Johannes Eisele/AFP via Getty Images

- The "everything bubble" of 2021 has deflated, but stocks still look overvalued, according to Ned Davis Research.

- Meanwhile, bonds have approached fair value after a 50% decline spurred by high interest rates.

- These are the valuation metrics that tell NDR stocks are still too high.

The "everything bubble" of 2021 has finally deflated after a surge in interest rates sparked losses across the bond and stock markets.

But while bonds have reached "fair value" territory after a 50% crash, stocks still appeared overvalued, according to a recent note from Ned Davis Research.

Of course, stocks don't look as overvalued as they did two years ago when SPACs, NFTs, and meme-stocks were catching fire with investors. But they're still priced at extremes that suggest future returns could be underwhelming for investors.

The 2022 bear market, which sparked a more than 20% decline in the S&P 500, helped rein in valuations. And last week, the S&P 500 entered correction territory.

But NDR still isn't confident that equities currently represent a good deal for investors.

"Even using my more generous analysis the market was very overvalued in 2021. It is less so now but still in the overvalued zone where stocks have done poorly," Ned Davis of NDR said, pointing to various valuation metrics.

For one, stocks have outrun the boom in money supply growth, according to the note, pointing to the M2 gauge.

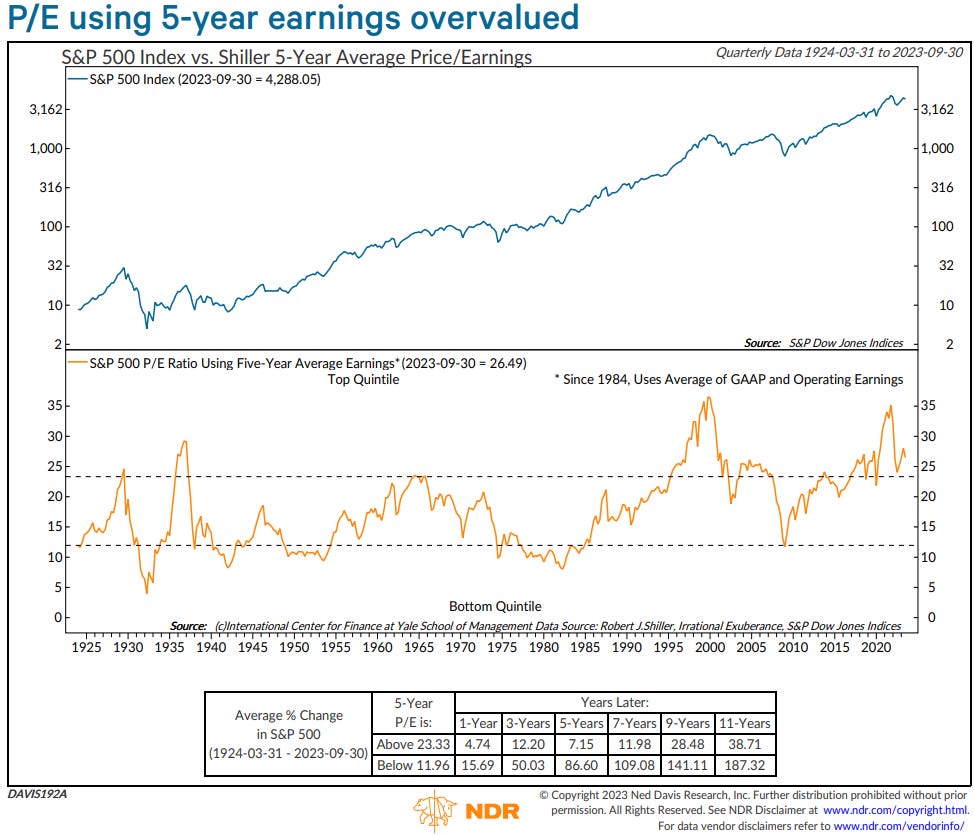

A "more normal valuation" metric also shows stocks are still overvalued, based on the price-to-earnings ratio of the S&P 500 using five-year earnings.

"All three of these charts go back to the 1920s and still show a bubble in stocks," Ned Davis said.

Ned Davis Research

The stock market also looks overvalued when compared to the hefty returns that bonds are offering.

"While stocks are not as overvalued as they were in 2021 on an absolute valuation basis, relative to bond yields they are more overvalued," Davis said.

Finally, Davis pointed out that US households are still overweight stocks, with nearly 40% of households owning stocks, well above the long-term average of 27%.

Meanwhile, US households hold underweight allocations in real estate, bonds, and cash, with cash the most underweight relative to 72-year norms.

These readings suggest that stocks could be the biggest losers if US households get fed up with their exposure to equities and decide to shift their money elsewhere, meaning more room for valuations to fall lower.