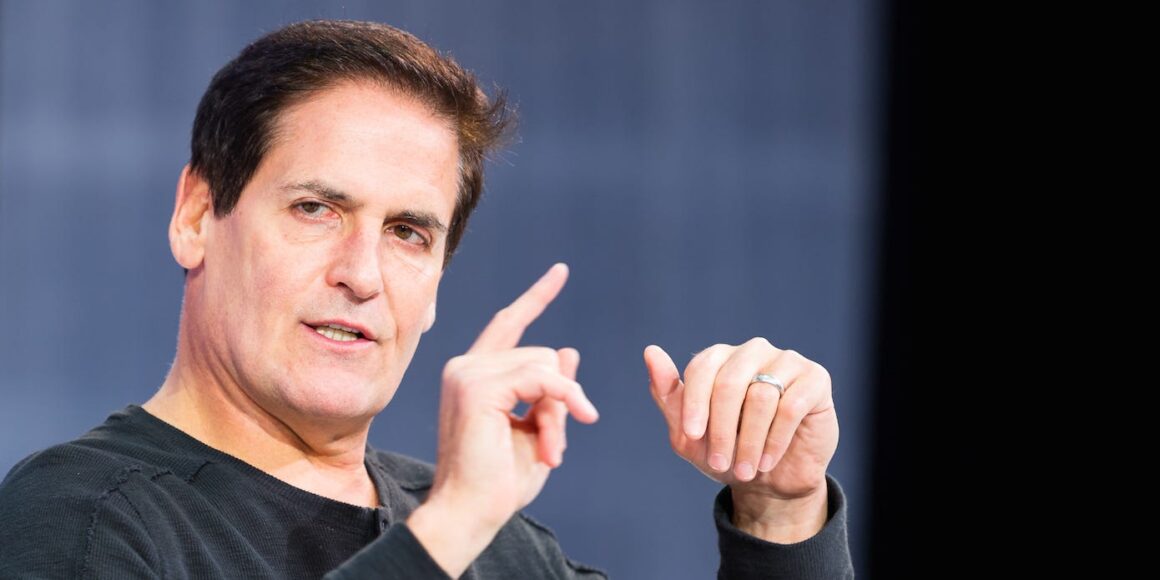

Michael Cohen/Getty Images for The New York Times

- Mark Cuban expects a tougher market backdrop to spark a shake-out in stocks and crypto.

- The "Shark Tank" star warned that businesses built on hype and easy money will disappear.

- In contrast, genuine disruptors with solid business models will emerge as winners, Cuban said.

Mark Cuban expects a shake-out in the stock market and cryptocurrency industry, as companies built on hype and profligacy fail, while those offering truly disruptive technologies and sound business models succeed.

"In stocks and crypto, you will see companies that were sustained by cheap, easy money — but didn't have valid business prospects — will disappear," he told Fortune.

The tech billionaire and "Shark Tank" investor quoted Warren Buffett to underline how surging inflation, historic interest-rate hikes, plunging prices of stocks and crypto, and recession fears will separate the winners from the pretenders.

"Like Buffett says, 'When the tide goes out, you get to see who is swimming naked," Cuban told the magazine. Crypto players including Terra and Celsius have run into trouble in recent weeks, as bitcoin, ether, and other tokens have more than halved in value this year.

The Dallas Mavericks owner told Fortune that transformational applications and technologies, even if they're released during a bear market, always attract customers and succeed. He added that tech stocks and crypto face an uphill battle until the current flurry of rate hikes is priced in, but argued "game-changing applications" would escape that pressure.

Cuban has previously compared the mix of excitement and skepticism around crypto to the early days of the internet, and predicted a market downturn would highlight the long-term winners in the space.

"Bitcoin, Ethereum, a few others will be analogous to those that were built during the dot-com era, survived the bubble bursting and thrived, like Amazon, eBay, and Priceline," Cuban tweeted in January 2021. "Many won't."

Cuban, who sold an internet-radio startup called Broadcast.com to Yahoo for $5.7 billion in 1999, has trumpeted Buffett's wisdom in the past. For example, he urged the US Treasury to model its bailouts of the "Big Four" US airlines during the pandemic on Buffett's stock-warrant deals with Goldman Sachs, General Electric, and other companies during the financial crisis.

Sen. Jack Reed, who helped craft corporate-relief packages after the housing bubble burst and at the height of the pandemic, told Insider that Buffett's dealmaking inspired him to demand warrants from companies on both occasions.