nihilism” in the argument that nothing means anything; everything in crypto is a meme anyway, and it’s “mid curve” to support projects that actually have a purpose.

“Seeing meme coins leading to disillusionment/churn of crypto builders to a degree more extreme than even the bear market the past few years,” says Michael Dempsey, managing partner at Compound, a New York-based venture capital firm.

“Building something of durable value is a long emotional journey, and it can be tough after a two-year bear market […] to then have a reversion of curiosity from crypto, and the main vacuum of energy is gambling.”

Another venture capital executive, Eddy Lazzarin, chief technical officer at Andreessen Horowitz, says meme coins are “undermining the long-term vision of crypto” that has kept so many in the space.

Are meme coins worth it for attention and users?

But ignoring the racist tokens, rug pulls, and scams, meme coins aren’t all bad. Some argue the attention that meme coins bring is still a net benefit for crypto. It’s certainly a net benefit for blockchain networks as traders race to buy and sell coins. Solana, Base and BNB Chain in particular, are benefiting from a big influx of meme coin stans looking for a cheap way to trade coins.

In the last few months, layer-1 blockchains BNB Chain and Avalanche have launched million-dollar funds to try to bring meme coin magic to their networks to drive network growth.

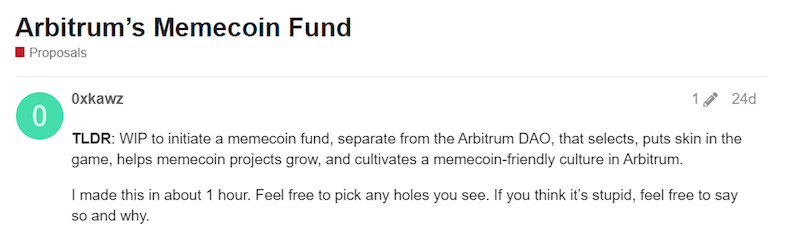

A community proposal on the Ethereum layer-2 network Arbitrum is also seeking a massive $3.3 billion fund to open the proverbial meme coin floodgates. As befits a meme coin proposal asking for billions, it was knocked up in an hour.

“Everyday, we see headlines of how Solana meme coins go from 0-100M+ FDVs in a matter of days,” says 0xkawz, who created the meme coin fund proposal.

“There is no reason Arbitrum DAO shouldn’t at least try to spur a meme coin initiative […] it’s hard to argue that Solana and, more recently, BASE, have taken all the attention,” they added.

Solana meme coins frenzy drives usage

In mid-March, Solana’s network activity briefly surpassed Ethereum’s as traders hoped to catch the next runaway meme coin success. Trading volume on March 15 reached $3.5 billion, outpacing its older and slower rival by more than $1.1 billion, per DefiLlama.

The frantic activity tested the scaling limits of the network and found them wanting, with up to three-quarters of all transactions failing at one point. This was addressed in a patch a month later.

The speculative degen blockchain of choice from the last cycle, BNB Chain, is eying that same market. The chain announced it would allocate up to $1 million throughout April to reward developers who hit a 30-day volume above $2 billion on the network as part of its “Meme Innovation Campaign.”

“When the community sends a clear signal that something matters to them, we seek to deliver on it,” a spokesperson from BNB Chain says, adding that meme coins have the potential to bring more users into crypto whether or not they end up being just “noise in the crypto market.”

Solana’s head of strategy, Austin Federa, says meme coins have been getting traction on Solana largely due to the tokens having become “rather strictly proxies for online culture and community.”

“For example, certain meme coins, like BONK, have rallied communities together and built vibrant ecosystems that resonate in the broader crypto space.”

“We’re seeing this momentum because Solana’s cost structure makes it possible for projects to launch tokens and send transactions inexpensively.”

Meme coins make millions addicted to Base

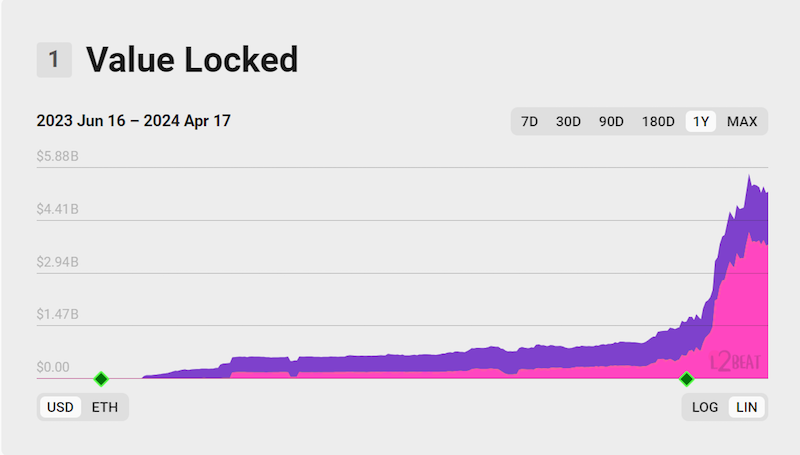

Coinbase’s Base network has also been a huge winner in the recent meme coin rush, with its layer-2 network’s total value locked recently surpassing $5 billion per L2Beat data.

“There’s been a ton of energy on base,” Base creator Jesse Pollak said in a presentation for an April 20 hackathon in New York, which was re-recorded and posted on X.

The Base founder said that while speculation is driving the activity, one of the aspects of memes he was most optimistic about was the creative ways that meme communities have tried to onboard new followers.

“What that’s creating is this kind of Cambrian explosion of onboarding experiments where people are taking tons and tons of shots on goal to say ‘how do we get our culture into the hands of more people,’” said Pollak.

“The thing we’ve built more conviction on is that in the years ahead, we’re actually going to see these memes bring in millions more people [to Base] — they’re going to be one of the biggest drivers because they’re doing that work constantly to onboard more and more folks through that in a really creative way.”

“Base’s mission is to bring the next billion users on-chain, and we are encouraged by the recent influx of activity on Base,” a Coinbase spokesperson tells Magazine.

Vitalik Buterin thinks meme coins can be used for good

In a recent blog post on his website, Ethereum co-founder Vitalik Buterin wrote that while he has “zero enthusiasm” for coins named after “totalitarian political movements, scams, rug pulls,” he sees potential in tokens that could fund important public projects or even allow people from lower-income countries to earn a living.

“If people value having fun, and financialized games seem to at least sometimes provide that, then could there be a more positive-sum version of this whole concept?” he said.

Famously, one of the most successful investments Buterin ever made was turning $25K into $4.3 million with Dogecoin, which he bought in 2016 and sold in 2020.

Meme coins with real-world utility

Thomas Tang, the vice president of investments at crypto venture capital firm Ryze Labs, tells Magazine he believes meme coins can be a “go-to-market strategy” for an entity or a business — turning a token into a rallying point for a community.

Tang cites DEGEN on Base as a recent example. It started as a tipping token for users on Farcaster’s Degen channel to reward others for good posts but later morphed into a layer-3 chain of its own.

“You have accumulated a whole community of people that have been tipped in this token […] it’s gained massive mass popularity because everyone’s tipping each other, and everyone holds it,” said Tang.

“So they built a layer 3, based on that.”

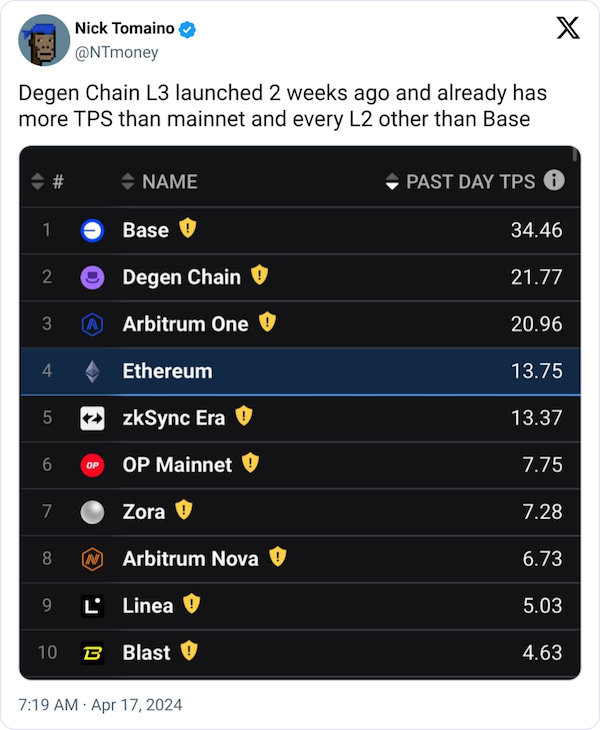

DEGEN chain launched as a layer-3 network built on top of Base in late March, and uses DEGEN as its native gas token.

The developers say the new chain will enable experiments with tipping, community rewards, payments and gaming. It’s mostly been used for meme coin speculation so far, but the activity saw Degen hit 37.12 transactions per second on April 18, making it the fastest protocol in the Ethereum ecosystem. Demand is a big driver of the TPS of scaling solutions rather than pure technical capacity.

Dogecoin and meme coin communities

CK Zheng, co-founder and chief investment officer of ZX Squared Capital, sees meme coins as a product of the attention economy and argues Dogecoin (DOGE) is a “good example” of a meme coin story gone right.

“At the beginning, nobody knew how Dogecoin would be used.”

“But if you get a large network of people with the same interest and get a community built […] things can happen. A coin is purely a platform,” said Zheng.

Some even argue that all of crypto is driven by memes, including the projects that claim to actually do something.

Dogecoin was launched in December 2013 by software engineers Billy Markus and Jackson Palmer, who created it to poke fun at rampant cryptocurrency speculation at the time.

The cryptocurrency now has a $26.7 billion market cap, making it the eighth most valuable cryptocurrency, just behind USD Coin (USDC) with roughly 4.6 million non-zero addresses, according to BitInfoCharts.

Elon Musk’s Tesla accepts it as a form of payment for its merchandise, and there are hints that users will one day be able to buy an entire car with it.

Zheng said a similar thing happened when merchants from ancient Rome and China met to trade on the ancient Silk Road thousands of years ago.

“There was no dollar then; there was no Chinese yen,” said Zheng, adding that through “generations and generations of exchange, gold became ingrained as a means of exchange.

“It’s the same thing with Dogecoin. If there are 7 or 10 million people that use Dogecoin, that becomes a community […] It’s a snowball effect, and when you have more and more people, the value of the underlying (asset) will increase.”

There’s also a sizeable camp of people who don’t really like meme coins, but are prepared to put up with them because one of crypto’s core ideals is being open and permissionless.

What are meme coins if not the freedom to transact?

“On the whole, I believe meme coins are good because they reflect society’s commitment to upholding digital property rights through a free and open market,” says Yuga Cohler, the engineering lead at Coinbase, wrote in a March thread on X, adding:

“Meme coins are one of the purest expressions for citizens to exercise their freedom to transact without contingency.”

Solana co-founder Raj Gokal is also among them, calling out VCs that suggest memecoins are scaring away “serious builders.”

“If you’re fragile enough to get spooked by how young people choose to use permissionless systems to have fun, you will quite simply not make it here,” he said.

“I value people’s desire to have fun, and I would rather the crypto space somehow swim with this current rather than against it,” Buterin added in his blog post.

However, Zheng says he ultimately sees meme coins as just a “sideshow.”

“Every cycle, there’s a certain amount of hype, and people use that cycle as a way to test out new things,” said Zheng, noting NFTs grew extremely popular in the last bull run.

“Personally I see Bitcoin as the fundamental driver in terms of the crypto ecosystem.”

week.

The post Meme coins: Betrayal of crypto’s ideals… or its true purpose? appeared first on Cointelegraph Magazine.