Katie Canales/Insider

- I moved my crypto from Coinbase Wallet to a hardware wallet for more security.

- Coinbase warned this week that users' crypto could be collateral in the unlikely event of bankruptcy.

- Hardware wallets add a physical layer of protection and are favored by seasoned crypto users.

A few weeks ago, I bought crypto for the very first time so that I could purchase a cartoon pig.

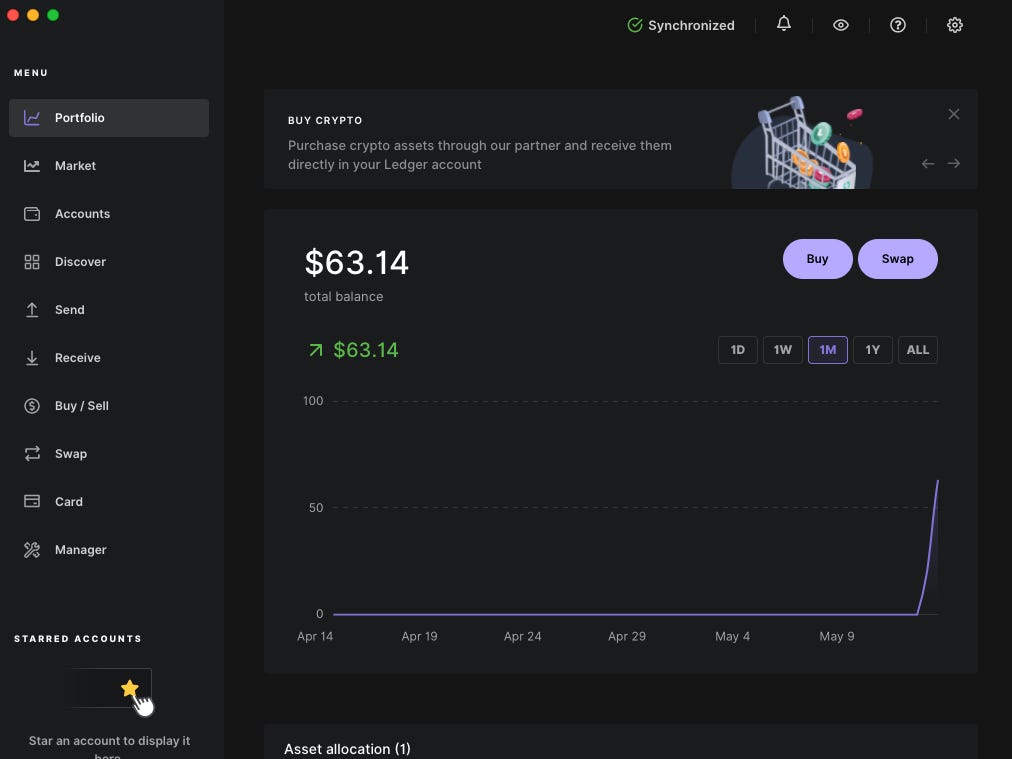

My Rave Pigs NFT is still in my possession, as is $63 worth of ether, the second-largest cryptocurrency by market cap and the native coin to the Ethereum blockchain. Those holdings were sitting in my Coinbase Wallet, a popular software self-custody wallet.

Due to new rules recently set by the Securities and Exchange Commission, Coinbase disclosed in its first-quarter earnings report this week that in the unlikely case of bankruptcy, the company could absorb crypto held by users on its exchange. In effect, Coinbase users would no longer have access to their holdings and the company would take over balances on the exchange.

Granted, this would potentially only impact Coinbase exchange and not Coinbase Wallet users, as they function separately. And while Coinbase CEO Brian Armstrong assured users that their funds are secure and there's no present risk of bankruptcy, it got me thinking about how to best store digital coins. Are exchanges, digital wallets, or physical wallets more secure?

I decided to buy a $59 hardware wallet and try it out myself. Here's what I found.

The process of transferring crypto to Ledger was mostly seamless

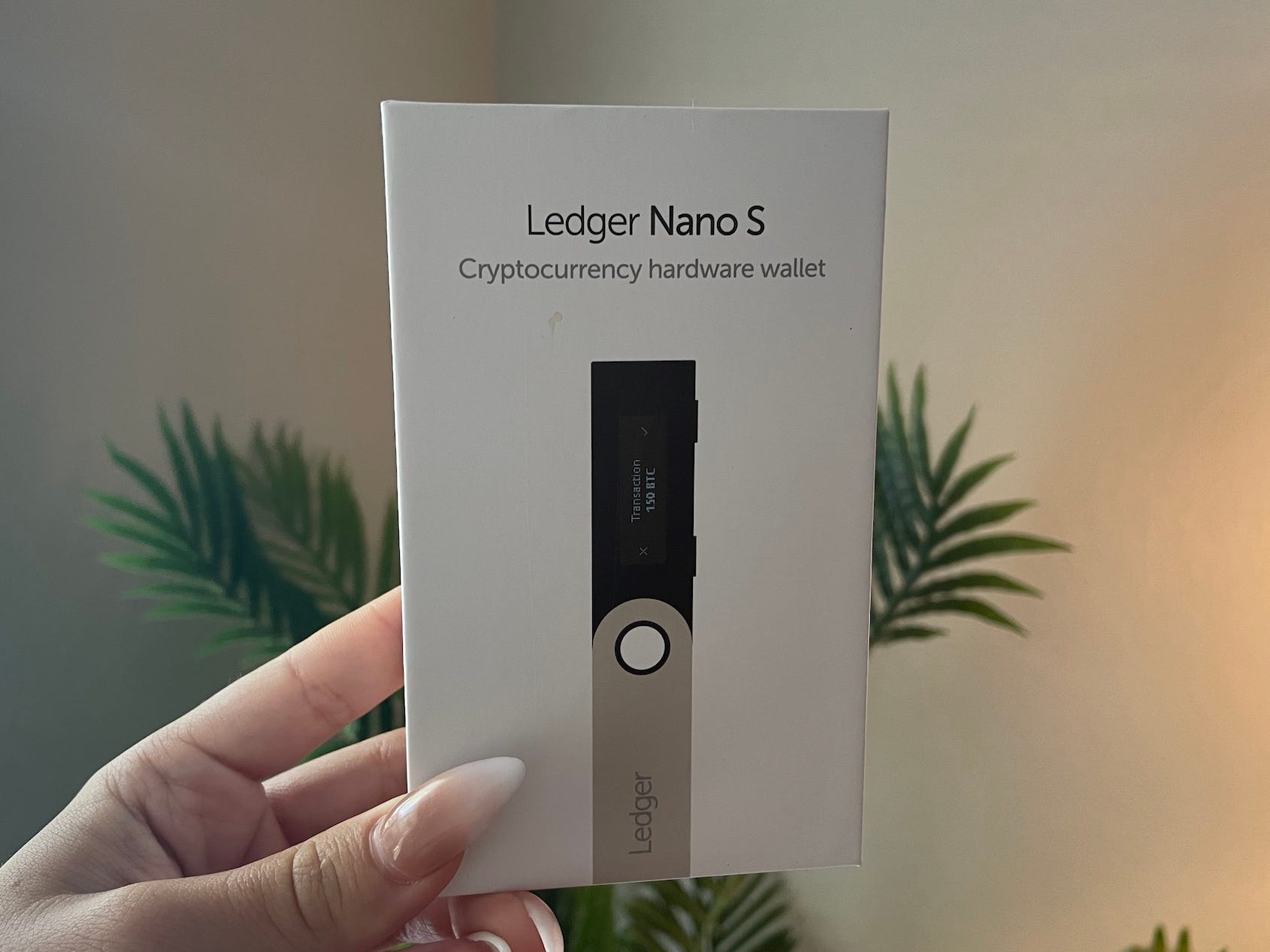

I went to a local Best Buy and snagged the Ledger Nano S, as Ledger is one of the most popular companies offering hardware storage gizmos. The employee that directed me to them asked if I was secretly a crypto millionaire. (I am not.)

The first thing I have to note is the Apple-ification of the product, from the packaging to the slim design. If you squint your eyes hard enough, it looks like the iPod Shuffle. RIP.

Katie Canales/Insider

The directions prompted me to connect the device to my laptop and download the Ledger Live app. The device showed up in my Mac Finder, and no, you can't drag random files onto it like you would a USB.

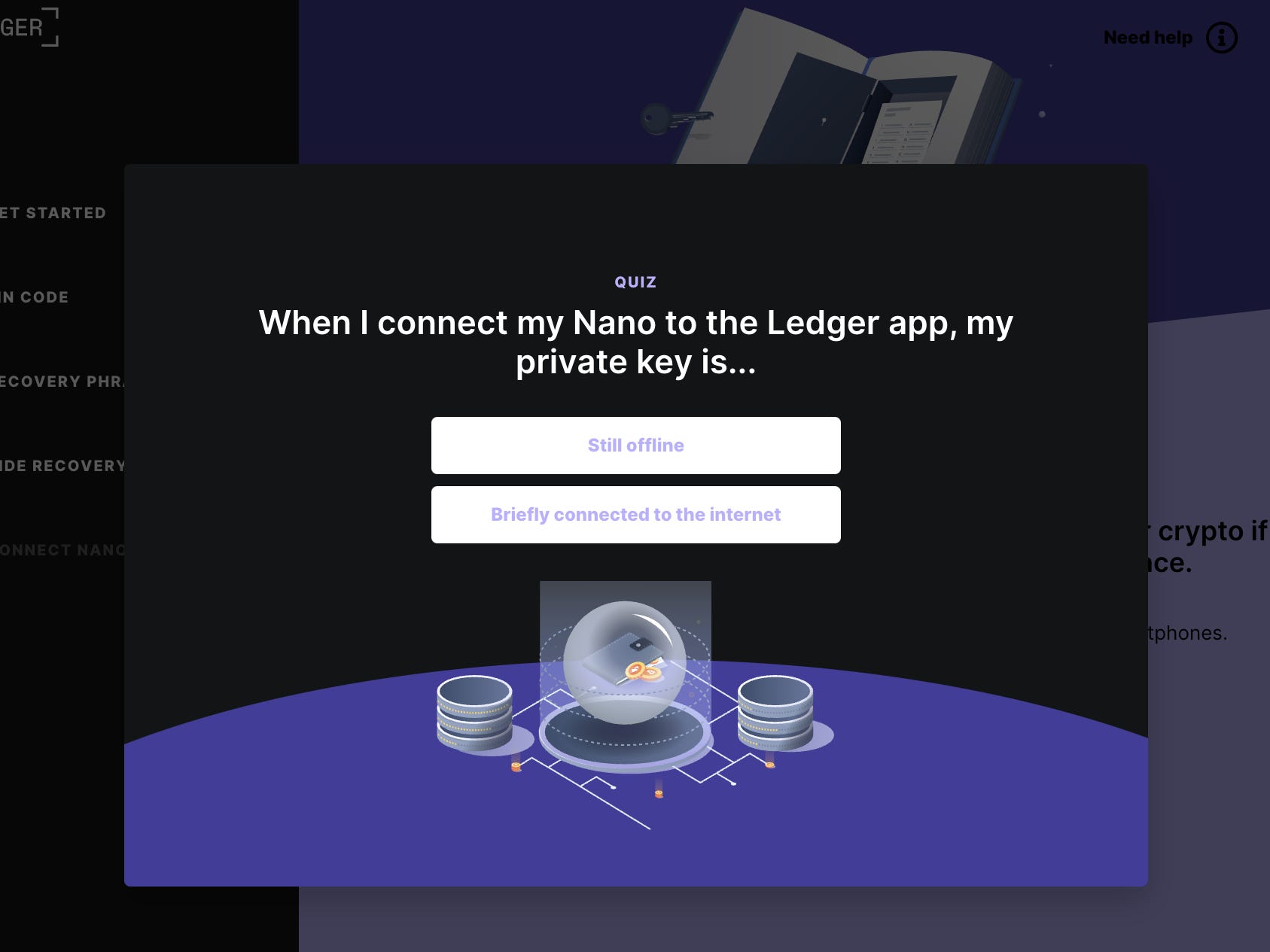

I was a bit confused that there was software involved in the setup process. Isn't the biggest perk of the physical wallet that it's free of hackable software capabilities? But the app reassured me that the Ledger never exposes my private key — nor my password to access my crypto — online, even when using Ledger Live.

Ledger

The first step was to get to know my Ledger. There's a small screen on it, and you use the buttons on the side to scroll and click "Okay." I set up a PIN and confirmed it — this isn't my private key, but rather a password just to get into my Nano.

I promptly wrote my PIN down in a secure location. You only get three tries to guess your PIN, otherwise you lose access to your assets forever.

Katie Canales/Insider

Next came my 24-word recovery phrase which created my new unique private key.

"It is your only backup to restore your accounts if needed," the gadget warned me. "If lost, stolen, or forgotten, all your assets will be irremediably lost."

But deleting Coinbase Wallet isn't so easy

Then it was time to connect my crypto. There's an option to use an existing software wallet with a Ledger hardware wallet, so I did that first — I merely connected my holdings on Coinbase Wallet to Ledger via a Chrome extension on my computer.

Now, nothing can happen to my holdings unless my Ledger is plugged into my computer, and I can view them in real-time on the Ledger Live app.

Ledger

However, my goal was partly to see if I could completely extricate myself and my holdings from the Coinbase ecosystem, even though keeping crypto on Coinbase Wallet is different than keeping it on the exchange.

I transferred my holdings to Ledger and tried deleting Coinbase Wallet, but I only went so far — you need to have zero funds in your account before you can delete it, and it costs money to move any remaining "dust" off.

I'll save that task, as well as moving my NFT on OpenSea over, for another day.

Ironclad protection for my tiny crypto balance

Katie Canales/Insider

Like anything related to the decentralized technologies I've tried, this process was slightly irritating, and the conclusion was a bit anticlimactic.

But I imagine the feeling would be very different for a crypto user with large holdings who can now sleep easier knowing there's more in the way between their money and bad actors seeking to steal it.

It's not that software wallets aren't safer than storing your crypto on an exchange like Gemini or Coinbase (they are), it's that users want the safest option possible in a space still fraught with security issues.

"The hardware wallet is essentially like putting something in Fort Knox," Douglas Borthwick — chief business officer at crypto firm INX — told me this week.

As small as my holdings are, it's nice knowing I now have that level of protection.