Justin Sullivan/Staff/Getty Images

- I bought tens of thousands of dollars of USDC, a stablecoin, through Voyager, which promised 9% APY.

- The company filed for bankruptcy last week and suspended withdrawals on its platform.

- Voyager claimed users' funds were FDIC-insured, but they weren't, and now my money may be lost.

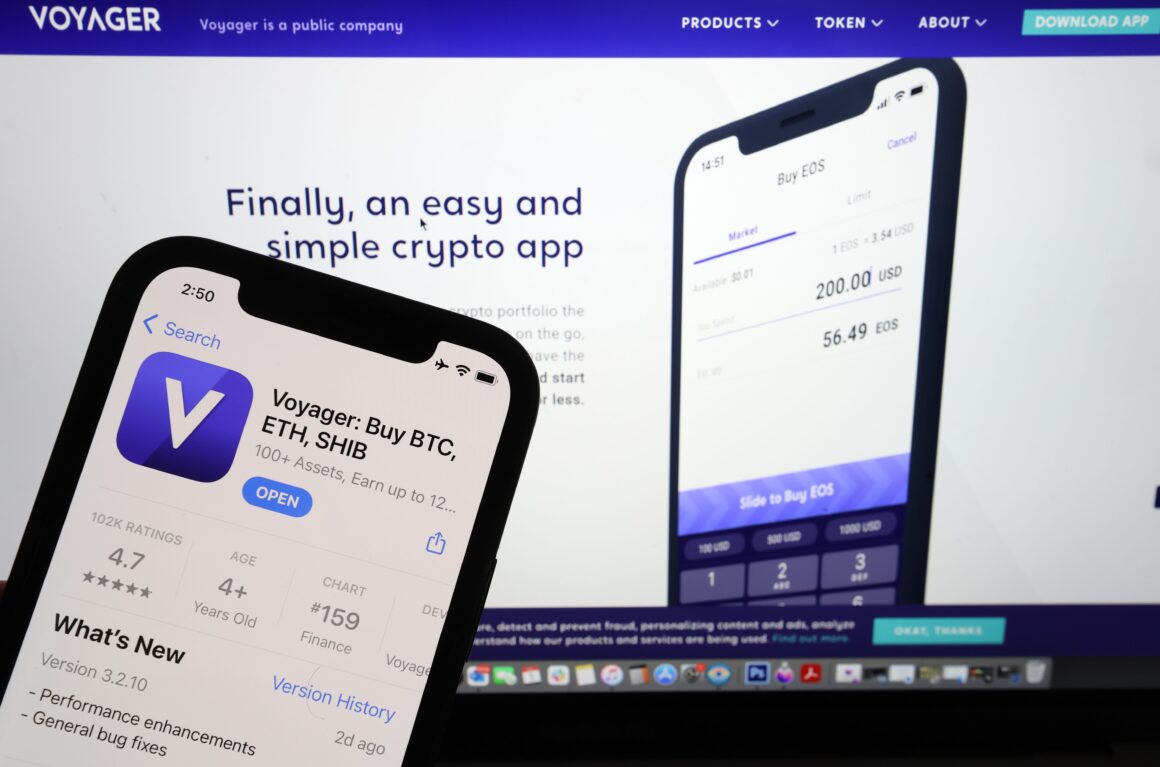

Last year, a friend told me about a cryptocurrency that yielded an astonishing 9% APY interest rate through an investing app called Voyager.

At first I was skeptical. Cryptocurrency seemed so volatile and companies seemed so sketchy. I dismissed the idea, until my friend told me that the currency was a stablecoin, which means its value doesn't change. The coin in question, USDC, was tied to the US dollar (meaning 1 USDC was worth $1 USD), so Voyager was basically offering a very high-yield savings account.

More curious now, I decided to put in a little money, less than $200, and see what would happen when the month was up. Typically, to make money with crypto, you have to buy the coin before its price shoots up then sell at a profit. But with the USDC coin purchased through Voyager, I thought I was buying a coin with a stable price. My assumption was that, like any bank, Voyager wanted my cash and was willing to pay me to hold it with them via USDC.

In the beginning of September 2020, I saw my first interest deposit: a 1.50 USDC "reward," which I could then sell and receive $1.50 USD in return. So I decided to add more money. And then thousands more. In the past two years, I've earned steady, high yields, and regularly taken money out of my Voyager account to pay bills.

The last time I deposited USD was on June 10, just two days before another crypto app, Celsius, announced it was freezing withdrawals, thus knocking over the first domino in an industry-wide semi-collapse. On July 1, Voyager did the same.

Crypto was just too good to be true

Voyager filed for bankruptcy protection last week. And, like 3 million other crypto investors, my funds remain inaccessible. When I try to sell my USDC and withdraw my money, a message pops up that says trading is currently disabled. If it's true that the money is gone, as many fear, it means I've just lost tens of thousands of dollars I could've used to pay off my student loans.

If I had the chance, would I do this all again? Definitely not.

Platforms like Voyager made buying these funds easy. Instead of going through the complicated process of creating my own cold wallet to store my cryptocurrency, I could simply create an account on Voyager and use the app like any other bank or crypto exchange. It also didn't require much knowledge of how cryptocurrency worked.

And it seemed safe. My money was, I believed, insured by the Federal Deposit Insurance Corporation (FDIC) because Voyager said it was. I was so excited about it that I told friends and family. I'd even wanted to write about it.

The cryptocurrency market has proven itself volatile, but for a while, stablecoins like USDC were — and perhaps still are — a solid way to save money in the midst of growing inflation and weak yields in traditional savings accounts. It's like flying in the jetstream of crypto-mania without facing the same risks. Or so I thought.

It turns out, at least in my case, it was too good to be true. Maybe crypto is here to stay, but I'm done participating for now.

Digital currency is still the Wild West

It's now clear that investors never got the full picture. Metropolitan Commercial Bank, the source of Voyager's claim that cash held in Voyager was FDIC-insured, issued a statement that any dollars users had in their accounts were protected only in the case that Metropolitan Commercial Bank failed, not Voyager.

This means that there's a good chance my money is gone, or I'll somehow only receive a fraction of what I once held. I'm in a unique, privileged position that is allowing me some semblance of sanity, even though it hurts — I don't have kids, am in my early 30s, and was already packing up to travel to cheaper countries. For some, the stakes are much higher. Last week, I saw a tweet from a panicked single mother who had $70,000 in the app saved to buy a house. Many people have six figures or more saved in the same way I did.

The FDIC is now investigating Voyager for its claim that funds were insured. I feel a little less silly and a little more angry. Still, there's little I can do. I agreed to terms and conditions that bar users from participating in class-action lawsuits.

I've learned my lesson — I won't invest in crypto again until there's adequate government regulation and I would not keep cryptocurrency in an online exchange but in a personal wallet. When I invest again, I'll go back to index funds, CDs, real estate, and a regular high-yield savings account, much as it hurts to see my savings essentially losing value over time.

USDC and Voyager looked like a savvy choice. But I see now that I did not have the information I needed to make a wise decision.

I'm still wondering if there's a future for crypto

Bill Gates has said he thinks cryptocurrencies and NFTs are "100% based on greater fool theory." It's possible that actually using cryptocurrency as currency could one day be mainstream, making it more legitimate and tied to something that's actually real, but I don't think we're very close to that.

Crypto is just too unknown, too open to hackers, and too complicated for the average person who is used to easy-to-use tech. Next time I see sky-high APYs and jargon so complex I can barely Google it, I'll run in the other direction.