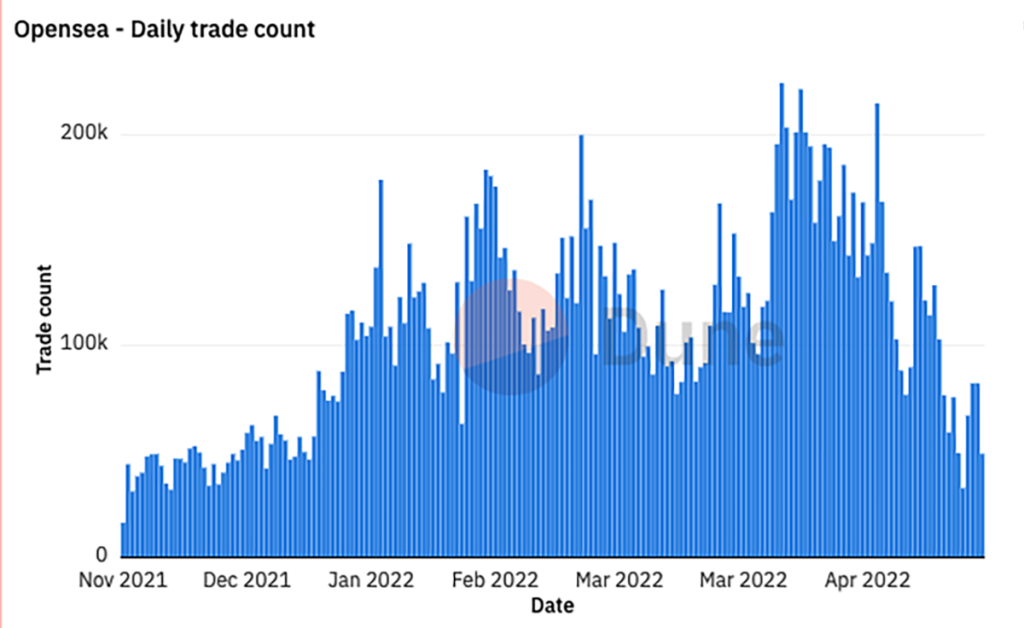

On Sunday, nonfungible tokens worth a total of $52 million were traded on OpenSea, which is the largest market for these items. This is the platform’s slowest single day since December, and it’s a big change from April when trade volume rarely went below $100 million.

If demand drops, the prices of NFTs will drop very quickly. After starting at $400,000 each in April, Bored Ape Yacht Club NFTs can now be bought for $200,000. There have been similar drops in the value of other expensive collections. Pixelated Moonbirds’ admission fee has gone down from a high of $110,000 in April to $45,000, while Reese Witherspoon’s World of Women’s fee has gone down from $34,000 to $10,000.

Along with bitcoin and ether, the value of non-fungible tokens (NFTs) is also going down. Bitcoin fell below $28,000 for the first time since 2020 on Wednesday, and ether fell close to $2,000, which is a long way from its peak of $4,600 in November. Web3 is not happy right now.

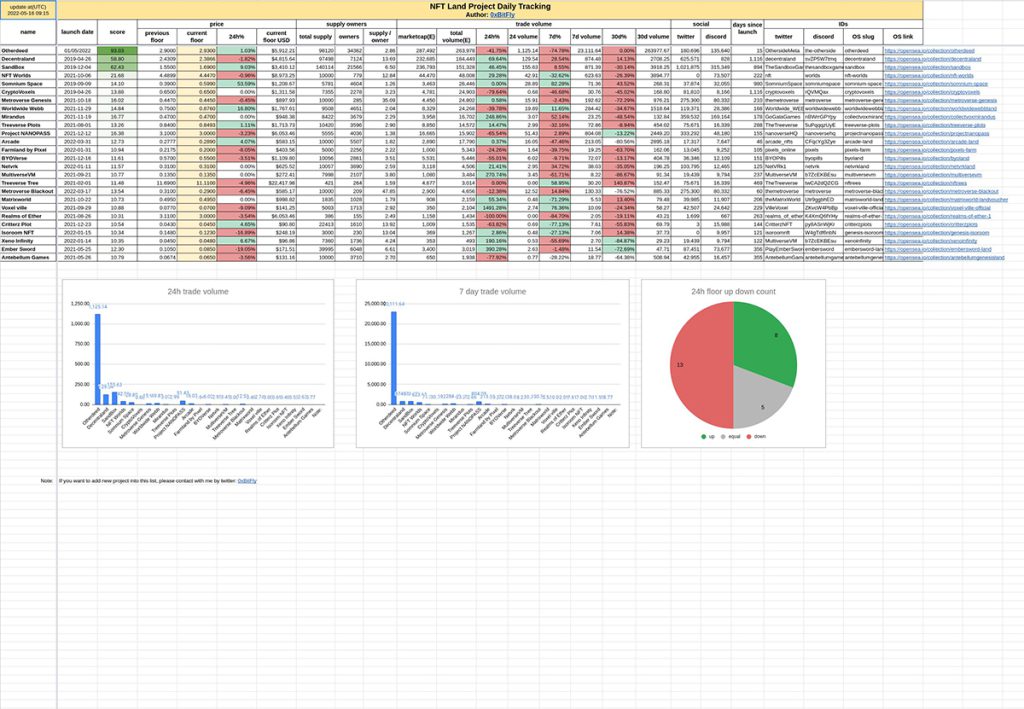

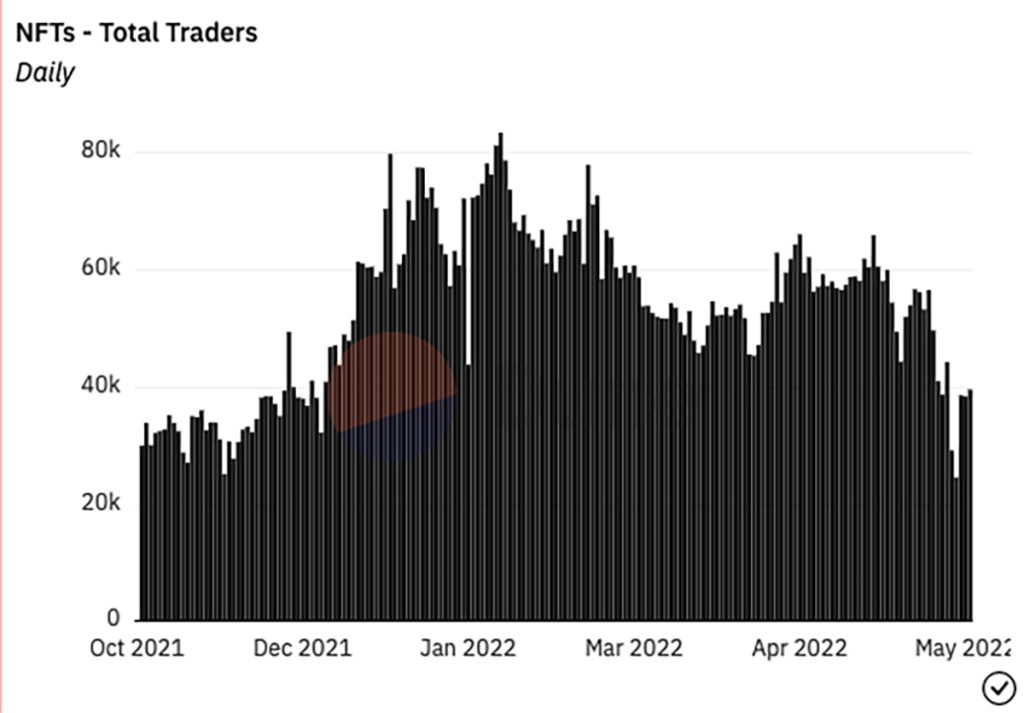

The Wall Street Journal said last week that sales of non-fungible tokens (NFTs) were “flatlining,” citing a sharp drop in the number of NFTs bought, while Yahoo wondered if the $140,000 sale of a CryptoPunk bought six months earlier for $1 million marked “the end of the NFT.” This has led to the second kind of happiness: punters predicting that NFTs will soon be gone.

There is a little bit of confirmation bias going on here. People say that a drop in the number of NFTs bought is proof of a collapse, but they don’t realize that money has moved to a few expensive NFTs instead of being spread out among thousands of cheaper ones. In April, investors spent $400,000 on a single Bored Ape instead of buying 100 separate NFTs for $4,000.

Some NFTs that were bought for a big price a few months ago and then sold for a small amount of that price is also misleading. Because NFTs are volatile, capital moves quickly from one trend to the next. True, Twitter founder Jack Dorsey’s first tweet sold for $2.9 million a year ago and was auctioned off in mid-April for $280. Does this mean NFTs are not working? Probably not in the same week that traders paid $76 million for pixelated owls at Moonbirds’ public sale.

People hate NFTs because most of them are bad for the environment and are mostly used by celebrities and the crypto-rich to show off their wealth. But if you hate something, you might be too quick to believe that it has died.

Saying that the NFT market is in great shape right now would be a lie. NFTs are indeed having a hard time. But claims that NFTs are dead don’t take into account the fact that the economy as a whole is also in trouble.

There are two pieces of news about how the market is getting worse. First, on May 4, the Federal Reserve raised interest rates by 0.5%, which was the most in 20 years. The Labor Department’s monthly Consumer Price Index, which came out on Wednesday, is a way to measure inflation. The drop in inflation isn’t enough to convince investors that interest rates won’t go up again soon.

If NFTs were up, they would almost certainly be the only thing up. In the last month, the Nasdaq stock index has dropped by 20%. Apple and Amazon’s stock prices have dropped by 12.5% and 30%, respectively, since the same day last month. IT companies aren’t the only ones who are feeling the strain; most businesses that deal with customers are as well. In the last 30 days, Disney’s stock has dropped by 19.5%, while WWE has reported record quarterly earnings but is still losing money every month. Nike is down 13.5 percent, Adidas is down 10 percent, and the company that owns Gucci, Kering, is down 13 percent.

With its price cut of 50%, The Bored Ape Yacht Club is now in the same league as Netflix. In the last 30 days, the streaming giant’s share price has dropped by half. This is because it has lost members for the first time.

What goes up must come down. DappRadar says that the market for NFTs grew by almost 2,500% in 2021 when $25 billion was spent on them instead of $94 million. Almost no one would disagree that speculation has caused an NFT bubble, but there are many different opinions on how big this bubble is.

But you could say the same thing about several companies, whose stock prices went up during the pandemic. In July of 2016, Amazon’s stock price reached $3,777, which was twice what it was before COVID. Over the past two years, the share prices of Apple, Netflix, and Meta all went up by four times, while Tesla’s peak was fourteen times its low.

The numbers go up. The number goes down.

NFTs are still around

The future metaverse Otherside, which is being made by the same people who made Bored Ape Yacht Club, Yuga Labs, shows how NFTs have changed in several ways. Yuga Labs released NFT property deeds for Otherside on April 30, and since then, just under $1 billion has been spent on the virtual land.

It is hard to say that NFTs are gone when the biggest trading day in history happened just two weeks ago.

However, the debut revealed several of crypto’s vulnerabilities, which are leading to the market’s decline. Because Ethereum isn’t very good, traders spent around $200 million on transaction fees, including thousands of dollars on purchases that didn’t go through. The deflationary mechanism of Ether burns these “gas” fees, which wipes out many days’ worth of market activity.

Still, the coming metaverse brings attention to the development of NFTs. Most of the time, NFTs are used as digital status symbols, but Yuga Labs wants Bored Ape to be a popular AAA game. Dozens of NFT developers are trying to sail from OpenSea to your living room. How well a few do will be a better sign of the long-term health of NFTs than a drop caused by an increase in interest rates, which has hurt most other indices.

The post The NFT market could have very low liquidity this weekend appeared first on NFT News Pro.