Polygon is facing questions over 400 million MATIC allegedly missing from its staking allocation — but most other projects have also not accurately followed their publicized token distribution strategies, says blockchain data firm ChainArgos.

Jonathan Reiter, CEO of the Singapore-based company, tells Cointelegraph that it has not yet encountered a single company that has fully honored the token distribution plans initially presented to investors.

“You’ve certainly seen questions about a very wide range of projects and whether or not the token allocations made any sense,” said Reiter.

“Essentially, every project we’ve ever looked into wasn’t done correctly.”

Making the situation worse for tokenholders, legal experts say the practice probably isn’t illegal in most cases, given that white papers are not accorded the same contractual status as an investment prospectus. Civil action may be a possibility in some cases, however.

ChainArgos is best known for unveiling the mismanagement of Binance USD (BUSD) last year, a stablecoin overseen by Paxos with Binance’s branding. The world’s largest cryptocurrency exchange has admitted that the stablecoin was undercollateralized by more than $1 billion in multiple instances.

ChainArgos accuses Polygon

ChainArgos has accused Polygon of misappropriating at least 400 million MATIC tokens intended for its staking program in a research report. Polygon is an Ethereum scaling network whose native token, MATIC, has the 16th largest market cap worth $7.34 billion, according to CoinGecko.

Polygon launched in 2017 as a proof-of-stake sidechain to help scale Ethereum and is now aggressively expanding into an ecosystem of zero-knowledge-proof solutions. MATIC’s market value was worth $20 billion at its peak.

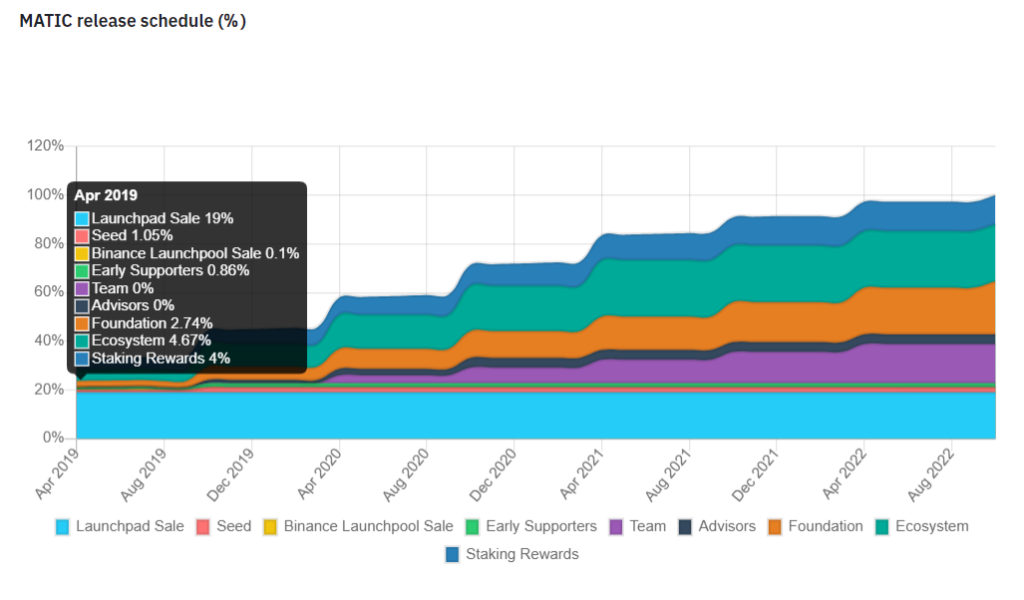

Polygon states on its website that it set aside 1.2 billion MATIC at launch, or 12% of the 10 billion total supply, for staking rewards. This 12% was to be gradually transferred to the staking address over time, starting with 4%, or 400 million MATIC, during its initial exchange offering on Binance in April 2019 (an IEO is similar to an initial coin offering but held on an exchange).

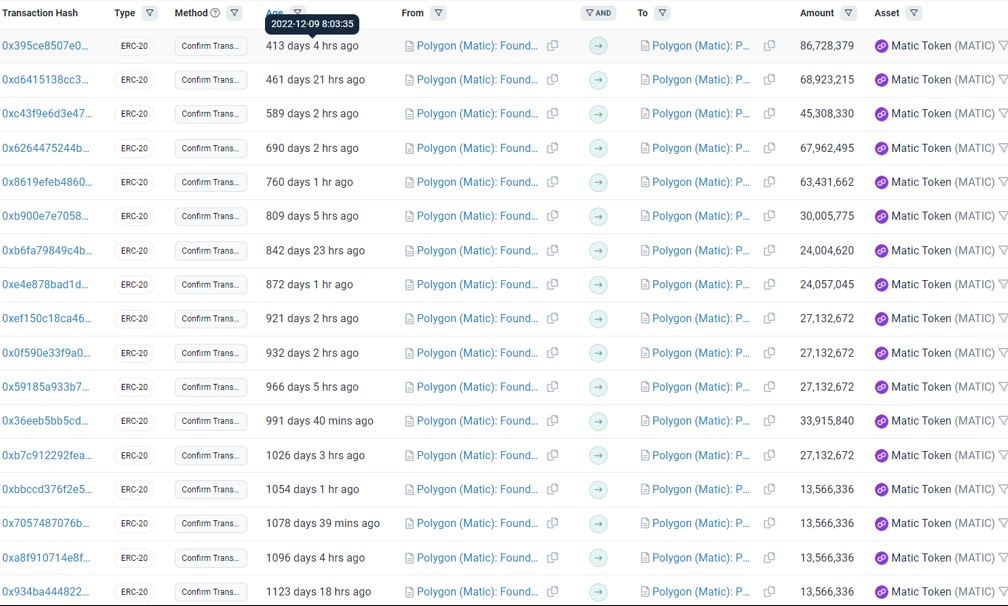

Polygon’s project roadmap shared by Binance shows that the 12% MATIC transfer to the staking address should have been finalized by December 2021. But blockchain transactions suggest that hasn’t been the case, as only 790 million MATIC have been transferred from the Polygon Foundation to the staking address.

ChainArgos alleged in its report that the “missing” 4% may potentially relate to a transaction that occurred in April 2019.

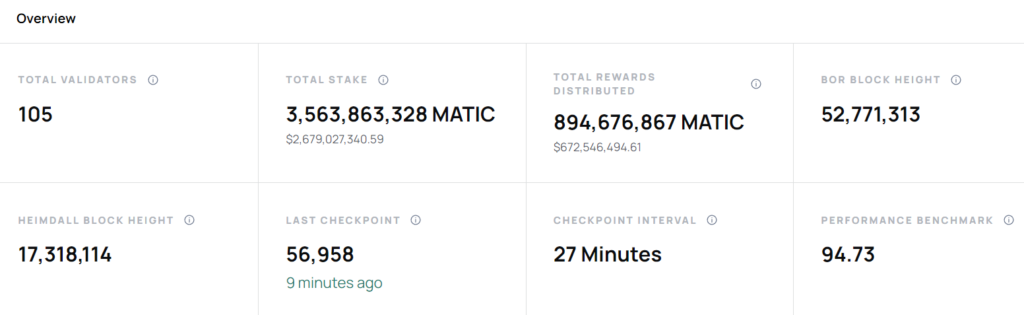

Polygon’s staking website reports the network has dished out 894 million MATIC in rewards so far — 100 million more than the Polygon Foundation has transferred to the staking address — raising further questions.

Cointelegraph has contacted three Polygon executives and the firm’s press office directly to comment on the allegations. The company has not responded.

In addition to MATIC allocated for staking, Polygon’s token distribution breaks down to 3.80% of the total supply going to private sales, 19% to Binance Launchpad sales, 16% to its team, 4% to advisers, 21.86% to the Polygon Foundation, and 23.33% to ecosystem and marketing.

Enig-MATIC token allocation

Let’s dive deeper on-chain to see what happened.

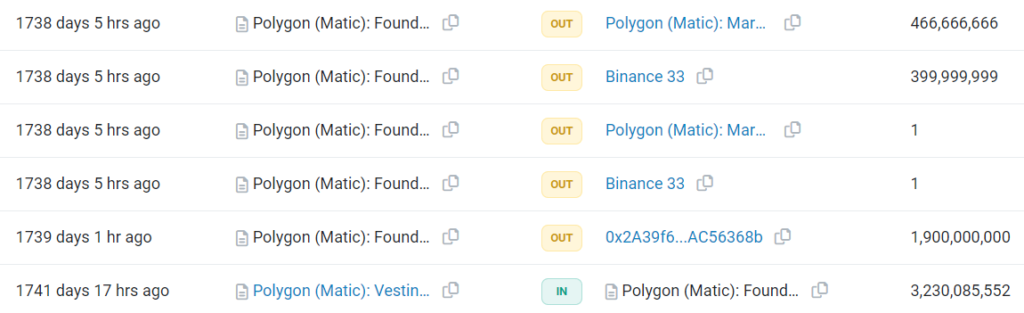

During deployment in April 2019, the entire MATIC supply was transferred to Polygon’s vesting contract. This address has only sent MATIC to Polygon’s Foundation contract and currently holds over 273 million MATIC.

Blockchain transaction records suggest that Polygon’s token allocations, including transfers to the staking contract, are conducted through its foundation address.

The Polygon Foundation initially received 3.23 billion MATIC (32.3% of the total supply) from the vesting contract in April 2019. From this, 400 million MATIC were sent to an address labeled “Binance 33” on Etherscan.

It subsequently transferred 300 million MATIC to 0x2f4Ee65D536c5a2Dd72004778167B30aeCb8719C (which we will refer to as 0x2f) over multiple transactions. Binance 33, currently the 12th-largest MATIC address with 92 million tokens, almost exclusively transacts with Polygon-related accounts.

The foundation address also sent 467 million MATIC to Polygon’s marketing and ecosystem address, which gradually transferred the entirety of this amount to 0x2f. The 767 million MATIC that 0x2f received then flowed to “Binance 14” and “Binance” over time.

While the address lacks a label on blockchain viewers like Etherscan, 0x2f’s transaction history suggests that the account is controlled by, or closely related to, the Polygon Foundation.

If true, this would mean 767 million MATIC from the foundation, which includes 300 million of those allegedly linked to the missing staking tokens, flowed to Binance exchange wallets, raising suspicions that staking rewards were sold by Polygon.

However, it remains possible that the foundation is holding these tokens on the exchange or that it moved the tokens to a separate wallet to transfer the funds to the staking contract.

In February 2022, 0x2f received 10 million ALPHA ($3.57 million) from Alpha Venture DAO, which was subsequently sent to Binance. A few months later, Alpha and Polygon partnered to launch a Web3 accelerator with a second incubator program soon after.

“Whether they were deposited into the exchange and then withdrawn to a different wallet that also belongs to the staking process, in theory, that’s possible. There’s no way to know if they were sold on Binance,” says Reiter.

Unlike “Binance 33,” which appears to only interact with Polygon and still holds a significant amount of MATIC, “Binance” and “Binance 14” are used to service the exchange’s customers, including Alameda Research, which put almost $17 billion through the address, and Three Arrows Capital, which transacted $7.3 billion, according to Arkham Intelligence.

Binance ICO malarky

The allegations about Polygon’s missing 400 million MATIC could highlight a greater trend of projects that haven’t been completely honest about their token distributions or ICOs.

For instance, an investigation by Forbes last year alleged that Binance exaggerated the success of its summer 2017 ICO for BNB, the exchange’s native cryptocurrency with a 200 million token supply ceiling.

According to Forbes, Binance did not release 120 million BNB in its ICO as its white paper stated but only moved 55 million tokens, while the rest of the token’s total supply, 145 million BNB, was left untouched at Binance’s deployer address for more than a year after the ICO’s conclusion.

The investigation also alleged that Binance quietly doubled the amount allocated to investors to 40 million BNB during the ICO, rather than the 20 million tokens stated in its white paper.

“If you consider a white paper to be a legally binding document, then they would be in a breach,” Jonas Rey, co-founder of blockchain litigation firm Liti Capital, tells Cointelegraph. However, he adds that crypto white papers are not legally binding documents like shareholder agreements.

“A white paper is considered to be there for information purposes only, and it is understood that it represents a snapshot of the situation on time X and that this situation will evolve with the project.”

Despite token movements suggesting an underwhelming ICO, Changpeng Zhao, founder and former CEO of Binance, hyped up the event as a success in a LinkedIn post, claiming to have raised $15 million from 20,000 users, with BNB selling out at $0.15 a token.

Forbes estimates the company is more likely to have raised $1.65 million from 2,000 users.

However, an ICO flop may have been a blessing in disguise for Binance. If Forbes’ investigation is accurate, the company would have been left with 65 million unsold BNB in its war chest, which grew in price from $0.15 to cross an all-time high price of $686 per token in May 2021, according to CoinGecko. BNB is trading for $292.62 at the time of writing.

Legal situation for incorrect token allocations “murky”

Polygon is not a public company and does not have a legal obligation to disclose its financial information to the public. But unlike traditional businesses, crypto firms’ token holdings can be examined by anyone thanks to blockchain’s transparent nature.

Winston Ma, an adjunct law professor at New York University, says that he believes cryptocurrency issuers have affiliated responsibilities to ensure the integrity of token schemes. However, he adds that:

“From a legal perspective right now, it’s quite murky.”

According to Liti Capital’s Rey, investors may take action if they believe they have been wronged by a project not following through on its token allocation strategy.

“They would have a claim, but for that, they would have to show financial damage,” Rey said.

Despite ChainArgos’ accusations, the Polygon Network has distributed over 894 million MATIC to at least 105 network validators in its staking program, suggesting consistent rewards distributed to date. More than 3.535 billion MATIC ($2.6 billion) has been staked as of January 23, according to Polygon.

Ma adds that investors and regulators are becoming more aware of the risks associated with decentralized finance applications, such as staking.

“In the traditional finance world, people will ask for reps and warranties from counterparties, like in this case, the issuers. Down the road, you may see investors demand reps and warranties,” says Ma.

week.

The post Mystery of Polygon’s missing MATIC: Everyone’s doing it, says ChainArgos appeared first on Cointelegraph Magazine.