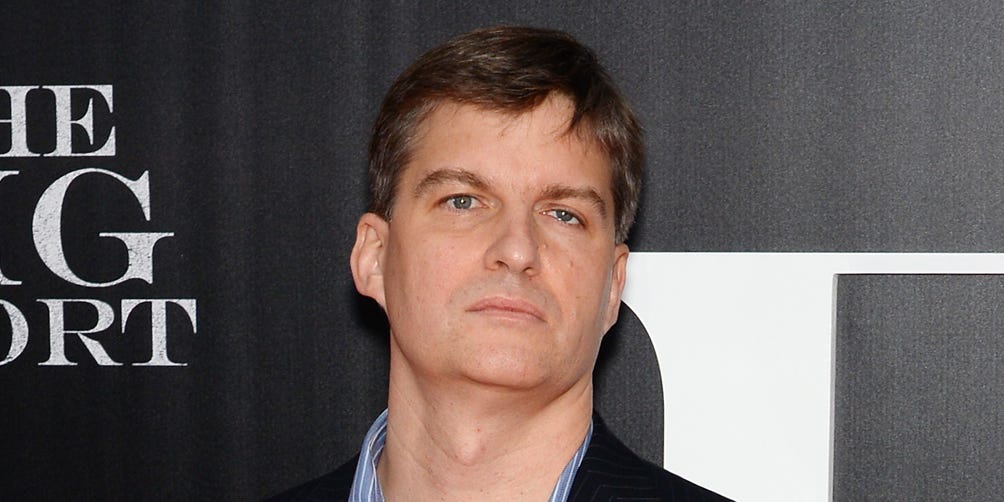

Andrew Toth/Getty Images

- Michael Burry underscored the importance of the inflation threat to investors.

- He cautioned against relying on the same portfolio strategies that have worked in recent years.

- The investor of "The Big Short" fame poured cold water on hopes of a big rebound in stocks.

Michael Burry warned in a Wednesday tweet that inflation changes the game for investors — and portfolio strategies that have paid off in recent years might fail to protect against the new threat.

"What markets are going through is something they haven't had to deal with in over 4 decades," Burry tweeted. "Yet today all these chartists and analysts point to how great this strategy or that strategy worked the last 2 decades. Meet the new boss, same as the VERY old boss."

The Scion Asset Management chief attached two charts showing that the last two periods when investors were overweight bonds relative to equities, March 2009 and May 2020, were followed by major stock rallies. The charts stemmed from a recent Bank of America survey that found fund managers have cut their net overweight position in stocks to its lowest level since October 2008.

However, Burry's tweet suggests investors should think twice about piling into stocks in anticipation of a big rebound. Markets are facing rapid inflation for the first time in 40 years, meaning this downturn is different, and there's no guarantee a shift from stocks to bonds will herald a bounce in stocks this time around — at least in his view.

The last part of Burry's tweet suggests he sees inflation as the key driver of the stock market today, and a critical factor in investors' decisions.

Burry, who raised the prospect of post-pandemic inflation as early as April 2020, has repeatedly accused the Federal Reserve of overstimulating the economy and moving too slowly to rein in rising prices.

However, the investor of "The Big Short" fame has also noted that American consumers — who are grappling with higher food, fuel, and housing costs — are saving less, racking up debt, and on track to virtually exhaust their savings by Christmas.

The prospect of weaker consumer demand, coupled with retailers likely slashing prices to get rid of excess inventory, means Burry expects inflation to slow later this year. That would potentially allow the Fed to resume cutting rates and growing its balance sheet again, he said recently.

Burry is best known for issuing dire warnings about bubbles and crashes, and calling and cashing in on the collapse of the mid-2000s housing bubble. He also inadvertently paving the way for the meme-stock craze by investing in GameStop a few years ago, and placed high-profile bets against Elon Musk's Tesla and Cathie Wood's Ark last year.