Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & more!

Dear Bankless Nation,

Blur has dominated the market share of the NFT marketplace sector since February 2023, when $BLUR Season 2 rewards were introduced.

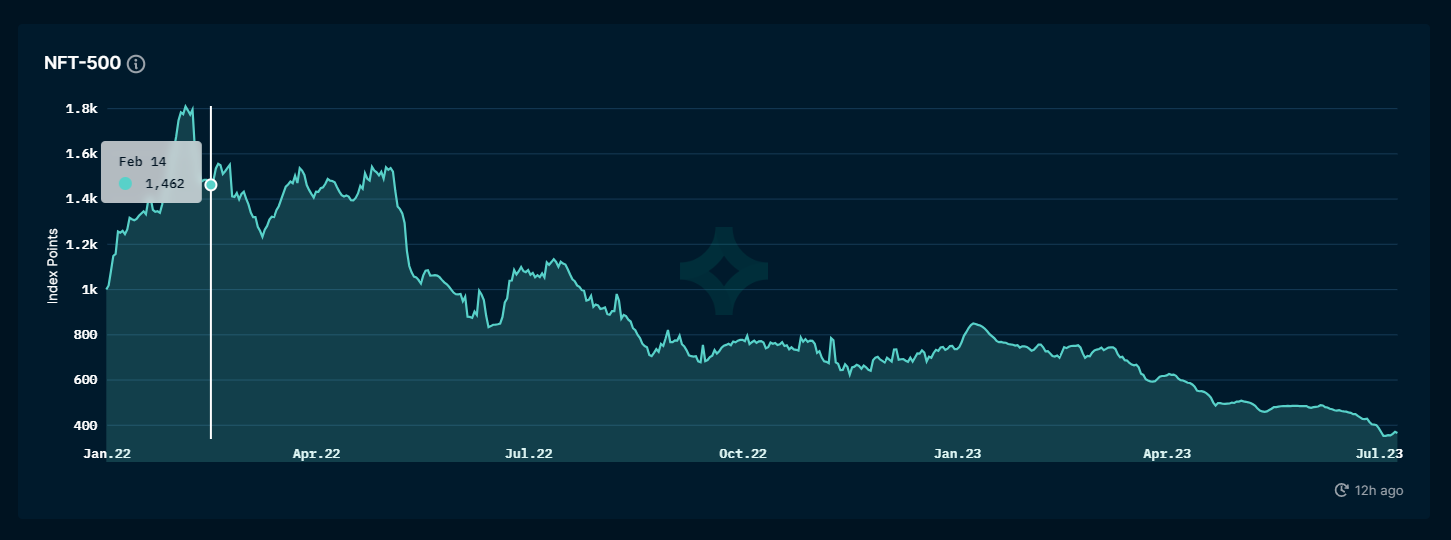

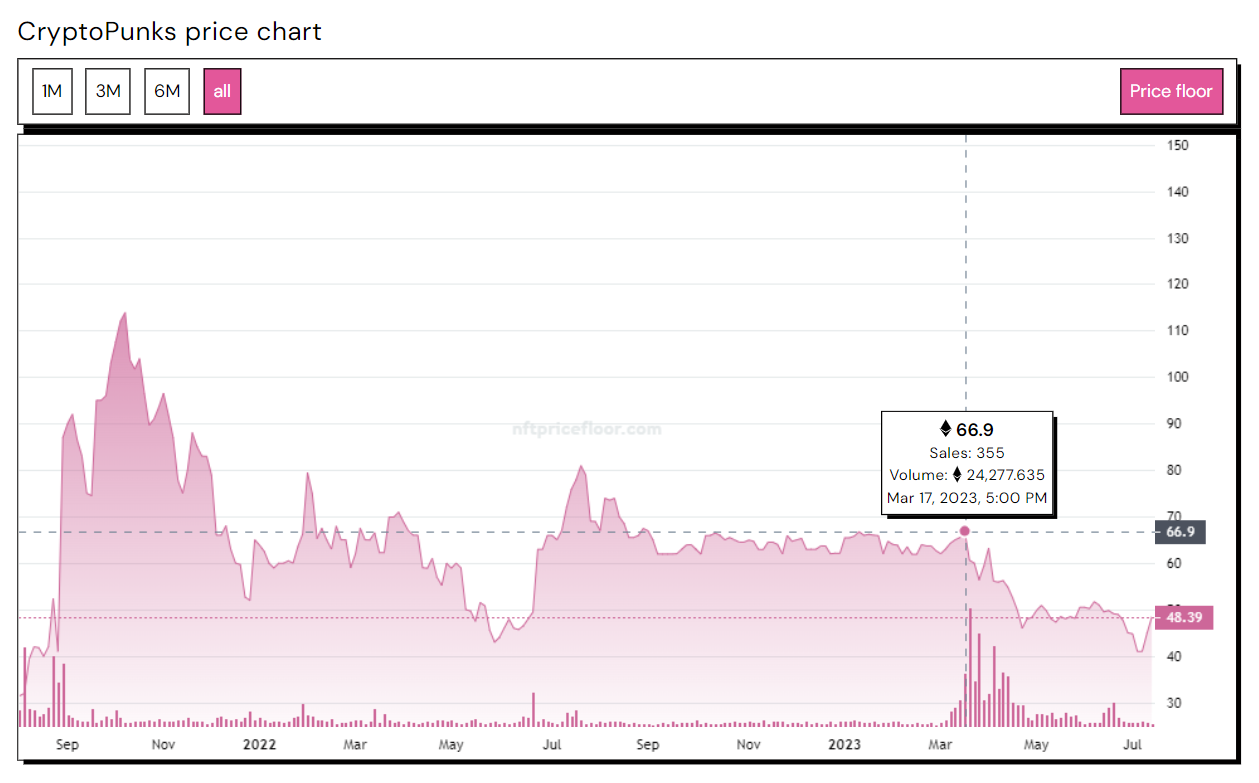

Yet the NFT space has also seen floor prices and other stats trending downward ever since, leading some to call out the platform’s operations as damaging to the ecosystem.

What’s it all about? Let’s get you caught up on this important discussion for today’s post!

-WMP

🦊 Thanks to MetaMask Portfolio 🦊

👉 Your web3 assets in one place, and much more ✨

Blur: Saving or Draining NFTs?

To what extent has Blur’s Season 2 $BLUR farming contributed to this year’s downturn in NFTs? In my opinion, it’s inconclusive.

Remember, the Season 2 system awards traders with bidding and listing points, which will later be converted into $BLUR rewards.

A prominent criticism against this system is that it seemingly incentivizes NFTs to get dumped over and over again, pressuring floor prices lower as farmers accept ETH losses on bids so they can keep trading in exchange for more prospective $BLUR profits later.

Want to unlock $1,000+ in Citizen deals and perks across crypto?

The crux of the question here is the extent, how much pressure is coming from Blur, and is it the main cause of pressure here?

Of course, we are in a crypto bear market, and attention and activity levels are down bigly across the board. If interest’s down, prices go down. If confidence’s down, prices go down. For example, many people have dumped from their collections as morale and narratives have sunk, like the recent deflation of Azuki’s reputation after its controversial $40 million Elementals mint.

And there are other influences in play too, like how NFT floor prices pumped en masse last week after NFTperp paused its v1 system and NFT shorts instantly dried up. There are many moving parts that are affecting the NFT ecosystem at any given time, to be sure.

Personally, I do think if $BLUR farming stopped right now we’d see some degree of pressure come off NFT floor prices. On the flip side, I think Blur defenders make a compelling point that $BLUR incentives have generated major liquidity and created new buyers in the market, and thus that NFT prices might have cratered even worse in recent months if it wasn’t for the prospect of these rewards.

So again, I don’t think you can say conclusively that Season 2 $BLUR farming has been the main driver of this year’s NFT downturn. I don’t doubt at all that $BLUR farming pressures floor prices, e.g. when big whales like Machi Big Brother dumps dozens or 100s of NFTs en masse to rotate farming positions, but I also don’t doubt that these rewards have also helped stem deeper selloffs in the space in recent months. So there’s some counteracting effect that’s gone on here I believe.

Is Blur eating NFT project market caps to gain and maintain market share? One could argue so. Are $BLUR incentives best for Blur? Definitely. But is Blur the singular cause of the NFT bear? No, I don’t think so.

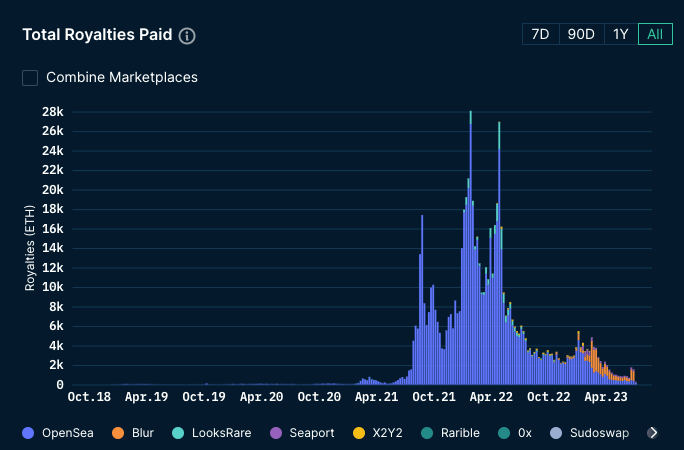

In contrast, I think where you can more readily hit Blur is where you can hit most NFT marketplaces right now, namely for killing the vibe by not remaining steadfast on NFT royalties, which have died down to a trickle across the board as the marketplace wars have raged on in recent months.

Talk to most non-technical creatives who’ve arrived in the space over the past few years, and automated royalty payments on secondary sales were a huge draw for many if not, well, all of them. It’s one of non-skeuomorphic “only possible with NFTs” things that’s lost its magic now that its power’s been pierced.

In my opinion, it’d go a long way if Blur and OpenSea and others reverted from this new meta of making royalty payments optional to simply enforcing the rates that creators set, and working toward that cultural norm once more of royalties being considered part of NFTs full sales price, like how IRL “service included” establishments cover gratuity in their full bills.

Bring the good vibes back, bring royalties back, bring a second wind to NFT creators. Would doing this stop the NFT bear market overnight and fix all our problems? No. Would it win everyone to Blur’s side? No. Yet it could lead to a rallying effect in more ways than one that would be good for Blur, good for the space, and turn anti-Blur narratives on their heads!

Action steps

-

❓ What’s your take on Blur’s current impact, yay or nay? Let me know your two gwei in the comments below!

-

📰 Catch up on my previously weekly NFT roundup: Perp’s Pause? Pixel’s Pump

Author Bio

William M. Peaster is the creator of Metaversal — a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also a senior writer for the main Bankless newsletter.

A Bankless Citizen ⚑ turned $264 into $6,077 last year. A 22x ROI 🚀 in a bear market!

🙏 Together with 🦊 MetaMask Portfolio 🦊

The web3 ecosystem is an expansive world, full of endless opportunities for those curious enough to explore them! Head over to MetaMask Portfolio to get started, where you can view your assets in one place and discover other features such as Buy, Swap, Bridge, and Stake.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.