Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & collectibles

Dear Bankless Nation,

“The NFT market is collapsing.”

That’s per NFT Sales Are Flatlining, an article published earlier today by Wall Street Journal reporter Paul Vigna.

<div class="tweet" data-attrs="{"url":"https://twitter.com/paulvigna/status/1521452683269398529","full_text":"NFTs have too much supply for the demand. For every buyer, there are five distinctive, special, “unique” NFTs. wsj.com/articles/nft-s…","username":"paulvigna","name":"Paul Vigna","date":"Tue May 03 11:32:41 +0000 2022","photos":[],"quoted_tweet":{},"retweet_count":14,"like_count":24,"expanded_url":{},"video_url":null}”>

NFTs have too much supply for the demand. For every buyer, there are five distinctive, special, “unique” NFTs. wsj.com/articles/nft-s…

In the article, Vigna points to things like declining NFT search trends and sales numbers to suggest the first big NFT bubble is bursting.

In the very least, though, this bursting notion is complicated in the near term by how the NFT ecosystem just witnessed a handful of unprecedented activity milestones. Let’s walk through these milestones to get a better bird’s-eye view of the space as it currently stands.

-WMP

🙏 Sponsor: Rarible – discover & trade NFTs across multiple blockchains and communities✨

NFT market collapse or consolidation?

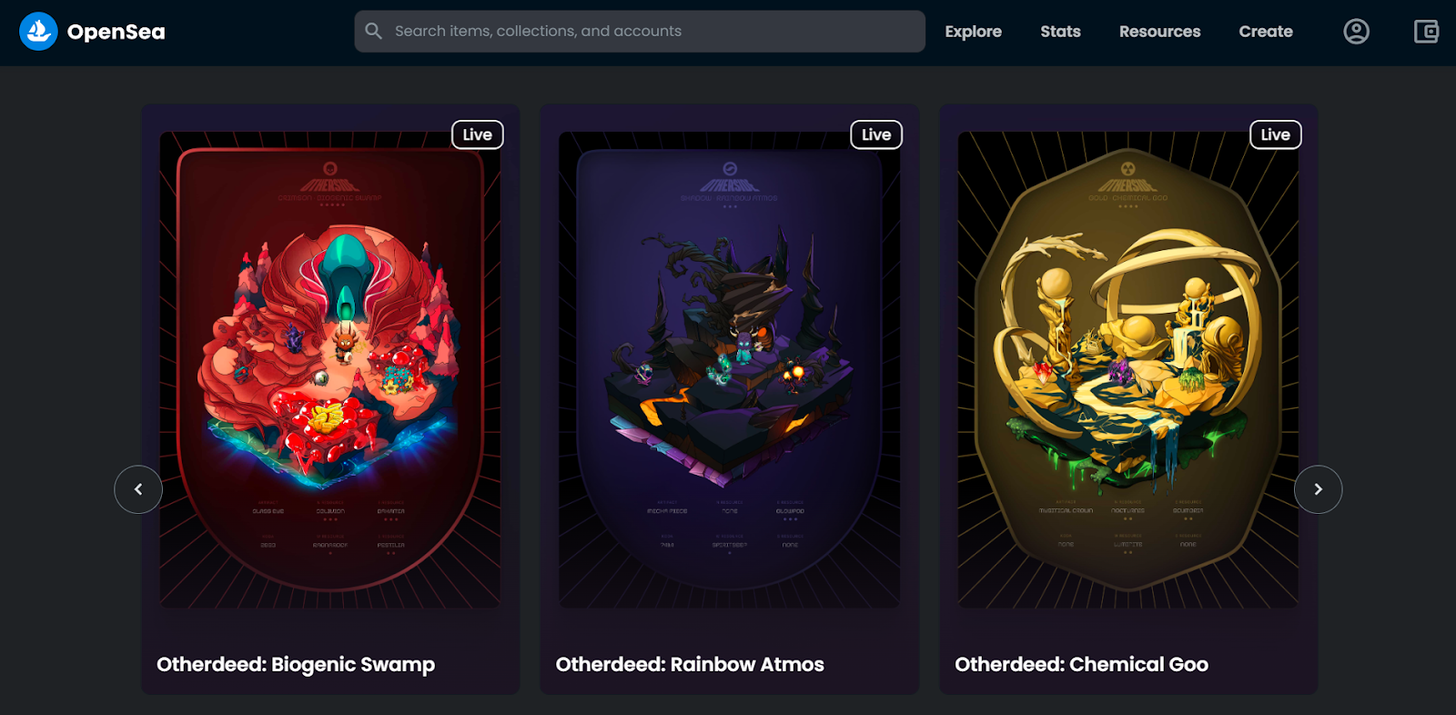

On Saturday, April 30th, Yuga Labs — the creators of the Bored Ape Yacht Club universe — launched minting and claims for Otherdeeds.

These NFT deeds offer holders a right to digital land in Yuga’s in-progress Otherside metaverse project, so demand for the drop (and the rare Kodas spread among some of the deeds) was unlike anything the NFT ecosystem has seen before.

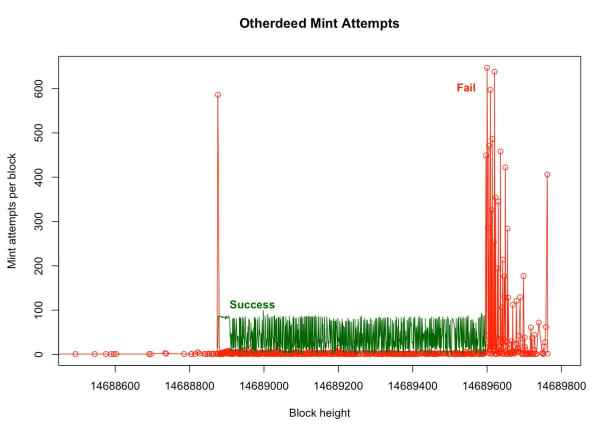

<div class="tweet" data-attrs="{"url":"https://twitter.com/Nifty_Table/status/1521274861733175299","full_text":"Otherdeeds were the root of all this madnessnn☠️14k failed mint txns that cost 1.6k ETH in gasnn🗺️29k successful mint txns that cost 60k ETH in gasnnCredit: @takenstheorem (Master of Chains ⛓️✨) ","username":"Nifty_Table","name":"NiftyTable","date":"Mon May 02 23:46:05 +0000 2022","photos":[{"img_url":"https://pbs.substack.com/media/FRymgftXIAEVOfX.jpg","link_url":"https://t.co/9VGHq74ckf","alt_text":null}],"quoted_tweet":{},"retweet_count":2,"like_count":20,"expanded_url":{},"video_url":null}”>

Otherdeeds were the root of all this madness

☠️14k failed mint txns that cost 1.6k ETH in gas

🗺️29k successful mint txns that cost 60k ETH in gas

Credit: @takenstheorem (Master of Chains ⛓️✨)

That said, The inefficient design of the minting contract and the straightforward style of the sale event led to a gas war that easily eclipsed all gas wars Ethereum’s seen previously. On Sunday, May 1st, an unprecedented NFT trading surge kicked off too.

For example, according to a thread of charts curated by 1confirmation’s NiftyTable, major new records that were set on Sunday include:

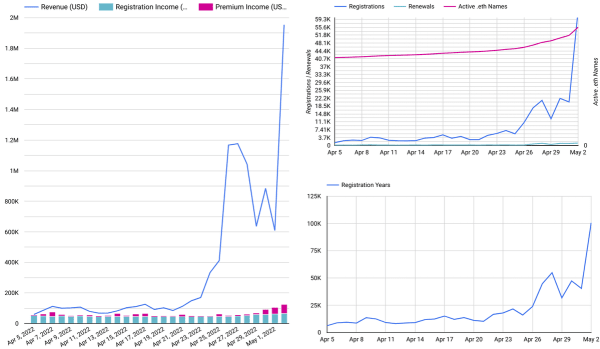

However, it’s not all the “Yuga Effect” in play here. Indeed, consider how Ethereum Name Service NFT domains had their best activity day ever on May 2nd after seeing tons of growth throughout April 2022.

Looks like May 2 was another crazy day for ENS. Breaking records again: Highest revenue ($1.95M), most registrations (63k), most registration years (100k).

So while activity and interest may be shrinking in some parts of the cryptoeconomy, it’s surging in others.

It seems the simplest answer here is that instead of total collapse, we’ve recently seen many people attempting to consolidate from smaller NFT projects into bigger, more proven “blue-chip” collections.

There are many NFT projects whose floor prices and volume levels are down over, say, the past 30 days. Yet there are more than a few projects whose floors prices and volume levels are up over the same span, too. Scroll down the “30D Chg” and “30D Volume” columns on NFT analytics site WGMI.io to see what I mean.

I do think we’re seeing consolidation, a sort of King of the Hill effect where the biggest collections are generally doing the best right now. Is an all-out collapse of the NFT market occurring? I don’t see that at this point, though we’re in crypto so it’s always shrewd to prepare for rainy days … or rainy years, as DC Investor put it:

not financial advice, but my approach:

– enough cash (to survive a rainy day, or rainy years)

– enough ETH to stake and earn something meanigful

– optional: enough culturally relevant NFTs you think might actually survive a bear or utility drought with a meaningful narrative

Action steps

-

🤔 Is the NFT market growing or contracting? Share your thoughts in the comments below, I’m keen to hear what you’re thinking.

-

🕵 Read my latest Bankless tactic 5 tips to spot the next big NFT

Author Bio

William M. Peaster is a professional writer and creator of Metaversal—a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, JPG, and beyond!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

RARIBLE

Rarible.com is a top multichain NFT marketplace underpinned by Rarible Protocol, the open source, community-governed NFT API that simplifies building community marketplaces and any other NFT projects and integrations.

💸 Connect up to 20 Ethereum, Polygon, Tezos, Flow wallets to your profile

🙋♀️ Place a floor bid on BAYC, BossBeauties, mfers, and other NFT collections

📲 Monitor and manage your NFT portfolio in Rarible mobile app (iOS, Android)

🔗 Start building on Rarible Protocol: no API key, no rate limit, your own node option

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.