In eight days, the backwards-incompatible Shapella hard fork, also called the Shanghai upgrade, will let users withdraw their “staked ether.”

The market is still worried that when the ETH that was put into the network to make it more secure in exchange for rewards is unlocked soon, some token holders will rush to exchanges to sell their tokens.

Some analysts think that the increase in selling pressure that followed could be worth a few billion dollars.

“1.1m ETH related to partial reward withdrawals could face the market, while Celsius is likely to sell its 158k staked balance as part of its bankruptcy process. These two numbers represent nearly 1.3m ETH or approximately $2.4bn worth of potential sell-side pressure to face the market,” in a note to clients on Tuesday, analysts from K33 Research said.

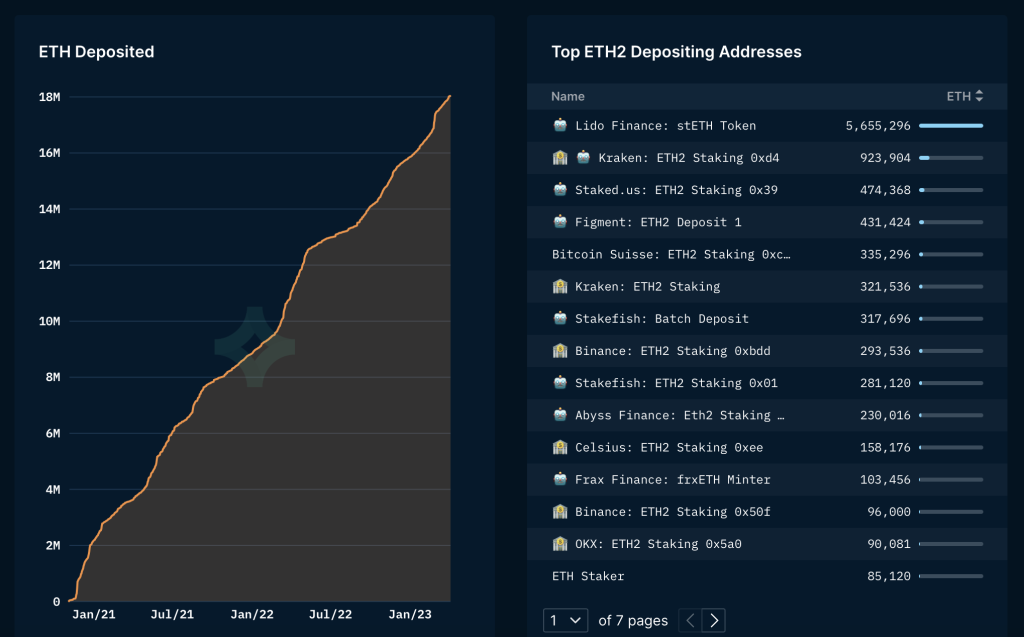

Since December 2020, when the Beacon Chain went online, more than 18 million ether have been bet on the network.

Even though the whole balance can’t be unstaked right away after the upgrade, about 1.1 million coins that were earned by staking can be taken out right away. People who stake ETH get paid in ETH.

Another thing that could push people to sell could be the bankrupt crypto lender Celsius selling its stake of 158,176 ETH to get at least some of its creditors’ money.

K33 shows that the San Francisco-based cryptocurrency exchange Kraken, which was recently fined for not registering the offer and sale of their crypto-asset staking-as-a-service program, is likely to unstake any ETH staked by US investors. At the time this was written, 1.2 million ETH had been bet on Kraken.

“Kraken will unstake all ETH staked by U.S. investors as a result of its Wells Notice, this could entice some of Kraken’s ETH stakers to sell,” analysts noticed.

No big sale

According to data from Coingecko, the estimated increase in supply of more than $2 billion is only 20% of the average daily trading volume of ether.

According to a study by 21Shares, it will take 5–6 days to process a partial withdrawal, and it will take 3–4 months to process a full withdrawal.

In other words, the pressure to sell will likely be spread out over a few days, giving buyers a chance to keep up.

“Thanks to the modest daily limit on the original 16.27mn ether, this potential selling pressure is evenly distributed over a long time. This should allow buyers to match the selling pressure without much impact on the price,” said in the Shanghai Upgrade preview.

Eberhardt also said that many people who move ether are long-term investors who aren’t likely to sell their holdings after the upgrade.

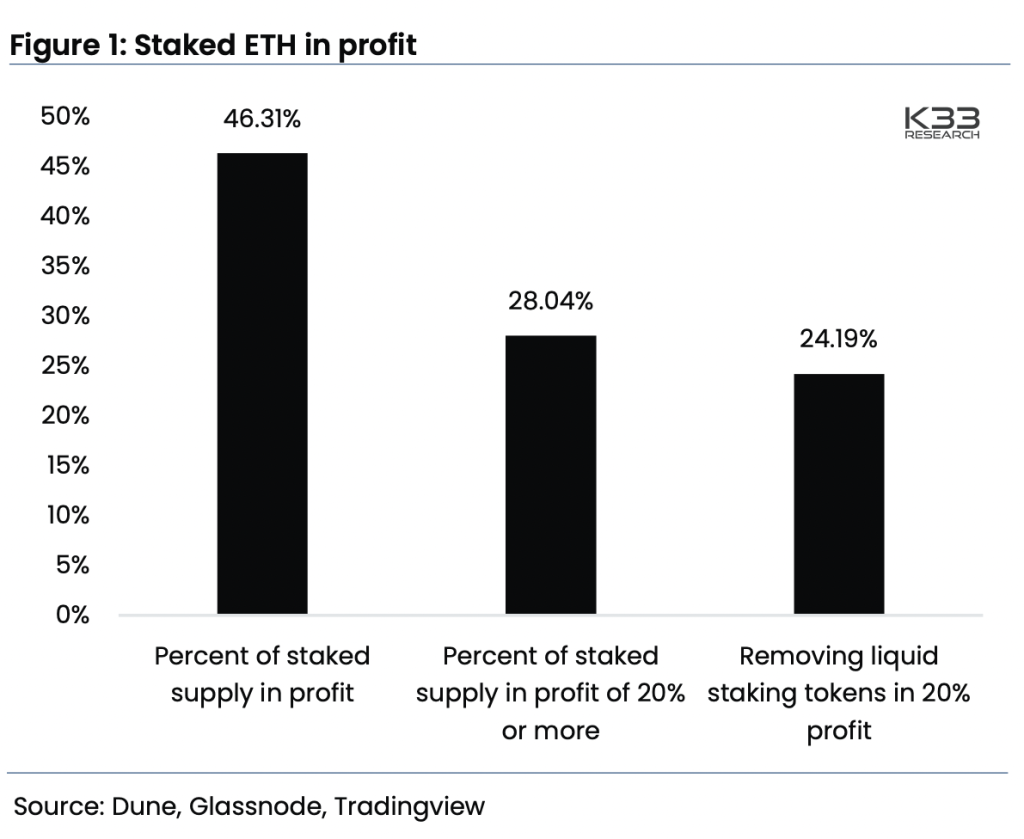

K33’s graph shows that 46.3% of the ether that was staked is profitable because the price of ether on the market is higher than the price at which these coins were locked in the network. At the same time, 28.04% of the ether that was bet is making more than 20%.

If we leave out coins staked through Lido and Coinbase’s liquid staking services, the number drops to 24.2%. K33 says that long-term investors put in 16% of all ETH staked, or 66% of this 24.2%, before February 2021.

Content Source: coindesk.com

The post Ethereum’s Shanghai upgrade to bring $2.4B selling pressure appeared first on NFT News Pro.